Weekly digest - October 12 2022

|

By the Numbers

AVCJ RESEARCH

GROWTH GAP

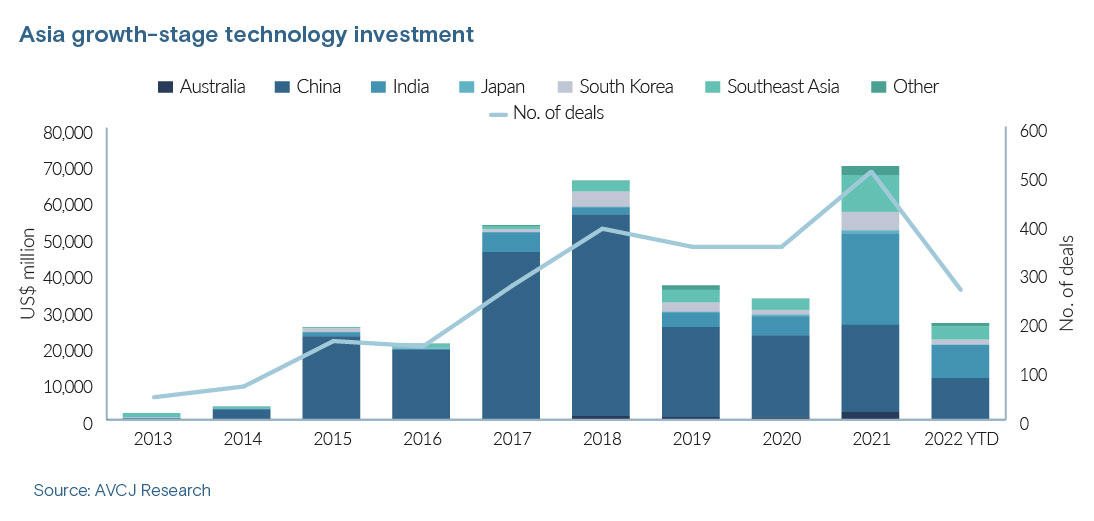

Growth-stage investment in Asia's technology sector has seen two peaks. The first, in 2018, was all about China. The country accounted for 84% of the USD 65.6bn deployed and 76% of the approximately 390 deals announced. The second came last year, when investors put USD 69.6bn to work across about 500 deals against a backdrop of regulatory uncertainty in China. Its contribution to the Asia total was roughly the same as 2020, but its share dropped to 32% of capital invested and 51% of deals announced. India and Southeast Asia made up the shortfall, posting totals of USD 25bn and USD 10.1bn, respectively. Korea also weighed in to some extent.

Right now, investment is experiencing a trough, with USD 26.5bn deployed in the region as of early October. A valuation correction of listed technology stocks globally - which is beginning to filter through to private markets, although not consistently across all geographies and stages - is largely responsible. The running totals for China, India, and Southeast Asia are USD 11.3bn, USD 9.1bn, and USD 3.7bn. Approximately 265 deals have been announced, of which only about 100 are in China.ate growth.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.