India's Jashvik Capital reaches first close on debut PE fund

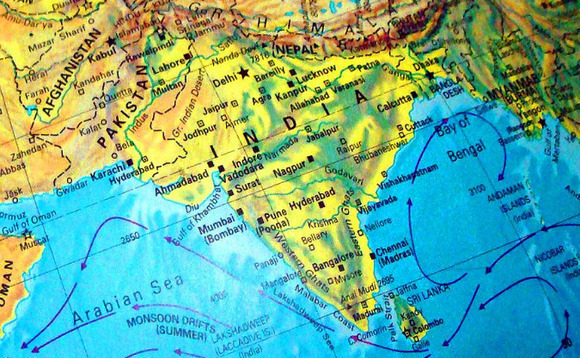

India’s Jashvik Capital, a private equity firm set up by Naresh Patawari, formerly a partner at TA Associates, has achieved a first close of undisclosed size on its debut fund. The target is USD 350m.

Jashvik was established last March and confirmed formal launch of its fund in July, expecting to complete the process within 12 months. It will make growth investments of up to USD 50m, focusing on profitable healthcare and consumer companies locally. The hard cap is USD 400m.

Patawari spent about seven years at TA, where he focused on healthcare and consumer in India. His standout deals were arguably in the financial technology space, however, including payments app BillDesk and artificial intelligence provider Fractal Analytics.

BillDesk was valued at USD 4.7bn last year when industry counterpart PayU offered to acquire the company; the deal has since fallen through. Fractal raised USD 360m in January from TPG Capital at a reported valuation of USD 2.5bn. It is currently planning an IPO.

"India presents an attractive option for investors globally. We are likely to be the fastest-growing large economy for at least the medium term, if not longer. The policy framework is stable and continually improving. Businesses are feeling confident about the future and willing to invest for growth," Patawari said in a statement.

"If we are buying in the next 1-2 years, we will likely see margin expansion by the time we look to exit. Finally, as India PE continues to mature, the quality and depth of liquidity options will continue to improve on a strong baseline. It is an exciting time for Indian private equity."

Patawari's prior experience includes stints at ICICI Venture, McKinsey & Company, and Norwegian oil company Schlumberger, where he was a field engineer. His support team for Jashvik features operating partners Vijender Singh and Anil Matai, both healthcare industry veterans.

"As India aims to grow from a USD 3trn to a USD 30trn economy, healthcare and consumer sectors will account for a disproportionate share of that growth, and high-quality, profitable growth businesses in the mid-market will be fundamental to delivering on this opportunity," Singh said in a separate statement upon joining Jashvik in August.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.