China

PE-backed Country Style Cooking, Tuhu file for HK listings

Chinese restaurant chain Country Style Cooking (CSC), which was de-listed in the US in 2015, and automotive after-sales service platform Tuhu, which was previously targeting a New York offering, have both filed for IPOs in Hong Kong.

CR Capital joins Series E for China's Newlinks

CR Capital Management, an investment arm of China Resources Group, is backing Newlink Group, operator of a platform that helps drivers locate the best value gas stations and charging piles, as part of the company's Series E round.

Longreach expands partner group to six - update

North Asia-focused mid-market buyout firm The Longreach Group has promoted Keitaro Tsuda, Sonny Chan, and Ken Law to partner, expanding its leadership group to six.

Vision Fund backs China healthcare robotics player

Fourier Intelligence, a Shanghai-based medical technology start-up that focuses on rehabilitation robots, has raised CNY 400m (USD 63m) in Series D funding led by SoftBank Vision Fund 2.

Centurium takes control of China's Luckin Coffee

Centurium Capital is now the controlling shareholder in Luckin Coffee, having teamed up with IDG Capital and Ares SSG to take out interests formerly owned by executives of the scandal-hit Chinese coffee shop chain.

China raw egg brand Yellow Swan raises $95m - update

Yellow Swan, a China-based edible raw egg producer incubated by Proterra Investment Partners, has raised CNY 600m (USD 95m) across two tranches.

Asia Alternatives fund-of-funds closes on $2b

Asia Alternatives has reached a final close of USD 2bn for its sixth private equity fund-of-funds and several related vehicles. It is the firm’s largest raise since its inception in 2015.

China IPOs: Offshore angst

Private equity exit timelines were thrown into disarray last year when US IPOs abruptly stopped. Regulators have offered some clarity, but investors are unsure when – or if – the magic will return

Deal focus: Foundation eyes Bright future

In leading a USD 82m cross-currency restructuring of a consumer-tech portfolio managed by China’s Bright Capital, Foundation Private Equity opted for a structure that is unusual yet prioritises alignment

China medtech start-up SiBionics raises $79m

China-based medical technology start-up SiBionics has raised CNY 500m (USD 79m) in a third tranche of Series C funding co-led by CPE and China Life Investment.

Vision Fund leads $150m round for China e-commerce enabler

Shoplazza, a China-based software-as-a-service (SaaS) provider specialising in cross-border e-commerce, has raised USD 150m in the first tranche of Series C led by SoftBank Vision Fund II.

River Head Capital hits first close on latest reminbi fund

China’s River Head Capital has achieved a first close on its second Innovation Growth Fund, a renminbi-denominated vehicle that has an overall target of CNY 2bn (USD 135m).

Brookfield backs Sequoia China's new economy infra fund

Sequoia Capital China has raised a new economy infrastructure fund – which will invest in the likes of logistics, data centres, and life science parks – with Brookfield serving as the largest LP.

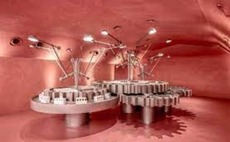

China beauty retailer Harmay raises $200m

Harmay, a China-based omnichannel beauty products retailer, has raised USD 200m across Series C and D rounds.

Asia PE investment hits new high in 2021

A rebound in China-based activity took Asia private equity investment to a record USD 105.3bn in the fourth quarter, ensuring that 2021 represents a new high watermark for the industry.

China's Dishangtie Car Rental raises $200m

Dishangtie Car Rental, a Shenzhen-based electric vehicle (EV) rental service, has raised a USD 200m Series D round across two tranches featuring CICC Capital.

Deal focus: Starfield serves up Series B

The Chinese manufacturer of plant-based protein replacements has secured USD 100m in funding to advance a product portfolio that aspires to diversity and structural sophistication

4Q analysis: Record quarter, record year

China rebounds as Asia private equity investment ends 2021 with a bang; bright spots in improving fundraising environment; sponsor-to-sponsor exits thrive while PE-backed IPOs stumble

Fund focus: Ince eyes global entrepreneurs

Blockchain, hardware, and entrepreneurs going global are on the agenda for Ince Capital Partners’ second fund, which closed above target despite LPs getting spooked by the tech sector crackdown

China GPs emphasize consumer sector opportunities

Policy volatility in China has prompted many investors to eschew consumer-facing business models in favour of B2B plays like deep-tech, but sector specialists still see opportunity, the Hong Kong Venture Capital & Private Equity Association’s (HKVCA)...

China 5G chip designer Eigencomm raises $157m

SoftBank Vision Fund II has led a CNY 1bn (USD 157m) Series C for Shanghai-based chipmaker Eigencomm, with participation from new investors Cathay Capital, CoStone Capital, Chobe Capital, and GF Qianhe, a unit of GF Securities.

PE consortium cuts 51job take-private offer by 28%

A private equity consortium pursuing a take-private of US-listed Chinese online recruitment platform 51job has cut its offer price by 28%, citing deteriorating market conditions, regulatory tightening in China, and the continuing impact of COVID-19.