Healthcare

Deal focus: NSSK builds out drugstore empire

NSSK found a rare succession-driven special situations deal in Japan’s prosperous healthcare space with pharmacy operator Kraft. It is the eight-year-old private equity firm’s largest deal to date

TPG completes buyout of Australia's iNova Pharmaceuticals

TPG has completed its acquisition of a majority stake in Australia-based prescription medicines business iNova Pharmaceuticals, facilitating exits for Pacific Equity Partners (PEP) and The Carlyle Group.

India's Jashvik Capital reaches first close on debut PE fund

India’s Jashvik Capital, a private equity firm set up by Naresh Patawari, formerly a partner at TA Associates, has achieved a first close of undisclosed size on its debut fund. The target is USD 350m.

Deal focus: Elevation makes Korea healthcare debut

Adverse fundraising conditions didn’t deter deal-by-deal player Elevation Private Equity from investing in Korea healthcare turnaround, and by extension, aligning with a key domestic partner

VC-backed Singapore biotech start-up agrees SPAC merger

Singapore’s AUM Biosciences, a VC-backed oncology treatments developer, has agreed to a NASDAQ listing via special purpose acquisition company (SPAC) at a pre-money equity valuation of USD 400m.

Portfolio: Warburg Pincus and HTDK Group

Warburg Pincus’ investment in Chinese medical devices industry services provider HTDK Group is riding the domestic healthcare wave. Bringing foreigners to the party is the next chapter

Japan's NSSK buys Sakura pharmacy chain

Japanese middle-market private equity firm NSSK has acquired 100% of Kraft, a local pharmacy chain that operates under the Sakura brand, for an undisclosed sum.

China's VectorBuilder raises $57m Series C

Guangzhou-based gene delivery company VectorBuilder has raised a CNY 410m (USD 57m) Series C round led by Legend Capital, Sui Kai Equity Investment, and Yuexiu Industrial Fund.

Polaris buys Japan care home operator

Polaris Capital Group has agreed to acquire a majority stake in Social Inclu, a Tokyo-based operator of more than 150 group homes for people with disabilities. The size of the investment was not disclosed.

Japan healthcare start-up Ubie closes $43m Series C

Japanese healthcare technology start-up Ubie has closed its Series C round on JPY6.3bn (USD 43.2m) with the latest tranche featuring PE-owned pharmacy chain operator Sogo Medical.

China's Neushen Therapeutics gets $20m pre-Series A

China’s Neushen Therapeutics, a biotech developer focused on central nervous system (CNS) disorders, has raised USD 20m in pre-Series A funding led by local VC firm Lapam Capital.

Sequoia, ChrysCapital to exit India's Curatio

Sequoia Capital India and ChrysCapital Partners are set to exit Indian skincare brand Curatio, with Torrent Pharma agreeing to acquire 100% of the company for INR 20bn (USD 245m).

India's Molbio secures Temasek backing, becomes unicorn

India’s Molbio Diagnostics, a medical equipment maker best known for its COVID-19 testing systems, has raised a USD 85m round featuring Temasek Holdings at an enterprise valuation of USD 1.6bn.

KKR walks away from bumper Australia healthcare take-private

A KKR-led consortium has ended its pursuit of Australia-listed hospital operator Ramsay Health Care, having failed to reach an agreement on a AUD 20.1bn (USD 13.9bn) take-private that would have been among the largest private equity deals ever seen in...

China drug developer Worg secures $57m Series B

Worg, a China-based drug developer, has closed a Series B round of CNY400m (USD57m) from five local investors - Jiachen Capital, Longpan Capital, Kaitai Capital, Puhua Capital and Anji Ruixing Capital.

PE-backed Mankind Pharma files for India IPO

Indian drug maker Mankind Pharma has filed for a domestic IPO, setting up an exit for Capital International, a private equity arm of Capital Group.

Blackbird leads $23m Series B for Australia's Sonder

Australia’s Blackbird Ventures has led a AUD 35m (USD 23.4m) Series B round for Sonder, a staff and student management app focused on wellbeing and safety.

China's HighLight hits first close on life sciences fund, targets $650m

HighLight Capital, a China-based life sciences investor, has completed a first close of USD 540m on its fourth US dollar-denominated fund. The overall target is USD 650m.

Everstone buys India's Softgel Healthcare

Everstone Capital has acquired a controlling stake in Indian pharmaceuticals manufacturer Softgel Healthcare (SHPL) for an undisclosed sum.

TPG-backed Dingdang Health raises $51m in Hong Kong IPO

Chinese online pharmacy platform Dingdang Health has raised HKD 402.4m (USD 51m) through a Hong Kong IPO, defying challenging conditions for financial sponsors targeting the bourse.

Singapore's Docquity raises $44m Series C

Singapore-based Docquity, a networking service for more than 300,000 doctors across Southeast Asia, has raised USD 44m in Series C funding led by Japan’s Itochu Corporation.

China drug developer BoomRay gets $43m

Chinese drug developer BoomRay Pharmaceuticals has raised a CNY300m (USD 43m) Series A round led by Sequoia Capital China.

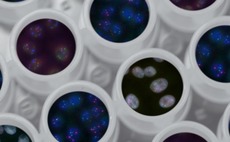

China cell therapy developer Neukio raises $50m

Shanghai-based cell therapy developer Neukio Biotherapeutics has raised USD 50m in the first tranche of a Series A round led by medical technology-focused CD Capital. Other new investors include Alwin Capital and Surplus Capital.

Novo Holdings leads $50m round for India's MedGenome

Novo Holdings, which manages the wealth of Denmark’s Novo Nordisk Foundation, has led a USD 50m investment in MedGenome, an India-based genetic testing business.