Fund focus: Novo Tellus closes second Southeast Asia fund at $250m

Although its second fund is considerably larger than its first, Novo Tellus Capital Partners expects to target the same kind of Southeast Asian industrial technology businesses that have succession and expansion issues

Southeast Asia private equity is not the easiest sell. LPs generally cite uninspiring performance and a shallow pool of investable managers as reasons for their wariness. This could be linked to difficulties in finding the right balance across fund size, strategy, and geography in a region characterized by differences in language, culture, and development as much as it is unified by trade policies.

Novo Tellus Capital Partners, which closed its second fund at $250 million at the end of December, addressed this issue by turning the fund pitch on its head. The manager first emphasized its strategic positioning and domain expertise before mentioning its geographic mandate.

"Southeast Asia is definitely a mental block for a lot of LPs. I made a lot of calls and as soon as you mention it, they say they aren't interested. So we began saying we are sector-focused, we do industrial technology, we are lower middle market, and we are starting in Southeast Asia," says Wai San Loke, the firm's co-founder and managing partner. "That can get you a first meeting. And once we showed them our fund performance, there was normally some interest."

Fund I, which had a corpus of $25 million, had one institutional backer, a fund-of-funds out of the UK. The rest came from Asian families and high net worth individuals (HNWIs). For Fund II, 80% of the corpus is institutional, featuring pension funds, endowments and foundations, and sovereign wealth funds. Most of them are based in the US and Asia.

Regulatory wrinkle

The fundraising process itself was not especially disrupted by COVID-19. Novo Tellus launched the vehicle in early 2019 and reached a first close of $50 million – comprising re-ups from existing LPs – by the second quarter. There followed a six-month international road trip spent courting prospective new investors. Loke made a final push in January 2020, visiting some LPs in the US.

"I came back later that month and was supposed to be on the road again in March, but then COVID-19 struck," he recalls. "Fortunately, during that final push I saw the relevant investment committee members, so they came back to us in April and we got them across the line. They had already conducted their due diligence and come out to meet the team."

Then it became apparent that the fund, which had a target of $175 million, was oversubscribed. In Singapore, crossing the S$250 million ($189 million) threshold means a firm must operate as a licensed fund management company with a capital markets services (CMS) license. Novo Tellus wrapped up its final commitments in July 2020. However, applying for the license to accommodate the oversubscription delayed the final close by about four months.

While Fund II is 10 times the size of its predecessor, Loke does not anticipate any change in strategy. Indeed, total capital deployed in deals out of Fund I reached $200 million with contributions from other GPs. For example, the equity check for MFS Technology, a flexible printed circuit board manufacturer acquired in 2015, was around $90 million. Navis Capital Partners was the co-investor.

"Most LPs now appreciate co-investment opportunities and now we have deeper-pocketed LPs," says Loke. "A $90 million check is not too large for us – we could do $50 million from the fund and $40 million in co-investment. Even for larger deals than that, we are equipped to raise co-investment within our LP base."

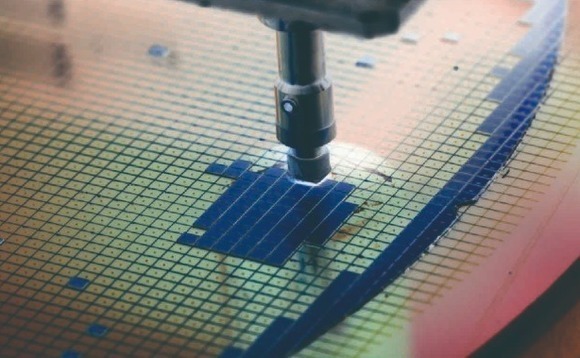

MFS was sold in 2018 for a 3x return. It is one of four exits that have pushed distributions to paid-in (DPI) on Fund I to 350%. AEM Holdings, another semiconductor industry supplier, was a bigger success story at 15x. Novo Tellus took a one-third interest – plus management control – in 2011 when the Singapore-listed company's shares were trading at S$0.07. They are now above S$4.00 and the market capitalization is S$1.1 billion. Revenue grew fivefold during the holding period.

Domain expertise

Two investments from Fund II have closed: ISDN Holdings, an industrial robotics specialist, and Procurri Corporation, a data center equipment provider. A third in Grand Venture Technology, yet another player in the semiconductor supply chain, was announced last week.

The target area is relatively concentrated, but growth is driven by a couple of compelling themes. First, supply chain diversification as multinationals look to ease their dependence on China-based manufacturers. Second, generational change in the Asian Tiger economies, specifically industrial manufacturing established in the 1980s to serve multinational customers.

"It is like what has happened in Europe as well as in Japan and Taiwan. There are mid-size industrial technology companies in Southeast Asia, especially Singapore and Malaysia, that were started by families 20, 30 or 40 years ago and they are now looking for transition or a partner to help them scale," says Loke. "The trend probably wasn't there 20 years ago, but it was there 10 years ago, when I started Fund I. I told people there was a big opportunity here, but no one believed me."

Novo Tellus claims to receive increasing inbound deal flow from founders that have seen how the firm works with management teams and want to work with it. Investments frequently involve raising capital to structure out a family member or to support expansion, including M&A. Novo Tellus helped AEM make five bolt-on acquisitions. Expansion into Vietnam is a key theme.

The firm has added to its bench strength, notably bringing in Keith Toh and Sam Tsui as partners. Toh previously spent more than a decade with Francisco Partners, while Tsui worked on M&A for Microsoft. They bring competencies in software as well as hardware, complementing Loke's own experience in this area as an IT specialist for Baring Private Equity Asia in Singapore and Silicon Valley. This points to a broadening of Novo Tellus' investment scope, but Loke stresses the team will not stray beyond its core areas of expertise.

"We understand our space – we don't go into consumer, we don't go into lifestyle, we don't go into food and beverage," he says. "We are deep in our domain and we can relate to Asia-based families and business owners. We know how to work with local owners."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.