Healthcare

ICG invests in Korea's Big Mama Seafood

Intermediate Capital Group (ICG) has announced a second deal in three weeks from its fourth Asia fund – which closed last year on USD 1.1bn – with a commitment of undisclosed size to Korea-based Big Mama Seafood.

Deal focus: TR leads $150m multi-asset secondary for India's Samara

TR Capital first worked with Samara Capital on a single-asset continuation fund for Sapphire Foods India – and saw the local Yum Brands franchisor go public about three months after the deal was announced. It has now reunited with Samara for what amounts...

Advent acquires majority stake in India's Suven Pharma

Advent International has agreed to acquire a 50.1% stake in India-listed drug industry supplier Suven Pharmaceuticals for INR 63.1bn (USD 761.5m) with plans to acquire an additional 26%.

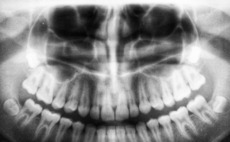

MBK buys Korea dental scanning player Medit, Unison exits

MBK Partners has agreed to buy Medit, a South Korea-based manufacturer of 3D dental scanners, for a valuation of approximately KRW 2.4trn (USD 1.88bn). The transaction facilitates an exit for Unison Capital’s Korea business.

Quadrant buys Australian healthcare equipment supplier

Quadrant Private Equity has bought a majority interest in Aidacare, an Australia-based distributor of healthcare equipment, with a view to supporting domestic and international growth.

NSSK exits Japan nursing care provider to Ricoh Leasing

Japan-based mid-market private equity firm NSSK has exited nursing care provider Welfare Suzuran to Ricoh Leasing, a Tokyo-listed leasing and finance company, for an undisclosed sum.

Singapore's Doctor Anywhere raises $38m, makes acquisition

Southeast Asia-focused telehealth platform Doctor Anywhere has closed a second tranche of Series C funding worth USD 38.8m and acquired Singapore-listed Asian Healthcare Specialists (AHS).

KKR buys Japan's Bushu Pharmaceuticals from BPEA EQT

KKR has agreed to buy Japan-based contract drug manufacturer Bushu Pharmaceuticals from BPEA EQT – formerly Baring Private Equity Asia – for an undisclosed sum.

Co-Stone leads $43m round for China biosynthesis player

Co-Stone Capital Management has led a CNY 300m (USD 43m) Series B round for Readline, a Shenzhen-based company that specialises in synthetic biology.

Australia's Heal Partners closes debut fund on $137m

Australia’s Heal Partners, a health, education, and lifestyle-focused venture capital firm, has closed its first fund on AUD 200m (USD 137m). The target was AUD 100m.

Hillhouse buys Australia CRO George Clinical

Hillhouse Capital has agreed to buy George Clinical, an Australia-based clinical research organisation (CRO) with a global footprint, for an undisclosed sum.

China medical devices manufacturer LavaMed raises $40m

SuZhou LavaMed, a China-based medical devices manufacturer, has raised USD 40m in angel and Series A funding from Zhejiang Silk Road Fund, Junshang Capital, and Lilly Asia Ventures (LAV).

Hong Kong's E15 VC raises $61m for third fund

Hong Kong’s E15 VC has hit a first close of USD 60.75m on its third global deep tech fund with an anchor investment from existing cornerstone LP Sun Hung Kai & Co (SHK).

Australian needle-free vaccine start-up raises $23m

OneVentures and UniQuest have led a AUD 34m (USD 23m) funding round for Vaxxas, an Australia-based biotechnology company running clinical programmes that include a needle-free COVID-19 vaccine candidate.

China CRO Safe Pharma gets $71m Series D

Safe Pharmaceutical Research Institute, a Beijing-based clinic research organization (CRO) focused on novel drugs, has raised a CNY500m (USD 71m) Series D round led by SDIC Venture Capital and China State-owned Venture Capital Fund.

Chinese investors sell international assets of condom maker LifeStyles

A Chinese investor group featuring several private equity firms has sold the non-China assets of LifeStyles Healthcare, a global sexual health and wellness platform best known for the Lifestyles condom brand, to US-based Linden Capital Partners.

CEO of Singapore's EDBI departs to launch own fund

Swee Yeok Chu, CEO and president of Singapore government investor EDBI, is stepping down from her role with a view to launching her own fund.

Deal focus: IFM secures debut long-term capital deal

Targeting PRP Diagnostic Imaging through its long-hold fund meant IFM Investors could offer the company stability and partnership. It expects to generate dividend yield and capital growth

Fund focus: Panacea defies biotech downturn

Having raised its second fund amid weakening investor sentiment for biotech, Panacea Venture expects deployment to be guided by a widening valuation gap between the US and China

Tread more cautiously in PE-infra overlap – AVCJ Forum

Investors are increasingly challenged to reconcile a vanishing divide between some infrastructure and PE strategies, the AVCJ Private Equity & Venture Forum heard.

Panacea closes second healthcare fund on $276m

Panacea Venture, a healthcare-focused investment firm established by James Huang, formerly a partner at KPCB China, has closed its second fund with approximately USD 276m in commitments.

Singapore's Speeddoc gets $28m pre-Series B round

Bertelsmann Investments, Shinhan Venture investment, Mars Growth and Vertex Ventures Southeast Asia & India have participated in a USD 28m pre-Series B round for Singapore virtual healthcare platform Speedoc.

Investcorp leads $66m round for India dental chain

Investcorp has led a INR 5.45bn (USD 66.7m) investment in Global Dental Services (GDS), an India-based dental clinic chain that claims to be the largest business of its type in Asia and one of the top 15 globally.

China's Giant Biogene trades up after $70m Hong Kong IPO

Giant Biogene, a China-based producer of skin treatments that use bioactive ingredients, gained nearly 10% on debut following a HKD 549.4m (USD 70m) Hong Kong IPO.