USA

Australia carbon neutral courier raises $35m Series C

Sendle, an Australia-based package delivery provider for small businesses that claims to be 100% carbon neutral, has raised a $35 million Series C round led by local investor AP Ventures.

India-founded SaaS start-up BrowserStack raises $200m

KPCB growth-stage spinout Bond has led a $200 million Series B round for BrowserStack, a software testing platform established by two Indian entrepreneurs.

ChrysCapital exits US-based Infogain to Apax

ChrysCapital has exited Silicon Valley-based Infogain – an IT services provider that helped solidify the US-India cross-border opportunity set – to Apax Partners.

India's Zenoti gets Series D extension, hits $1.5b valuation

TPG Capital has led an $80 million Series D extension for Zenoti, an India-founded and US-headquartered software provider for the spa and wellness industry.

DFC backs Openspace, Chiratae funds

The US International Development Finance Corporation (DFC) – formerly the Overseas Private Investment Corporation (OPIC) – has made commitments to funds being raised by Southeast Asia-focused Openspace Ventures and India’s Chiratae Ventures.

Blackstone buys International Data Group from China Oceanwide

The Blackstone Group has agreed to acquire International Data Group (IDG) from China Oceanwide Holdings for an enterprise valuation of $1.3 billion.

Deal focus: NiKang pursues hard-to-drug targets

With big pharma scaling back early-stage discovery, CBC Group is keen to incubate biotech start-ups developing drugs from scratch. NiKang Therapeutics is the first to secure wider investor attention

Vision Fund leads Series C for India-founded Zeta

SoftBank Vision Fund 2 has led a $250 million round for Zeta, an Indian-founded and now US-headquartered banking software-as-a-service (SaaS) provider, at a valuation of $1.4 billion.

Korea's Centroid rallies local support for TaylorMade buyout

Korean GP Centroid Investment Partners is tapping local investors to participate in a KRW1 trillion ($886 million) equity pool in support of its $1.7 billion acquisition of US golf club manufacturer TaylorMade.

Singapore biotech start-up closes $125m Series C

Novo Holdings, which manages the wealth of Denmark’s Novo Nordisk Foundation, has led a $125 million Series C round for Hummingbird Bioscience, a Singapore and US-based drug developer.

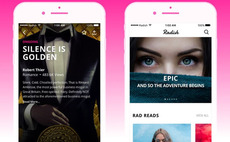

Korea's Kakao acquires VC-backed storytelling platform

Radish, a Korea and US-based mobile fiction platform, will be acquired by a unit of Kakao Corporation for $440 million. Its backers include SoftBank Ventures Asia and Kakao.

Japan's Infinity Ventures joins global alliance

Japan’s Infinity Ventures has teamed up with US and Europe-based E.ventures as well as its Brazilian affiliate Redpoint Eventures to form a global VC under the name Headline.

Yale's David Swensen dies aged 67

David Swensen, head of the Yale University endowment who pioneered a new approach to institutional investment management, has died aged 67 following a long battle with cancer.

Q&A: B Capital's Raj Ganguly

In the past few months, B Capital Group has closed a late-stage fund, entered China, and moved forward with a seed-stage vehicle. Co-founder Raj Ganguly explains the firm’s thinking

India's Chargebee closes Series G, hits $1.4b valuation

Sapphire Ventures, Tiger Global Management, and Insight Venture Partners have led a $125 million Series G round for Chargebee, an India-founded and US-headquartered enterprise services business.

Deal focus: Partners Group-backed IT play ripens early

Partners Group is set to generate a 5x return on the sale of its 45% stake in GlobalLogic to Hitachi as momentum in corporate digital transformation makes the IT services player a hot commodity

Partners Group, CPPIB exit GlobalLogic to Hitachi

Partners Group and Canada Pension Plain Investment Board (CPPIB) are exiting a combined 90% stake in US-headquartered GlobalLogic to Japan’s Hitachi at an equity valuation of $8.5 billion.

Invesco leads $155m round for China's Brii Biosciences

Invesco has led a $155 million Series C round for China-focused infectious diseases drug developer Brii Biosciences.

China's Connect Biopharma gains 8% on debut after $191m US IPO

Connect Biopharma, a China-headquartered drug developer specializing in treatments for T cell-driven inflammatory diseases, gained 8.8% on debut following a $191.3 million US IPO.

US-Japan VC hits $75m first close on cross-border fund

SIP Global Partners, a US and Japan-headquartered VC firm, has reached a first close of $75 million on its debut cross-border fund. The target is $150 million.

B Capital launches SPAC

B Capital Group, a US-based venture capital firm with a presence in Singapore and a significant Asia portfolio, is looking to raise $300 million for a special purpose acquisition company (SPAC).

China's CITIC sells US dental business

CITIC Capital Partners has exited US-based dental business DDS Lab – the private equity firm’s first acquisition in the US as a lead investor – to RoundTable Healthcare Partners for an undisclosed sum.

AVCJ Awards 2020: Special Achievement: Lip-Bu Tan

Recognized as one of the pioneers of venture capital in Asia, Walden International’s Lip-Bu Tan still gets a kick out of leveraging his years of experience to help nascent start-ups

Ravi Thakran's SPAC plans merger with aviation business

A special purpose acquisition company (SPAC) launched by Ravi Thakran, formerly head of L Catterton’s Asia operation, plans to merge with Wheels Up – a US-based aviation business described as Uber for private jets – at a valuation of $2.1 billion.