USA

Q&A: Office of New York City Comptroller's Wendy Garcia

Wendy Garcia, chief diversity officer for the Office of New York City Comptroller discusses her team’s diversity and inclusion objectives and what this means for GPs seeking allocations from city’s pension funds

Olympus-sponsored SPAC raises $130m

Olympus Capital has raised $130 million for a special purpose acquisition company (SPAC), which it is sponsoring via its fifth pan-Asian fund.

Silver Lake raises $20b for global tech fund

Silver Lake has closed its sixth global buyout fund at the hard cap of $20 billion as the US tech investor exhibits a growing appetite for mega-deals in Asia. Its prior vintage raised $15 billion in 2017.

Australia's VC-backed Xpansiv raises $40m pre-IPO round

Australia and US-based Xpansiv CBL, a VC-backed marketplace for clean commodities such as carbon offsets and renewable fuels, has raised $40 million with plans to list in Sydney this year.

China robotics player Flexiv gets $100m Series B

Flexiv, a China and US-based industrial robotics start-up specializing in machines that can adapt to unpredictable environments, has raised a $100 million Series B round featuring Gaorong Capital.

Everstone exits Singapore BPO business to Brookfield

Everstone Group has agreed to sell Everise, a business process outsourcing (BPO) company it formed through the amalgamation of several existing assets, to Brookfield Asset Management.

LP interview: Rockefeller University

Rockefeller University has aggressively expanded its endowment program by ramping up its appetite for risk. Asian venture capital is playing a key role in this agenda

Cross-border e-commerce player Wish files for US IPO

Wish, a cross-border e-commerce platform that connects Chinese merchants who primarily sell products through domestic channels like Alibaba Group’s Taobao and Tmall with consumers in the US and Europe, has filed for a US IPO.

Proterra supports plant-based egg start-up's Asia rollout

A consortium led by Proterra Investment Partners has committed $100 million to the establishment of an Asian unit of Eat Just, the company behind the US vegan egg substitute brand Just Egg.

Profile: Jihoon Rim

Jihoon Rim has been a venture capitalist, CEO of one of Korea’s largest technology companies, and a US business school professor – in the space of a decade. He explains the appeal of new challenges

India, US-based Chargebee raises $55m Series F

Chargebee, an India-founded and now US-headquartered financial technology provider, has raised $55 million in Series F funding led by Insight Partners.

GGV targets $2b for China, US tech investments

GGV Capital will return to market with its latest set of China and US-focused funds, seeking to raise an aggregate $2 billion, up from $1.88 billion in the prior vintage.

LPs see decoupling as bigger issue than delisting - AVCJ Forum

The long-term implications of US-China decoupling are of greater concern than the prospect of Chinese companies being forced to delist from US stock exchanges, LPs told the AVCJ China Forum.

US LPs in China: Willing buyers?

There is no clear evidence of US LPs passing on China funds as a result of tensions between the two countries, but their current or future reluctance could be shrouded in various obfuscations

Baring to buy IT outsourcing player Virtusa for $2b

Baring Private Equity Asia has agreed to buy Virtusa, a global business consulting and IT outsourcing company with major delivery centers in India and Sri Lanka, for approximately $2 billion.

Vision Fund leads $100m Series C for Singapore-founded Biofourmis

SoftBank Vision Fund has led a $100 million Series C round for Biofourmis, a Singapore founded and now US-based operator of a health analytics platform.

L Catterton Asia: Unhappy families?

The merger of Catterton and L Capital was unique in its size and scope, creating the world’s largest consumer-focused private equity firm. However, perspectives on the experience remain polarized

US-China tensions worry tech investors - M&A Forum

Asia technology investors warned that an escalation in US-China tensions that impedes the development of start-ups will ultimately cost end-consumers as well as public market investors.

India-China-US: Byte back

Historically a neutral power, India appears to be siding with the US in a multi-faceted war with China. This could have far-reaching consequences for VC investors and the technology ecosystem

Lever VC reaches $23m first close on food fund

Lever VC, a Hong Kong and US-based food tech specialist, has confirmed a $23 million first close for its debut fund, which will invest alternative protein start-ups globally with a strong focus on China.

Yunfeng backs take-private of China-US biotech player

Yunfeng Capital, a private equity firm co-founded by Jack Ma, is backing the privatization of Cellular Biomedicine, a US and China-based biotech developer.

India's Prime Venture names Helion co-founder as partner

Ashish Gupta (pictured), a co-founder of Helion Ventures, has joined Indian VC firm Prime Venture Partners as a partner emeritus. He will remain based in the US.

Rocketship targets Asia with second global VC fund

Rocketship, a US-based data science-focused venture capital firm that has backed a number of Indian start-ups, has closed its second global fund at $100 million with a strong focus on Asia.

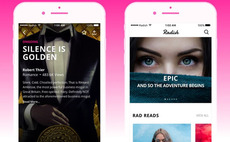

Korea, US-based serialized fiction app gets $63m

SoftBank Ventures Asia and Kakao have led a $63.2 million Series A round for Radish, a Korea and US-based producer and broadcaster of serialized fiction for mobile devices.