4Q analysis: Record quarter, record year

China rebounds as Asia private equity investment ends 2021 with a bang; bright spots in improving fundraising environment; sponsor-to-sponsor exits thrive while PE-backed IPOs stumble

1) Investment: Another USD 100bn quarter

To many investors, technology and property in China come with a health warning attached. Both sectors have faced intense regulatory scrutiny in the past 12 months. Technology bore the brunt of efforts to stamp out anti-competitive behaviour and consumer exploitation, while in property, a multi-year drive to reduce overleverage intensified, claiming the scalp of China Evergrande.

Yet the top two deals announced in the fourth quarter of 2021 involved these sectors: a CNY 40bn (USD 9.4bn) restructuring of chipmaker Tsinghua Unigroup and a USD 6bn pre-IPO commitment to Wanda Commercial Management Group.

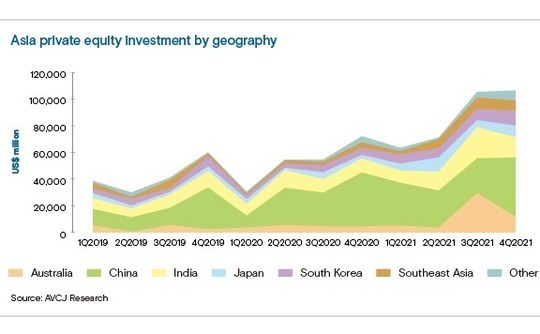

They helped end a run of three consecutive quarters of declining private equity investment in China. Indeed, the USD 44.4bn deployed between October and December represents an all-time high. It was enough to set a record for Asia-wide activity as well. The fourth-quarter total came to USD 106.4bn, even as India and Australia – mainstays of the third quarter's USD 105.3bn – fell back.

The second-half flourish brought investment for 2021 in full to USD 342.9bn, according to preliminary figures provided by AVCJ Research (the total is likely to be revised upwards). This is USD 130bn more than the previous high, set in 2017. It's worth noting that Asia dealmaking crossed the USD 150bn threshold for the first time as recently as 2015.

The state-owned company was the country's designated consolidator-in-chief but ended up overburdened with debt. Jianguang Asset Management (JAC Capital), a state-owned investor, has teamed up with frequent collaborator Wise Road Capital, described as an international Asian growth capital investor, to lead a consortium that will pick up the pieces.

As for Wanda Commercial, it might be controlled by a major player in a debt-ridden sector, but the company is an asset manager rather than an asset owner. It is the Chinese commercial real estate story writ large, with a shopping mall portfolio twice as large as the closest competitor, US-based Simon Property Group, and revenues that outstrip those of the rest of the global top 10 combined.

PAG took the lead, committing USD 2.8bn – of which one-third was bank debt – in what represents its largest-ever investment. Other participants included Ant Group, CITIC Capital, Country Garden Holdings, and Tencent Holdings.

Unigroup and Wanda Commercial were two of 21 USD 1bn-plus deals announced in the fourth quarter, nearly double the count for the prior three months. The top five was filled out by three secondary buyouts (another key industry trend – see below).

Other notable China transactions represent the continuation of existing phenomena. Hard-tech like semiconductors and sustainability-themed investments, which encompass everything from electric vehicles to wind turbines, are industry watchwords. Both are regarded as favourable policy plays, removed from the consumer-facing areas of the technology sector targeted by regulators.

Early and growth-stage investment in technology recovered from a mid-year slump to USD 10.7bn, but exposure to content and services delivered to consumer remains resolutely low. Meanwhile, USD 2.4bn went into sustainability deals, matching the record level set in the third quarter.

Having comfortably exceeded China in the July-September period, early and growth-stage activity in India's technology space retreated to USD 9.1bn. Nevertheless, the sector pushed overall private equity investment in the country into uncharted territory in 2021. The unicorn population more than doubled to 90 and now ranks third after the US and China.

India was not alone. Every major market in the region – Australia, China, India, Japan, South Korea, and Southeast Asia – posted a new annual high for capital deployed. In Australia, South Korea and Southeast Asia, investment in 2021 exceeded the combined totals for 2019 and 2020. Japan came close to emulating this feat.

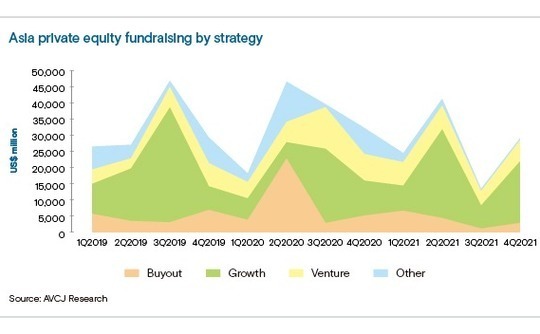

2) Fundraising: Drawing positives

Asia private equity fundraising recovered from its third-quarter nadir, but overall, 2021 will be remembered as a disappointing and frustrating 12 months. Starting in 2015, capital committed to funds targeting the region has consistently exceeded USD 100bn. Last year's total of USD 111.9bn is the lowest since that streak began.

Drawing positives from the situation, developments in the final three months of 2021 did offer some pointers for 2022. Nearly 30% of the USD 29bn raised, up from USD 13.4bn in the third quarter, was spread across two closes on Baring Private Equity Asia's (BPEA) eighth pan-regional fund. It was the year's largest close of any kind.

There were only 19 closes of USD 1bn or more – down from 27 in 2020 – and five above USD 2bn. However, BPEA and Hillhouse Investment are expected to complete fundraising processes this year, each potentially topping USD 10bn, while The Blackstone Group is said to have collected more than USD 5bn for its latest Asia offering. PAG and The Carlyle Group are also returning to market with expectations of raising USD 8bn-plus.

Fundraising rose from USD 2.2bn in the third quarter to USD 3bn in the fourth, but it hardly represents a panacea. In addition, Boyu Capital accounts for nearly one-quarter of the 2021 total, suggesting an increasingly stark two-speed market.

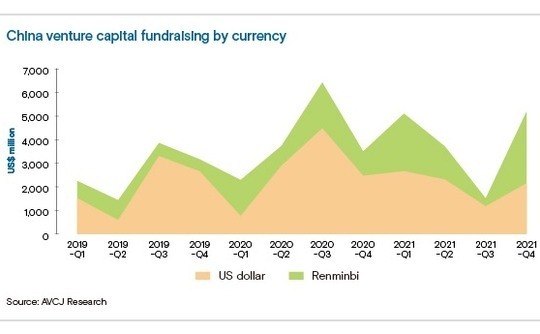

Overall commitments to China managers rose threefold in the final three months from the three months prior largely thanks to an unexpected spike on the renminbi side.

Local currency fundraising has been weak ever since a redrawing of regulatory boundaries in 2018. The USD 13.9bn fourth-quarter total is the most in more than a year, and it may yet prove to be a blip. Certainly, renminbi fundraising for 2021 in full was an uninspiring USD 30.6bn, down from USD 42.3bn. For context, in each of 2016 and 2017, it topped USD 90bn.

But it is argued in some quarters that the renminbi resurgence represents a response to the policy upheaval, much like the second-half decline on the US dollar side. Investors recognise that China wants to safeguard its technology, especially in sensitive areas like hard-tech and deep-tech, so start-ups in these areas will most likely list on domestic markets.

While currency conversion can be reasonably straightforward, the most efficient way to access these assets is through renminbi funds. A CNY 20.4bn (USD 3.2bn) vehicle launched by IDG Capital made an outsize contribution in the fourth quarter, followed by CNY 7bn from Source Code Capital.

Twelve of the 15 largest closes – final or incremental – from the last three months involved China-focused funds. Eight of these were renminbi-denominated. The standout effort on the US dollar side came from Lightspeed China Partners, which took three months to secure USD 920m across venture and growth funds. A focus on policy-friendly deep-tech and green-tech helped its cause.

3) Exits: IPOs down, PE-to-PE deals up

SenseTime's Hong Kong IPO might be interpreted as an act of defiance. The China-based artificial intelligence technology developer withdrew its offering days before launch date after being placed on a list of "Chinese military-industrial complex companies" that are off-limits to US investors.

This wasn't the first time the start-up had appeared on a US blacklist – it happened in 2019, over an alleged contribution to human rights violations, which put an end to a planned New York IPO – and it wasn't to be deterred. SenseTime made a few adjustments and returned to raise HKD 5.78bn (USD 741m). It now trades at an 81% premium to the IPO price with a market capitalisation of USD29bn.

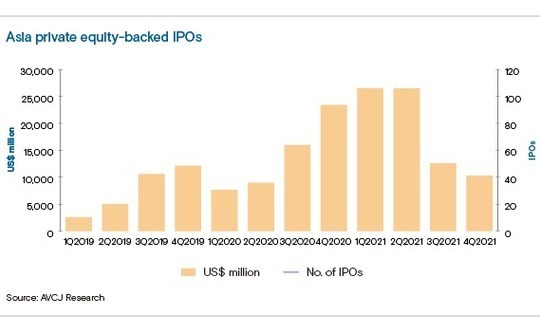

SenseTime was one of few private equity-backed companies to breakthrough in a decidedly weak quarter for China IPOs. Three offerings raised a combined USD 1.3bn, down from USD 5.5bn from 45 in July-September. One must go all the way back to 2016 to find a lower three-month total.

It has still been a record year, with USD 48.6bn in proceeds, but more than 80% of that was raised in the first half. US listings by Chinese companies then all but dried up amid regulatory uncertainty, but New York only accounted for less than one-third of the first-half total. The subsequent fallout has been broader, with the Star Market and other mainland boards, as well as Hong Kong, noticeably quiet.

Private equity-backed Indian companies raised USD 5.4bn in the quarter, an all-time high. This was not enough to offset the China decline. Proceeds for the entire region came to USD 10.3bn from 46 IPOs, compared to USD 12.6bn from 71 in the third quarter and USD 26.5bn from 109 in the first.

China's stellar first-half performance was enough to propel 2021 to USD 75.9bn, up from USD 55.9bn in 2020. Private equity exits – as opposed to liquidity events – also rose year-on-year, jumping from USD 37.9bn to USD 107.1bn. It is short of the record total set in 2018, but the post-COVID-19 recovery is encouraging.

However, this is not a revival built on trade sales alone. In 2018, nearly two-thirds of exit proceeds came from sales to strategic investors. Last year, this share fell to 55%. Sponsor-to-sponsor sales contributed 33%, up from 21% in 2018.

This changing dynamic emerged in 2020 when strategic investors were arguably slow to respond to the new reality presented by the pandemic in terms of due diligence or distracted by internal problems. Private equity players seized on the opportunity and retained hold, spurred by cheap debt and larger fund sizes. They are said to be increasingly willing and able to outbid strategic peers.

Sponsor-to-sponsor activity intensified as 2021 progressed, reaching USD 17.8bn in the fourth quarter, roughly twice the total for the prior three months. Capital was concentrated in a relatively small number of deals. Five of the 10 largest exits saw assets passed from one private equity firm to another.

This included all the top three: Accordia Golf (MBK Partners to Fortress Investment Group), Hexaware Technologies (Baring Private Equity Asia to The Carlyle Group), and Tricor Holdings (Permira to Baring Private Equity Asia). The combined deal value of USD 9.3bn exceeded that of the seven next-largest transactions.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.