Indonesia

Quadria backs Indonesia's Hermina Hospitals

Singapore’s Quadria Capital has paid an undisclosed sum for a minority stake in Hermina Hospitals, one of the largest hospital chains in Indonesia.

SPACs in Asia: Out of the comfort zone

Several Asian stock exchanges will consider allowing SPAC offerings, but implementation may run contrary to their regulatory ethos – and there is no guarantee of a strong market response

Singapore's East Ventures takes over EV Growth

EV Growth, a joint venture between Singapore’s East Ventures, Indonesia’s SMDV and Japan’s YJ Capital, is dissolving its co-GP structure, with East Ventures taking over as the sole manager.

Indonesia's Sicepat secures $170m Series B

Indonesian logistics start-up Sicepat has raised a $170 million Series B round from investors including Temasek Holdings’ growth-stage PE unit Pavilion Capital.

Ex-KKR executive to lead Indonesia's sovereign wealth fund

Ridha Wirakusumah, whose previous roles include serving as a director for Southeast Asia at KKR, has been chosen to lead Indonesia's new sovereign wealth fund.

Southeast Asia's shadow capital: Out of the darkness

Shadow capital – non-traditional pools of money held by sovereigns and corporates – has become a fixture in Southeast Asia’s tech space. Start-ups stand to benefit, but they must pick partners with care

General Atlantic backs Indonesia biotech developer

General Atlantic has invested $55 million in Kalbe Genexine Biologics, an Indonesia-based drug developer focusing on Southeast Asia.

AVCJ Awards 2020: Deal of the Year - Small Cap: TaniGroup

Openspace Ventures played a key role in helping Indonesian agriculture technology start-up TaniGroup achieve critical mass as COVID-19 weeded out much of the competition

SEAF hits first close on Southeast Asia women's fund

The Southeast Asia division of US-headquartered impact private equity firm SEAF has reached a first close of at least $16 million for a women’s economic empowerment fund.

Indonesian stockbroker Ajaib raises $25m Series A

Horizons Ventures, which is controlled by Hong Kong billionaire Li Ka-shing, and Indonesia’s Alpha JWC Ventures have led a $25 million Series A round for Indonesian investment platform Ajaib.

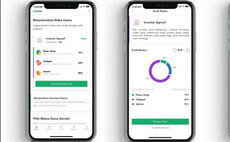

Sequoia India leads $30m round for Indonesia's Bibit

Sequoia Capital India has led a $30 million investment in Bibit, an Indonesian robo-advisory app for first-time investors.

TPG, Northstar commit $236m to Japfa's SE Asia dairy business

TPG Capital and Northstar have agreed to pay $236 million for an 80% stake in the Southeast Asia consumer dairy operation of Singapore-listed agribusiness giant Japfa.

BRI reaches first close on Indonesia fund

BRI Ventures, a unit of Bank Rakyat Indonesia has reached the first close of IDR150 billion ($11 million) on its locally incorporated tech venture fund.

MDI, Finch launch $40m ASEAN fund

MDI Ventures, the corporate VC arm of state-controlled Telkom Indonesia, has teamed up with financial technology investor Finch Capital to form a $40 million fund targeting early-stage investments in Southeast Asia.

Asia consumer & technology: Multifarious merchants

Technology is changing the way consumers interact with retailers both concrete and virtual. Ramping up the sociability factor has become a priority amid increasingly pervasive mechanization

Grab leads $100m round for Indonesia e-wallet player

Singapore-based ride-hailing and local services platform Grab has led a $100 million Series B round for Indonesian e-wallet services provider LinkAja.

Model behavior: China to Southeast Asia tech transplants

Plenty of internet start-ups in Southeast Asia have been inspired by Chinese forebears, but transplanting ideas from one market to another is often fraught with complications

Portfolio: Archipelago Capital Partners and Timuraya Tunggal

Archipelago Capital Partners is playing a subtle but foundational role in Indonesia’s ongoing industrialization by taking the helm of longstanding chemicals producer Timuraya Tunggal

Southeast Asia start-ups: Trials of leadership

COVID-19 has forced start-ups founders in Southeast Asia – many of whom have never experienced a crisis before – to make tough decisions. For investors, it represents a key test of management credentials

Indonesia's AC Ventures hits first close on debut fund

AC Ventures, a recent merger of Indonesia’s Agaeti Ventures and Convergence Ventures, has reached a first close of $56 million for its debut fund as a combined group. The target is $80 million.

Deal focus: CVC's soft sell

CVC Capital Partners helped Softex Indonesia grow its market share by penetrating modern retail channels and launching an ESG program. A $1.2 billion trade sale exit to Kimberly-Clark is its reward

Deal focus: Waresix builds Indonesia's logistical lynchpin

Jungle Ventures and EV Growth lead $75 million round for Waresix, backing the company's integrated platform as a solution to Indonesia's logistics challenges

EV Growth, Jungle lead round for Indonesia's Waresix

Indonesian logistics technology provider Waresix has secured about $75 million in Series B funding led by existing backers EV Growth and Jungle Ventures.

CVC to exit Softex Indonesia with 3.3x return - update

CVC Capital Partners will exit personal care products manufacturer Softex Indonesia after US multinational Kimberly-Clark agreed to acquire the business for approximately $1.2 billion.