TMT

Korea's Gentle Monster backs China AR player Nreal

Nreal, a Chinese manufacturer of augmented reality (AR) glasses that resemble normal sunglasses, has received USD15m from South Korean eyewear brand Gentle Monster.

Fundamentum raises $227m for India growth-stage tech fund

The Fundamentum Partnership, an India-based growth-stage technology investment firm established by Infosys co-founder Nandan Nilekani and Helion Venture Partners co-founder Sanjeev Aggarwal, has closed its second fund on USD 227m.

China luxury goods player Secoo gets private equity bailout

Secoo Holding, a US-listed Chinese luxury goods retailer that has seen its stock price fall by 95% since the start of 2020 and has filed for bankruptcy twice in the past eight months, has received USD 4m in funding.

PE-backed Korean ride-sharing player Socar drops on debut

Socar, a Korea-based car-sharing business backed by the likes of Bain Capital, IMM Private Equity, and SoftBank Ventures Asia, traded down on debut following a KRW 101.9bn (USD 76m) IPO.

Taiwan's Cherubic closes $110m VC fund

Cherubic Ventures, which makes early-stage investments in Asia and the US, has closed its fifth fund with USD 110m in commitments. Total assets under management now exceed USD 400m.

Korea's Kakao abandons plans for mobility unit stake sale

South Korean internet giant Kakao has abandoned plans to partially divest Kakao Mobility, its transportation division.

Bain targets $102m Japan advertising take-private

Bain Capital has won board approval from Net Marketing, a Tokyo-listed online advertising and media management business, for a take-private that values the company at approximately JPY 13.6bn (USD 102m).

Chinese investors back emerging markets e-commerce enabler

Jet Commerce, an e-commerce enabler that helps brands sell into emerging markets, has raised over USD 60m in Series B funding led by Jinqiu Capital, Hidden Hill Capital, and Zhejiang SilkRoad Fund.

Tech sector troubles hit Vision Fund performance

Valuation corrections across the technology sector globally continue to undermine the Vision Fund series, resulting in parent company SoftBank Group posting its second consecutive quarterly loss and founder Masayoshi Son professing shame at hyping up...

Fund focus: Insignia takes two months to scale up

Insignia Venture Partners received subscriptions to its third fund amounting to twice the size of the final corpus, underlining the appeal of Southeast Asia. The GP is keen to leverage China’s talent exodus

Uber, Tiger make Zomato realisations

Uber has fully exited its stake in India-based food services platform Zomato, which completed a domestic IPO just over 12 months ago, while Tiger Global has sold down part of its position.

Insignia raises $516m for latest Southeast Asia vintage

Insignia Venture Partners has raised USD 516m for its third Southeast Asia fund, comprising USD 388m for a core venture vehicle, an accompanying entrepreneurs’ pool of USD 28m, and a USD 100m annex fund.

Carousell buys VC-backed Indonesia re-commerce platform

Carousell, a Singapore-based mobile classifieds marketplace for second-hand goods, has acquired Indonesian re-commerce platform Laku6 with support from Temasek Holdings-owned Heliconia Capital.

Bertelsmann spinout BAI Capital closes $700m China fund

BAI Capital, formerly Bertelsmann Asia Investments, a captive unit of the eponymous German media company, has closed its debut China fund on approximately USD 700m.

Korea's NPX confirms $160m media platform acquisition

Korea’s NPX Capital has acquired online comics publisher Toomics via its Terapin Studios media platform for USD 160m.

Deal focus: Seeing light at the end of the COVID-19 tunnel

Taiwan travel start-up KKday continues to raise capital seemingly on its own terms despite flights remaining largely grounded. It expects a boom toward year-end and near-normalcy in 2023

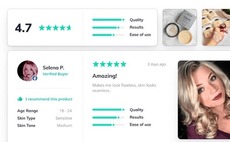

Australia customer reviews specialist gets $26m Series A

Okendo, an Australia-founded customer review platform for e-commerce brands, has received USD 26m in Series A funding led by US venture capital firm Base10 Partners.

China's Miss Fresh brings in state backer at knock-down valuation

Chinese online grocery delivery platform Miss Fresh, which went public on NASDAQ 12 months ago with a market capitalisation of around USD 3bn, has sold a minority stake to a state-owned enterprise at a valuation of USD 90m.

TGVest helps Taiwan's KKday lift Series C to $95m

Taiwanese e-commerce and travel platform KKday has closed a protracted Series C capital raising process with USD 95m. Local private equity firm TGVest Capital led the latest tranche.

2Q analysis: Substituting China?

India and Southeast Asia come to the fore as China demonstrates weakness in both growth-stage investment and fundraising; exits continue to struggle amid reluctance from strategic buyers

Indonesia B2B agriculture marketplace gets $35m Series A

AgriAku, an Indonesia-based B2B marketplace that looks to improve agriculture supply chain efficiency for retailers of agricultural inputs, has raised USD 35m in Series A funding led by Alpha JWC Ventures.

Korea's Kakao considers partial divestment of mobility spin-out

South Korean internet giant Kakao has indicated it may sell around 10% of Kakao Mobility, its transportation division, which has several private equity backers.

Sequoia raises $8.8b for China funds

Sequoia Capital has hit the hard cap on each of the four funds in its latest China vintage, accumulating USD 8.8bn for deployment in seed through late-growth rounds.

Joy sets modest target for China VC fund - update

Beijing-based Joy Capital has set a lower target for its latest US dollar-denominated fund than in the previous vintage and decided against raising a second accompanying growth vehicle.