Fintech

Australia's VC-backed Xpansiv raises $40m pre-IPO round

Australia and US-based Xpansiv CBL, a VC-backed marketplace for clean commodities such as carbon offsets and renewable fuels, has raised $40 million with plans to list in Sydney this year.

Hanwha leads $300m Series A for Grab's financial unit

Korea’s Hanwha Asset Management has led a $300 million Series A round for the financial services unit of Singapore-based ride-hailing and services platform Grab.

Warburg Pincus, Goodwater lead Series D for Vietnam's MoMo

MoMo, a Vietnam-based mobile wallet provider, has closed a Series D round of more than $100 million led by Goodwater Capital and Warburg Pincus.

Indonesian stockbroker Ajaib raises $25m Series A

Horizons Ventures, which is controlled by Hong Kong billionaire Li Ka-shing, and Indonesia’s Alpha JWC Ventures have led a $25 million Series A round for Indonesian investment platform Ajaib.

Bow Wave joins $175m round for Philippines-based GCash

Bow Wave Capital Management, a US-based private equity investor in mobile payment ecosystems globally, has participated in a $175 million round for Philippines-based mobile wallet GCash.

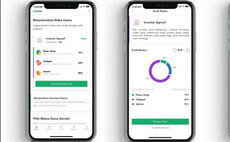

Sequoia India leads $30m round for Indonesia's Bibit

Sequoia Capital India has led a $30 million investment in Bibit, an Indonesian robo-advisory app for first-time investors.

Apax buys software business from India's 3i Infotech

Apax Partners has agreed to acquire the software products business of Indian IT provider 3i Infotech for INR10 billion ($136.6 million). It will be renamed Azentio Software.

PE-backed WealthNavi soars on Tokyo debut

Japanese financial technology start-up WealthNavi gained 100% on its trading debut following a JPY17.9 billion ($172.9 million) IPO that facilitated partial exits for Gree Ventures, Infinity Venture Partners, and Global Brain.

SoftBank joins $60m Series B for Korean payments player

SoftBank Ventures Asia has joined a $60 million Series B round for Korean payments technology start-up Chai.

China's Snowball Finance raises $120m

Snowball Finance, a Chinese online financial information platform with wealth management ambitions, has raised $120 million Series E from Orchid Asia.

Apis invests $35m in India's Cashfree

Apis Partners has invested $35 million in Indian digital payments services provider Cashfree as part of a Series B round also featuring Smilegate Investment and Y Combinator.

PE-backed Chinese fintech player Lufax files for US listing

Lufax, a Chinese online lending and wealth management platform valued at $39.4 billion following its most recent private funding round, has filed for an IPO in the US.

SBI, Sygnum launch digital assets fund

SBI Ven Capital, an investment arm of Japan's SBI Group, has teamed up with digital asset bank Sygnum Group and launched an early-stage fund investing in digital assets across Southeast Asia and Europe.

India, US-based Chargebee raises $55m Series F

Chargebee, an India-founded and now US-headquartered financial technology provider, has raised $55 million in Series F funding led by Insight Partners.

Asia lending start-ups: Bump in the road

Digital lenders in emerging markets need to survive a tricky year under the shadow of potential defaults, but the survivors might become significant players in a renewed financial landscape

Facebook, PayPal invest in Indonesia's Gojek

Facebook and PayPal have joined an ongoing Series F round for private equity-backed Indonesian ride-hailing and online-to-offline (O2O) services platform Gojek (formerly Go-Jek).

Deal focus: GoBear builds financial menu for Southeast Asia

GoBear, a Singapore-headquartered financial services platform, believes it can create financial products suitable for consumers and institutional partners alike

Singapore's GoBear raises $17m

Singapore-headquartered GoBear, a financial services platform focused on Asian consumers, has raised $17 million from Netherlands-based Walvis Participaties and Aegon

Deal focus: Validus takes holistic approach to SME financing

Singapore peer-to-peer lender employs algorithm-based credit assessment tools and an unorthodox approach to origination as it seeks to address inefficiencies in Southeast Asian supply chain finance

Singapore SME financing platform gets $20m

Validus, a Singapore-headquartered financing platform for small to medium-sized enterprises (SMEs) in Southeast Asia, has raised $20 million in a Series B+ round co-led by Vertex Growth and Orion Fund.

Deal focus: Oriente's plastic alternative

Well-capitalized though not immune to COVID-19 disruption, Indonesia and Philippines-focused online lender Oriente is waiting for the market to get back to normal

Cashlez gains on debut after Indonesia IPO

Indonesian mobile point-of-sale solution provider Cashlez - a portfolio company of Mandiri Venture Capital - traded up on debut following an IDR87.5 billion ($5.7 million) domestic IPO.

Hong Kong's PE-backed Oriente raises $50m

Oriente, a Hong Kong-headquartered financial technology start-up, has raised $50 million in a round led by Peter Lee, the co-chairman of local property developer Henderson Land.

Deal focus: VCs back DataCanvas' opensource solution

Chinese start-up DataCanvas wants to democratize artificial intelligence through a plug-and-play platform that lets companies customize algorithms. Financial institutions are the early adopters