India retail: Bazaar bedrock

Traditional micro-retailers continue to dominate India’s consumer economy, thriving amid COVID-19, encroaching supermarkets, and the rise of e-commerce. So, why is investing in them so hard?

India was home to about 63.4 million micro and small to medium-sized enterprises (MSMEs) in 2020, up 18.5% from the previous year. It's a ragtag sector colored by informal business practices and a lack of digitization that has increasingly inspired promises of modernization from government, industry, and private investors. There are many reasons this is not an easy thing to do, perhaps especially the fact that the MSMEs don't necessarily need the help.

The most resilient and fiercely independent MSME segment is the traditional neighborhood retailers, know colloquially as kirana shops. The population of kiranas is typically pegged around 13 million, but depending on how shop types are defined, this figure can be as high as 50 million. By most counts, they represent almost 90% of the local retail market versus modern outlets. In food and grocery, more than 95% of business is said to be in kirana hands.

The slow death of mom-and-pop shops caused by the growth of modern retail and e-commerce in other markets has not come to pass in India due to scaling and infrastructural challenges. The kiranas, meanwhile, have appeared immune to consolidation attempts, preferring the control and flexibility that comes with an independent, hyperlocal style. During the worst episodes of COVID-19, they have been among the only physical retailers to stay open, prospering as supermarkets falter.

Nevertheless, private equity and venture capital investors, as well as organized retailers, e-commerce players, and fast-moving consumer goods (FMCG) brands are asking kiranas to onboard apps and join online networks as a means of driving business efficiency. Rajat Wahi, a partner at Deloitte India, is skeptical. He observes that it simply isn't feasible for kiranas to operate with multiple apps on a daily basis, and that the idea of losing control as part of a chain remains unpopular.

"Everyone is trying to see how they can make a play for the kiranas, but the kiranas don't want to become tied to one company and dependent on the margins of that one player," Wahi says. "The way it works now, the kiranas are able to juggle various brands, wholesalers, distributors, and e-commerce companies, enhancing their margins through price arbitrage between these channels. Giving that away to modern retail or a company with an app doesn't make sense."

Big beasts

The biggest bet defying this logic is Reliance Industries. The historically energy and petrochemicals-focused conglomerate raised $26 billion last year from financial and strategic investors for a pivot largely focused on the perceived kirana sector opportunity. The plan is to co-mobilize its Reliance Retail, Jio Platforms, and JioMart businesses to create a network of Jio-branded kiranas serviced by Jio-owned e-commerce infrastructure and physical supply chains.

More recent traction in this vein includes last month's launch of the $250 million Amazon Smbhav Venture Fund, which plans to recruit one million offline retailers and kiranas onto Amazon.in by 2025. This is unfamiliar territory for the US e-commerce giant in at least two ways. First, B2C remains Amazon's core expertise rather than B2B. Second, its success to date has been mostly in developed markets, where mom-and-pops are more easily corralled, if not run out of business altogether.

"Reliance's approach sounded different to the traditional Amazon approach, which has been, ‘forget about the existing retail infrastructure, let's build a fresh tech-friendly stack of infrastructure from day one and scale that way,'" says one private equity investor in Jio Platforms. "That's not about corner stores and micro-retail, which is really a developing market phenomenon. That environment might be unfamiliar to Amazon but very familiar to locally grown tech companies."

One of Amazon's first investments under this strategy helps unpack a core reason kiranas remain a difficult target for foreign and local investors alike.

M1xchange, an invoice discounting marketplace also backed by Mayfield, Beenext and SIDBI Venture Capital, understands that while kiranas may be macro shock survivors, they are often barely scraping by. The start-up helps businesses balance thin margins with poor supply chain negotiating leverage by facilitating the sale of defaulted inventory invoices to banks. These transactions do not appear as loans on the kirana's books, and the bank takes on the risk of collection.

"The cost of funds for MSMEs on M1xchange is at least 50% lower than what they get on other platforms or on their own," says CEO Sundeep Mohindru, noting that business has boomed 2.5x since COVID-19 began rattling kiranas' upstream suppliers. "That's a huge difference in terms of costing. Everyone is trying to do financial inclusion, but if I do financial inclusion at a cost that is very high for an MSME, then the business becomes non-competitive."

It remains to be seen to what extent Amazon will cooperate with M1xchange or whether the start-up's VC backers can feasibly expect an exit via a full acquisition down the track. For the time being, Mohindru summarizes the relationship as an alignment of interests that could see his company tap the Amazon ecosystem. M1xchange currently works with 8,000 MSMEs across 600 cities.

"Innovation in terms of products and services that actually meet MSMEs' needs at the right price point, is where the private sector can play a role – but for that to be beneficial, you need scale. It's going to be about how do you play a role in supporting MSMEs that use the services of the Amazons and Jios," observes Craig Gifford, head of South Asia at CDC Group.

"What can the private sector bring that may not be the core focus of those kinds of large entities? The e-commerce side of it will require deep pockets, but credit and financial products, as well as logistics space, makes sense."

Easing the burden

Perhaps the key takeaway of M1xchange's growth during COVID-19 is that while kiranas have been resistant to consolidation and obsolescence, their economic success is precarious. This represents both an opening and a barrier to investors. Anything that can relieve financial pressure on a shop could be welcome, but not at any cost.

Digital payments services is the only digital upgrade concept that has seen widespread uptake, principally because it involves no cost to the kirana. It is not seen as a big moneymaker currently but may prove to have data collection value in time. Shopkeepers often consider other forms of software and tech-related services with subscription fees too risky for the price.

Modernization is also a cost issue from the investor perspective due to the sheer number of stores and the variety in their individual service needs. AVCJ challenged several investors and industry analysts to name a single organization that has aggregated a kirana network of more than 200,000 stores to no avail. Amazon, which has been in the space since 2014, has only about 50,000 signed up to its Local Shops program.

"We're not going to see 20-40 million of these stores divided between 2-3 large players. Maybe large corporations will get a few million here and there, but they're not going to dominate and brand everything in India under a few chains. It's too time-consuming and expensive," says Rajesh Raju, a managing director at Kalaari Capital.

"I think the nimbler new-age companies have a better chance of succeeding because they're trying to co-exist with the small stores without competing with them. The kiranas aren't stupid – they know the big guys are their competition."

Kalaari has concluded that the smartest entry here is supply chain services, with its two main plays being grocery wholesaler platform Jumbotail and distribution and fulfillment provider ElasticRun. Jumbotail, which has a network of 30,000 kiranas, closed a $25 million Series B round in January. ElasticRun, which helps 125,000 kiranas with limited infrastructure support manage low-volume inventory jobs, raised a $75 million Series D last month.

Much of the thinking with these investments is that kiranas may not be easy to change, but the broader logistics ecosystem around them is calling out for it. In part, the problem is that it can be difficult to organize the delivery of small quantities of branded goods to remote outlets. And even when those connections are made, valuable data about the consumption of the products is not being recorded and shared by wholesalers and other intermediaries.

"You have no idea what's happening to the product, where it's ending up, who's buying it, which town, village or which kind of customer is consuming it. All that information is lost once it leaves the distribution network," Raju adds. "Distributors are the eyes and ears of the brand in India. Even if they're not very tech savvy, they do have insights about how the competition is doing, what price points will work, what are the local tastes, and how are those tastes changing."

Money matters

ElasticRun's long-term plans are to build up to a network of one million kiranas, but the company knows this is a tall order. Not only are shopkeepers largely happy with their current logistics arrangements, so are the brands. Many brands targeting India aren't confident that modern retail players – whether they're conglomerates or start-ups – will have the ability to penetrate and navigate lower-tier cities and towns to fulfill their distribution goals.

Several private equity-backed B2B services providers are attempting to fill this void, perhaps most notably Udaan, whose food business grew 500% in 2020 as kiranas experienced spiking demand for essentials. Udaan, which provides an online marketplace for streamlining supply chain channels, has raised some $1.1 billion since 2018, including a $280 million round earlier this year.

Nevertheless, there remains is a sense among kiranas that their troubles stocking a wider range of brands have more to do with shelf space than logistics. Traditional retailers typically keep everything behind the counter and would require significant financing to develop a modern store layout.

A booming, private equity-backed industry of non-banking financial companies (NBFCs) has helped on this front with some of the larger retailers, less so at the micro level. Accounting start-ups have targeted kirana finances from more indirect angles. In addition to M1xchange, standouts include bookkeeping app Khatabook, which raised a $60 million Series B last year. There is little consensus, however, as to how far these models can be scaled.

"No one has cracked the model in terms of what makes it economically viable to do FMCG distribution to kiranas beyond what the existing distributors already do," says Deloitte's Wahi. "The margins are so thin, it just makes it prohibitively costly to cover thousands of outlets with 20-30 brands and up to 5,000 SKUs [stockkeeping units]. And it's also hard for NBFCs to take on the risk of a lot of small kiranas. There's an opportunity there, but right now, we're not seeing a lot of straight finance happening in kiranas through NBFCs."

Ultimately, uptake of digital bells and whistles has been slow among kiranas because they've seen little evidence that it works. But there is a chance to improve the chances of investor success in this area through education.

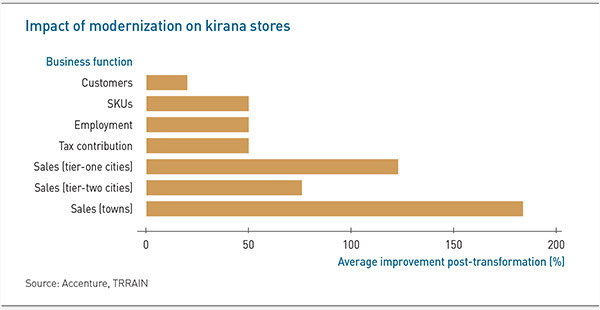

A recent report from Accenture and Trust For Retailers & Retail Associates of India (TRRAIN) hopes to support such efforts. A total of 57 kiranas in different sizes and formats across the country were asked about their experiences with shop transformation, considering everything from technology integration to simply reconfiguring in-store product placement. Every respondent said business had improved, with revenues up 20-300%, profits up 30-400%, patronage up 20% on average, and SKUs up 50% on average.

Still, one of the lessons of the study is that the kirana opportunity for investors lies less in solving business-level challenges than in tapping the mindsets and social undercurrents that make the overall sector tick.

Macro wave

One of these trends is the general economic uplift in lower-tier cities and rural areas, where kirana sales are set to reach $600 billion in the next five years. As one industry participant puts it: "About 10% of kiranas are in tier-one and tier-two cities, and everyone is fighting over them without going beyond."

There is also the idea that India is the most populated country globally for the age group 20-35, and almost 50% of that group is the second generation in the MSME sector. When those businesses change generations, technology uptake will accelerate but negative perceptions about social standing in the kirana space may create new areas of demand among family-run stores.

With this in mind, sprucing things up at disheveled kiranas has become an investment niche all its own. The most straightforward actor here is Kirana King, a start-up that rebrands independent kiranas as part of a chain with a uniform logo, modern interiors and tech-driven back-end operations. It received its seed round last year from Rajasthan Venture Capital Fund.

"The traditional system is considered unorganized, which is absolutely not true. The kiranas have proven we can rely on them during COVID, while the modern trade in supermarkets did not. But there is less respect," says B.S. Nagesh, founder of TRRAIN.

"I know a lot of traditional retailers whose children have started branded franchise shops because they get more respect. The shops are clean, and their business cards have brand names. They feel their status is improving. When traditional stores are run in a modern way, not only does business double but the next generation will stay on to run it."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.