Weekly digest - January 26 2022

|

AVCJ's weekly digest will not publish on February 2 due to the Lunar New Year Festival holiday in Hong Kong. Normal service will resume on February 9.

|

|

PORTFOLIO

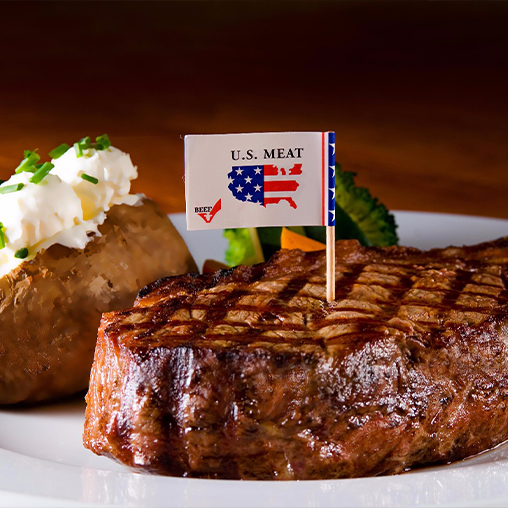

AFFIRMA AND KOREA'S SUNWOO FRESH

Affirma Capital is helping Korea's Sunwoo Fresh discover new revenue streams overseas, online, and in adjacent links of the beef importing value chain. Aggressive M&A has accelerated the process. Affirma Capital is helping Korea's Sunwoo Fresh discover new revenue streams overseas, online, and in adjacent links of the beef importing value chain. Aggressive M&A has accelerated the process.DEAL FOCUS

BARING ASIA COMPLETES INTERPLEX TURNAROUND

Refocusing on high-growth segments like electric vehicles – plus a smarter approach to sales and operations – underpinned Baring Private Equity Asia's 4x return on engineering business Interplex. Refocusing on high-growth segments like electric vehicles – plus a smarter approach to sales and operations – underpinned Baring Private Equity Asia's 4x return on engineering business Interplex.DEAL FOCUS

DARWINBOX'S UNUSUAL PATH TO UNICORN STATUS

Most of India's top software-as-a-service companies gained traction in the North American market. Darwinbox cracked Southeast Asia first, thanks to a product with broad appeal and local nuance. Most of India's top software-as-a-service companies gained traction in the North American market. Darwinbox cracked Southeast Asia first, thanks to a product with broad appeal and local nuance.DEAL FOCUS

FOUNDATION EYES A BRIGHT FUTURE

In leading an USD 82m cross-currency restructuring of a consumer-tech portfolio managed by China's Bright Capital, Foundation Private Equity opted for a structure that is unusual yet prioritises alignment. In leading an USD 82m cross-currency restructuring of a consumer-tech portfolio managed by China's Bright Capital, Foundation Private Equity opted for a structure that is unusual yet prioritises alignment. |

|

SEEN AND HEARD

REGIONAL REBALANCING

Investor interest in less-trafficked Asian markets - as a hedge to increasing geopolitical tensions and regulatory uncertainty in China - more specialized European strategies will continue to expand in 2022, according to Cambridge Associates. SEEN AND HEARD

ASIA CREDIT AGENDA

A Western-led economic recovery, attempts to tame inflation, the search for real yield, and increased emphasis on environment, social, and governance (ESG) will be the key private credit themes of the next 12 months, according to Zerobridge Advisors. |

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.