Region

China's VectorBuilder raises $57m Series C

Guangzhou-based gene delivery company VectorBuilder has raised a CNY 410m (USD 57m) Series C round led by Legend Capital, Sui Kai Equity Investment, and Yuexiu Industrial Fund.

Australia's AgriWebb upsizes Series B to $29m

AgriWebb, an Australia-based livestock management app used by farmers and ranchers, has closed its Series B round at USD 29.3m, following a USD 6.7m top-up featuring two new investors.

China's BA Capital raises $349m for latest renminbi fund

Black Ant Capital, also known as BA Capital, has closed its third renminbi-denominated fund on CNY 2.5bn (USD 349m), with commitments from independent fund-of-funds, government guidance funds, insurers, and corporates.

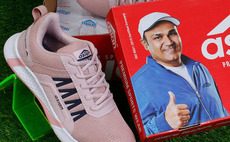

MO Alternates commits $28m to Indian footwear brand

Motilal Oswal Alternates (MO Alts), formerly Motilal Oswal Private Equity, has invested INR 2.2bn (USD 28m) in India’s Asian Footwears, which produces several shoe brands.

Insignia invests $10m in Thai beauty start-up

Insignia Ventures Partners has provided USD 10m in Series A funding to Thailand’s Konvy, a 10-year-old beauty e-commerce start-up.

GP selection: Discriminating customers

Sizeable LPs are hardening their criteria for fund commitments in reaction to a tougher investing environment. But going with fewer, deeper relationships is an uphill climb

Deal focus: Food app targets Thailand's first internet IPO

Thai restaurant delivery app Line Man Wongnai has leveraged the massive messaging service penetration of its parent company to position itself for what is hoped to be a breakthrough IPO

3Q analysis: Lean times

A flicker in India fails to disguise a miserable quarter for exits; a handful of fast fundraises snap Asia out of its slump; investment gravitates towards developed markets and manufacturing

Fund focus: Dymon Asia completes quickfire fundraise

Careful – and protracted – cultivation of prospective LPs and relatively strong performance for Southeast Asia helped Dymon Asia Private Equity secure USD 650m for its third fund

Deal focus: Euler finds favour with India-oriented EVs

Euler Motors is one of several India-based electric vehicle manufacturers attracting significant private capital, but the company believes its customised offering for commercial users is truly differentiated

Q&A: WeRide's Tony Han

Tony Han, founder and CEO of China’s WeRide, on commercialising fully autonomous passenger vehicles, surviving a capital winter, and why universities are vital to the hard-tech revolution

Vision Fund leads Series D for China dental 3D printing player

SprintRay, a China-based 3D printing company that specialises in orthodontics, has raised a USD 100m Series D round led by Softbank Vision Fund 2.

Warburg Pincus to buy majority stake in India's Vistaar Finance

Warburg Pincus has agreed to acquire a majority stake in Vistaar Finance, an India-based non-banking financial company (NBFC) that serves micro, small, and medium-sized enterprises (MSMEs).

Searchlight backs Singapore's Synergy Marine Group

US-based Searchlight Capital Partners has taken a minority stake in Singapore’s Synergy Marine Group, a shipping fleet manager and maritime services provider, for an undisclosed sum.

Mirae Asset recruits OneVentures director for Australia coverage

Mirae Asset Global Investments has expanded its Australian alternatives team with the recruitment of James McGrath, formerly an investment director at local VC firm OneVentures.

Airwallex raises another $100m, valuation holds steady

Hong Kong-based Airwallex, a cross-border payments provider turned broader financial technology platform, has raised USD 100m in a second extension to its Series E round at a valuation of USD 5.5bn. It comes 11 months after the company secured the same...

Citi, Accel back Hong Kong crypto start-up Xalts

Citi Ventures and Accel have invested in Hong Kong-based Xalts, a start-up founded by former HSBC and Meta personnel, with a view to facilitating digital asset management for institutional investors.

Investors call on Japanese start-ups to pursue overseas capital - AVCJ Forum

Japanese start-ups must attract more institutional capital from overseas given the paucity of local investors, especially in the growth stages, the AVCJ Japan Forum heard.

India's TVS Capital recruits managing partner from Flourish

Anuradha Ramachandran, who was previously an India-based director at financial technology specialist Flourish Ventures, has joined TVS Capital Funds as a managing partner.

Polaris buys Japan care home operator

Polaris Capital Group has agreed to acquire a majority stake in Social Inclu, a Tokyo-based operator of more than 150 group homes for people with disabilities. The size of the investment was not disclosed.

Japan healthcare start-up Ubie closes $43m Series C

Japanese healthcare technology start-up Ubie has closed its Series C round on JPY6.3bn (USD 43.2m) with the latest tranche featuring PE-owned pharmacy chain operator Sogo Medical.

Proterra backs Singapore biodiesel player

Specialist food and agriculture investor Proterra Investment Partners has agreed to invest in Aperion Bioenergy, a Singapore-based bioenergy producer that sources used cooking oil for feedstocks.

Dymon Asia closes Fund III at $650m hard cap

Dymon Asia Private Equity (DAPE) has closed its third Southeast Asia middle market private equity fund at a hard cap of USD 650m, beating a target of USD 550m.