Weekly digest - January 19 2022

|

ANALYSIS

4Q: RECORD QUARTER, RECORD YEAR

China rebounds as Asia private equity investment ends 2021 with a bang; bright spots appear in improving fundraising environment; sponsor-to-sponsor exits thrive while PE-backed IPOs stumble. China rebounds as Asia private equity investment ends 2021 with a bang; bright spots appear in improving fundraising environment; sponsor-to-sponsor exits thrive while PE-backed IPOs stumble.Q&A

GULF CAPITAL

Richard Dallas, a senior managing director at Gulf Capital, and new Asia head Shantanu Mukerji on using Singapore as a regional hub, cross-border expansion, and why a dedicated regional fund is unlikely. Richard Dallas, a senior managing director at Gulf Capital, and new Asia head Shantanu Mukerji on using Singapore as a regional hub, cross-border expansion, and why a dedicated regional fund is unlikely.DEAL FOCUS

ACA SEEKS ASIA-EUROPE SPORTING SYNERGIES

Japan's ACA Group has acquired a Belgium-based KMSK Deinze as part of a multi-club investment strategy that will – in part – bring Asian players into the middle tiers of European football. Japan's ACA Group has acquired a Belgium-based KMSK Deinze as part of a multi-club investment strategy that will – in part – bring Asian players into the middle tiers of European football.FUND FOCUS

INCE EYES GLOBAL ENTREPRENEURS

Blockchain, hardware, and entrepreneurs going global are on the agenda for Ince Capital Partners' second China fund, which closed above target despite LPs getting spooked by the tech sector crackdown. Blockchain, hardware, and entrepreneurs going global are on the agenda for Ince Capital Partners' second China fund, which closed above target despite LPs getting spooked by the tech sector crackdown.DEAL FOCUS

STARFIELD SERVES UP SERIES B

The Chinese manufacturer of plant-based protein replacements has secured USD 100m in funding to advance a product portfolio that aspires to diversity and structural sophistication. The Chinese manufacturer of plant-based protein replacements has secured USD 100m in funding to advance a product portfolio that aspires to diversity and structural sophistication.DEAL FOCUS

PRIME VENTURE SECURES FOUR-YEAR EXTENSION

Foundation Private Equity has made its first foray into India, taking out all the LPs in Prime Venture Partners' debut fund through a tender offer process. Foundation Private Equity has made its first foray into India, taking out all the LPs in Prime Venture Partners' debut fund through a tender offer process. |

|

By the Numbers

AVCJ RESEARCH

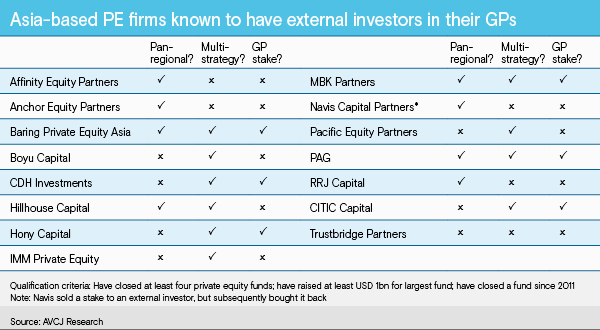

A PLETHORA OF PARTNERS

MBK Partners has become the latest Asia-based large-cap private equity firm to sell a GP stake to external investors. Dyal Capital Partners acquired a 12% interest, with the proceeds earmarked for seeding new investment strategies. Numerous managers across the region have entered into similar transactions, looking to support succession, expansion, or a near-term fundraise. Many are not disclosed. However, they are not necessarily doing business with the likes of Dyal, which have institutionalized the fund-of-firms approach and prioritize longevity, scale, and multiple fee streams. The only transactions readily comparable to MBK-Dyal involved PAG and Baring Private Equity Asia. Below is an admittedly broad snapshot of the Asia target universe, using filters such as number of funds closed, fund size, and recent fundraising activity. |

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.