Fintech

Korea's Viva Republica raises $405m at $7.2b valuation

Viva Republica, operator of the Korean money transfer app Toss, has raised a KRW460 billion ($404 million) round led by US-based Alkeon Capital, at a valuation of around $7.2 billion.

Apis leads $45m Series C for India's RenewBuy

Apis Partners has led a $45 million Series C round for RenewBuy, an India insurance comparison platform specializing in motor insurance.

Singapore fintech start-up MatchMove raises $100m

Singapore’s MatchMove, a financial technology start-up with several VC backers, has raised $100 million from US-based IT services provider Nityo Infotech.

US VCs lead $60m round for Indonesia's BukuWarung

US-based Goodwater Capital and Valar Ventures, a firm co-founded by PayPal co-founder Peter Thiel, have led a $60 million round for Indonesian financial technology start-up BukuWarung.

Pakistan's Habib Bank backs digital SME lender

Habib Bank, the largest bank in Pakistan, has joined a $10.1 million Series A round for Finja, a leading local financial technology start-up and small to medium-sized enterprise (SME) lender.

Vision Fund leads Series C for India-founded Zeta

SoftBank Vision Fund 2 has led a $250 million round for Zeta, an Indian-founded and now US-headquartered banking software-as-a-service (SaaS) provider, at a valuation of $1.4 billion.

Australia fintech start-up raises $19m Series A

Australian payments technology platform mx51 has raised A$25 million ($19.4 million) in Series A funding led by Acorn Capital, Artesian, Commencer Capital, and Mastercard.

Singapore fintech provider Thunes gets $60m

Insight Partners has led a $60 million round for Thunes, a Singapore-based financial technology provider specializing in B2B cross-border payments in developing markets.

Hong Kong crypto start-up gets $40m Series A

Sequoia Capital China, Tiger Global Management, and Boyu Capital have joined a $40 million Series A round for Hong Kong cryptocurrency services provider Babel Finance.

Deal focus: Bibit lays claim to be Indonesia's Robinhood

A couple of quickfire funding rounds for Bibit reflects global investor appetite for robo-advisory businesses and the Indonesian company’s rare double-headed product offering

Female-focused Indonesia lending platform raises $28m

Amartha, a financial services provider for women-led micro and small to medium-sized enterprises (MSMEs) in Indonesia, has raised $28 million in VC funding.

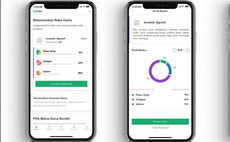

Sequoia India leads $65m round for Indonesia's Bibit

Sequoia Capital India has led a $65 million round for Indonesia robo-advisory app Bibit four months after leading a separate $30 million investment.

Tiger Global invests $25m in India crypto app

Tiger Global Management has invested $25 million in CoinSwitch Kuber, a cryptocurrency exchange for the Indian retail market that facilitates investments as small as INR100 ($1.33).

KKR joins $61m round for Japan's Netstars

KKR has contributed JPY4 billion ($37 million) to a JPY6.6 billion funding round for Netstars, a Japanese QR code payment gateway operator. SIG and Lun Partners, a Hong Kong-based global financial technology investor, also took part.

Deal focus: Gobi sees 100x return on Airwallex

Gobi Partners became Airwallex's first institutional investor in 2016 due to a lack of support in the Australian company's home market. The GP made a partial exit in a recent Series D round at a valuation of $2.6 billion

Japan payments start-up Paidy closes $120m Series D

Japanese payments start-up Paidy has raised $120 million in Series D funding from JS Capital Management, Soros Capital Management, Tybourne Capital Management, and Wellington Management.

Australia's Airwallex sees valuation hit $2.6b

Airwallex, an international payments technology provider that launched out of Melbourne, has closed a third tranche of Series D funding, taking the overall round to $300 million and its valuation to $2.6 billion.

India's PolicyBazaar raises $75m for Middle East expansion

PolicyBazaar, India’s largest insurance comparison portal, has raised $75 million from US-based Falcon Edge Capital for a Middle East expansion.

MDV, Kenanga launch $73m Malaysia fintech fund

Malaysia Debt Ventures (MDV) and Kenanga Investment Bank have launched a VC fund focused on the local financial technology space with a target of MYR300 million ($73 million).

Allianz leads $75m round for Hong Kong's WeLab

Allianz Group has led a $75 million round for Hong Kong’s WeLab with a view to helping the financial technology provider develop new insurance and investment products.

India's KreditBee secures $75m Series C

Premji Invest, Mirae Asset Capital, Alpine Capital and Arkam Ventures have contributed $75 million in Series C funding for Indian financial technology start-up KreditBee.

Deal focus: iStox finds firmer footing

A clutch of Japanese investors has validated iStox’s blockchain-enabled digital securities marketplace. Now the Singapore-based start-up is taking the idea to new markets

Singapore's iStox raises $50m Series A

A group of Japanese VC investors has backed a $50 million Series A round for Singapore’s iStox, a digital securities platform that deals in private markets.

Navis invests in Singapore fintech supplier Moneythor

Navis Capital Partners has made an investment of undisclosed size in Moneythor, a Singapore financial technology supplier focused on digital banking.