MO Alternates commits $28m to Indian footwear brand

Motilal Oswal Alternates (MO Alts), formerly Motilal Oswal Private Equity, has invested INR 2.2bn (USD 28m) in India’s Asian Footwears, which produces several shoe brands.

MO Alts said it was taking a significant minority stake in the business. It comes a week after the investor confirmed the closing of its fourth flagship growth fund with INR 45bn in commitments and a special interest in consumer models.

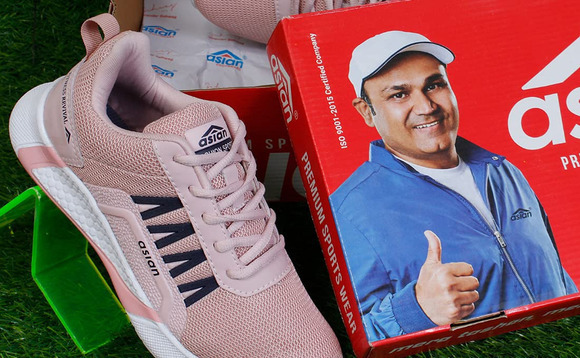

Asian Footwears was founded in 1994 with a focus on combining quality with affordability for the local market. It currently has more than 500 styles of shoes in a price range of INR 500 to INR 1,500 across the sports, casual, safety, and school shoe categories, as well as open footwear.

There has been an increasing emphasis on technological features such as breathable "flyknit" materials, foam insoles, and ergonomic designs. Design and manufacturing is all in-house. Brands include Wilto, a sports line, as well as Wiltech and PU Gold, both sandal lines.

Sales are realised via various e-commerce platforms and an offline network of more than 200 distributors and 10,000 retailers. Marketing was ramped up in 2018 with the endorsement of cricketer Virender Sehwag and the addition of the Delhi Capitals cricket team as an official footwear partner.

"India's branded sports and footwear market is witnessing a rapid growth, driven by increased health and fitness awareness, higher spending on lifestyle products, shift from unbranded to branded plays, and growing preferences for casual, multi-utility shoes," Vijay Dhanuka, head of consumer at MO Alts, said in a statement, adding praise for the Asian Footwears team.

"What also really excites us is that emerging players such as Asian with a focus on domestic manufacturing are expected to reduce India's dependence on imports and help achieve India's dream of Atmanirbhar Bharat."

Atmanirbhar Bharat, or self-reliant India, refers to a government agenda to encourage industry, especially manufacturing, to internalise supply chains and pursue wholly indigenous business models.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.