Portfolio: Warburg Pincus and HTDK Group

Warburg Pincus’ investment in Chinese medical devices industry services provider HTDK Group is riding the domestic healthcare wave. Bringing foreigners to the party is the next chapter

By 2018, Switzerland-headquartered conglomerate DKSH Group was shifting its Asian priorities away from China and healthcare. The company had long since divested its pharmaceuticals assets and was looking to do the same in medical devices. Warburg Pincus had an opposite agenda on all points.

Seeking to go deeper into the country's underpenetrated medical devices market, Warburg Pincus paid about USD 100m to acquire an underinvested unit of DKSH. The private equity firm had previously completed several control or co-control deals in China, but this was its first corporate carve-out in China and its first time taking a 100% position.

"We learned a lot and we think there are a lot of merits to doing carve-outs with MNCs [multinational corporations]," said Min Fang, head of China healthcare at Warburg Pincus. "Going forward, given the geopolitical tensions, there might be more opportunities to do deals like this as some MNCs think about divesting or reducing their exposure to the China market."

Fang is a director at the now independent medical devices services provider known as HTDK Group. Cross-border commercialisation services are the core offering, including product registration, import and export support, warehousing and fulfilment, and inventory, sales, and post-sales management.

As of 2020, HTDK claimed to be China's largest privately owned operator of its kind with a 12.3% market share overall and a 34.4% share in ophthalmic devices. Customers include major devices maker such as MicroVention, Illumina, Smith & Nephew, Roche, and Proctor & Gamble, as well as Alcon and Abbott, global leaders in ophthalmology.

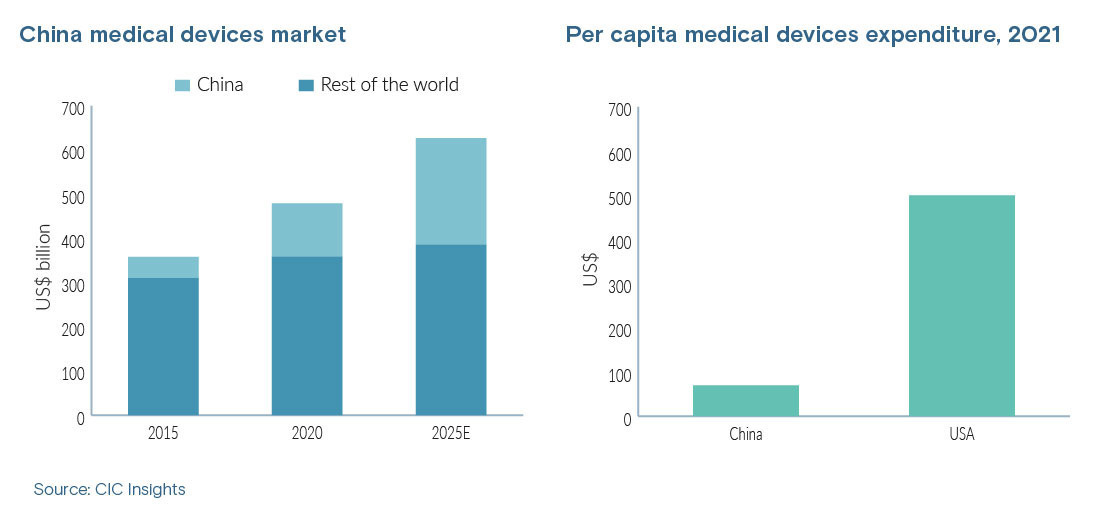

Growth to date has been significantly driven by market momentum, with CIC Insights estimating China's share of the global medical devices industry has jumped from 13% in 2015 to 25% in 2020. It is on track to hit 38% by 2025.

Fang also sees upside in a relative lack of uptake in the local market, with China's per capita expenditure on devices less than one-seventh that of the US. "By 2030, people aged over 60 will account for over a quarter of the population in China. That gives you a sense of the magnitude of the market potential for healthcare," he said.

Growth agenda

HTDK claims to have tripled both top line and bottom line during the holding period. At the time of acquisition, the assets sold to Warburg Pincus were tracking annual net sales of CHF 300m (USD 300m) and EBIT of CHF 146.5. Revenue and net profit for 2020 came to CNY 990.8m (USD 138m) and CNY 66.1m, according to an application for a Hong Kong IPO in July last year.

The more recent figures also reveal a sharp improvement in performance in early 2021, with revenue for the first five months coming in at CNY 674.1m, up 218% year-on-year. Likewise, profit for this period jumped 246% to CNY 30.6m. The IPO has been put on hold, however, with Warburg Pincus citing unfavourable market conditions.

At the time of investment, HTDK's ecosystem included 200 medical devices distributors, 1,300 public hospitals, and 600 private hospitals. Those figures are now 500, 1,700, and 900, respectively.

Meanwhile, the client base has increased from 13 to 33 as expanded logistics capacity grew the coverage area to some 3,000 counties. At acquisition, there were five warehouses in Beijing and Shanghai; there are now seven, including a Guangdong facility to cover the Greater Bay Area.

Cities within 500 kilometres of these three hubs qualify for next-day delivery. Further efficiencies have been pursued through various IT upgrades that are said to provide clients with seamless connectivity and business intelligence analysis.

There have also been important management changes, with the addition of a new CFO and heads of supply chain, legal, and IT. Teresa Chen, a 20-year veteran of the industry and formerly head of North Asia for DKSH's healthcare business, was brought in as CEO.

"She knows all the major players inside out, all the senior contacts, and more importantly, what their needs are in terms of supply chain management and commercial management for medical devices," Fang said. "We built the team around her, pretty much upgrading the entire C-level and C-minus one level – the backbone of HTDK."

The shake-up necessarily came with a shift in culture, most noticeably in decision-making. As a distant, de-prioritised subsidiary under its Swiss parent, the business needed up to two months to liaise with a regional boss. The Asia head would report to global, taking another three months. Then a final decision would come up to another nine months later. Now it takes about one month.

The importance of rapid decision-making came into focus in March this year, when Shanghai entered what would become a three-month lockdown to control the spread of COVID-19. The day before the order officially went into effect, HTDK scrambled 25% of its staff to live inside the local warehouse, noting the lifesaving urgency of its continued operations as a medical supplier.

The number of employees at the site – who received additional compensation – steadily ticked up over the course of the lockdown, with HTDK having secured special permission from the government for food deliveries in and device deliveries out.

Apart from in locked down districts, HTDK was able to achieve its key performance indicators related to next-day deliveries during the event. Despite the essential nature of the service, most of the company's competitors were frozen out of action.

The episode speaks volumes about the shift from conglomerate bureaucracy to management ownership and action. Indeed, senior management figures are now shareholders in the business – incentives were primarily cash-based under DKSH – and receive cash bonuses for business development success. This is believed to have encouraged better leadership through entrepreneurialism and longer-range vision.

"The expanded leadership team is much stronger, and their mindset is wider and more balanced," Chen said. "There are more fresh ideas and neutral thinking. There's a much longer-term view now. With Warburg Pincus, the message from the board is, where is the business opportunity, what support can they give us, and what is the outlook for the next five to 10 years."

A wider reach

Part of the broader outlook has involved diversification, with the ophthalmology and cardiovascular-focused business branching into areas such as orthopaedics, diagnostics, obstetrics, gynaecology, vascular surgery, endocrinology, respiratory, and diabetes. Much of the thinking here is to fill demand for treatments of conditions associated with China's increasingly affluent lifestyles.

Warburg Pincus has mobilised three China-based deal professionals for HTDK as well as six counterparts in the US and Europe to help with client introductions in those markets. Recent activity on this front includes a partnership with Softwave Medical, an Israel-headquartered but largely US-based specialist in non-invasive devices hoping to tap China's USD 29bn aesthetic medicine market.

"One of the key success factors for our distribution business is the ability to develop new clients with sizeable and profitable franchises, and Warburg Pincus has contributed enormously to this effort," Chen said. "I'm really impressed by the depth and breadth of the Warburg Pincus team in their industry knowledge worldwide and their expertise across different speciality areas."

Network and domain expertise expansion has also been inorganic to some extent. The sole majority acquisition to date came in May last year of Beijing Bohui, an in vitro diagnostics (IVD) company with extensive experience in registering foreign medical devices in China. The deal is said to have positioned HTDK to acquire China distribution rights for several global products.

"In quite a few cases, without Warburg Pincus, we would not be able to directly interact with the top management of very innovative medical devices companies such as IVD companies in the US or Europe," Chen added.

"We would have no way of achieving that level of connection in such a short time. And due to the trust they have built over the years, the conversations are detailed, which accelerates the business development process."

The ability to help foreign devices companies access China has played a key role in HTDK's latest phase of growth, with Warburg Pincus' global network feeding much of the progress. This is perhaps especially true with former portfolio companies such as Silk Road Medical, a US-based company that specialises in tools for stroke-related surgeries.

The latest partnership in this vein has the potential to take the concept to a new level. HTDK has agreed a partnership with a US-based operator considered a global leader in devices for diabetes management.

Diabetes already afflicts more people in China than the entire populations of Singapore, Malaysia, and South Korea combined. Nearly 40% of deaths are premature (people under 70), and the prevalence rate has been increasing steadily for decades. HTDK is initiating an in-licensing scheme for digital glucose monitoring devices expected to be a win-win for its new and former investees.

"The CEOs of those companies [exited foreign portfolio companies] are excited to connect with us again and connect with China," Fang said. "They've also identified the potential in the market, and they have ambitions, but they haven't had anyone local they've worked with before or anyone they can trust."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.