Southeast Asia

Singapore's iStox raises $50m Series A

A group of Japanese VC investors has backed a $50 million Series A round for Singapore’s iStox, a digital securities platform that deals in private markets.

Fund focus: Novo Tellus closes second Southeast Asia fund at $250m

Although its second fund is considerably larger than its first, Novo Tellus Capital Partners expects to target the same kind of Southeast Asian industrial technology businesses that have succession and expansion issues

Tower Capital hits first close on Southeast Asia fund

Tower Capital, a Singapore-based GP that previously operated on a deal-by-deal basis, has achieved a first close of approximately $250 million on its first Southeast Asia-focused private equity fund.

AVCJ Awards 2020: Deal of the Year - Small Cap: TaniGroup

Openspace Ventures played a key role in helping Indonesian agriculture technology start-up TaniGroup achieve critical mass as COVID-19 weeded out much of the competition

Asia PE investment ends 2020 on a tear

A fourth-quarter surge in growth-stage deal-making took Asia private equity investment to $198.5 billion in 2020, comfortably surpassing the previous year’s total despite the strictures of COVID-19.

Navis invests in Singapore fintech supplier Moneythor

Navis Capital Partners has made an investment of undisclosed size in Moneythor, a Singapore financial technology supplier focused on digital banking.

SEAF hits first close on Southeast Asia women's fund

The Southeast Asia division of US-headquartered impact private equity firm SEAF has reached a first close of at least $16 million for a women’s economic empowerment fund.

AVCJ Awards 2020: Firm of the Year - Large Cap: Warburg Pincus

Whether it is building a logistics platform, backing a take-private or anchoring a growth round for a tech start-up, Warburg Pincus prioritizes local partnerships in Asia

Hanwha leads $300m Series A for Grab's financial unit

Korea’s Hanwha Asset Management has led a $300 million Series A round for the financial services unit of Singapore-based ride-hailing and services platform Grab.

Singapore bourse to consider SPAC listings

The Singapore Exchange (SGX) will consider allowing listings by special purpose acquisition companies (SPACs) on the back of a spike in fundraising activity for these structures in the US.

Warburg Pincus, Goodwater lead Series D for Vietnam's MoMo

MoMo, a Vietnam-based mobile wallet provider, has closed a Series D round of more than $100 million led by Goodwater Capital and Warburg Pincus.

Indonesian stockbroker Ajaib raises $25m Series A

Horizons Ventures, which is controlled by Hong Kong billionaire Li Ka-shing, and Indonesia’s Alpha JWC Ventures have led a $25 million Series A round for Indonesian investment platform Ajaib.

Fund focus: Asian LPs amplify Mekong's ambitions

Travel restrictions forced Mekong Capital to look closer to home when raising its latest fund, but the manager was already building out a more Asia-centric LP base

Buyouts in 2021: Winners and losers

Asia could prove to be a deal-rich market in 2021, but buyout investors are still figuring out the long-term implications of COVID-19 for companies that cater to changing consumer demands

Novo Tellus backs Singapore semiconductor industry supplier

Novo Tellus Capital Partners has invested S$23.6 million ($17.7 million) in Grand Venture Technology, a Singapore-listed provider of testing, assembly, and engineering services for semiconductor manufacturing.

Myanmar's Ascent appoints two managing partners

Myanmar-based private equity firm Ascent Capital Partners has strengthened its leadership with the naming of two new managing partners. It follows a final close for the firm’s debut fund.

Bow Wave joins $175m round for Philippines-based GCash

Bow Wave Capital Management, a US-based private equity investor in mobile payment ecosystems globally, has participated in a $175 million round for Philippines-based mobile wallet GCash.

Thiel, Pacific Century launch second Southeast Asia SPAC

Peter Thiel (pictured), co-founder of PayPal, Palantir Technologies and Founders Fund, and Richard Li, son of Hong Kong billionaire Li Ka-shing, are launching another special purpose acquisition vehicle (SPAC) that will target new economy assets in Southeast...

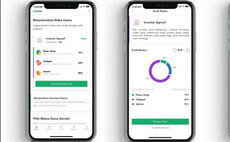

Sequoia India leads $30m round for Indonesia's Bibit

Sequoia Capital India has led a $30 million investment in Bibit, an Indonesian robo-advisory app for first-time investors.

Singapore's VC-backed GoBear to wind down

GoBear, a Singaporean financial technology start-up that received VC backing as recently as May, will cease operations and begin a phased closure of the business, citing pandemic-related disruption.

Vietnam's Mekong closes Fund IV at $246m

Vietnamese private equity firm Mekong Capital has closed its fourth flagship middle-market fund at $246 million, more than twice the size of its predecessor vehicle.

Zeitgeist: 2020 in quotes

What industry participants had to say on China IPOs, conducting due diligence on GPs, waiting for distress opportunities, working from home, co-underwriting deals, and sensible recruitment policies

Timeline: 2020 by numbers

A selection of the key fundraising, investment and exit events - presented in chronological order - from the past 12 months

GIC leads $203m investment in Vietnam hospital

A GIC-led consortium has agreed to invest VND4.7 trillion ($203 million) in Vinmec, a leading Vietnamese hospital developer and operator.