Investments

Morningside joins round for China's Epigenic Therapeutics

Morningside Venture Capital has teamed up with Kingray Capital, Trinity Innovation Fund, TigerYeah Capital, and FountainBridge Capital to provide USD 20m in angel and pre-Series A funding for Epigenic Therapeutics, a China-based gene editing specialist....

India fintech app Dezerv raises $21m Series A

Accel has led a USD 21m Series A round for Indian retail investment services app Deserv with support from existing investors Elevation Capital and Matrix Partners India.

Australia's Genesis makes biolabs investment

Genesis Capital, a mid-market Australian private equity firm specialising in healthcare, has acquired a majority stake in Crux Biolabs, a contract research organisation (CRO) based in the Melbourne suburbs.

Ex-EQT partner wins funding for Asia ESG services platform

Tak Wai Chung, who until early last year was a Singapore-based partner at EQT, has secured funding for a pan-Asian platform that will provide software solutions to corporates that need to meet environment, social, and governance (ESG) requirements.

Adamantem to carve out cardiology unit from Australia's GenesisCare

Adamantem Capital has agreed to acquire Australia’s largest cardiology services provider through as a carve-out from KKR-backed healthcare giant GenesisCare.

China biotech company GluBio raises $22m

China and US-based GluBio Therapeutics, which develops targeted protein degradation (TPD) drugs, has raised an extended Series A round of USD22m led by Qiming Venture Partners.

India's WebEngage gets $20m Series B

Singularity Growth Opportunities Fund and SWC Global have led a USD 20m Series B round for WebEngage, an India-based start-up specialising in customer retention and relationship management.

Japan satellite data, metaverse start-up raises $11m

Japanese VCs have provided a JPY 1.4bn (USD 11m) seed round for SpaceData, a start-up that uses earth imaging data from satellites to create virtual 3D environments replicating the real world.

Proparco commits $25m to India's Northern Arc

French development finance institution Proparco has invested USD 25m in debt in India’s Northern Arc Capital, a microfinance and small business lender with several private equity backers.

Australia hydrogen player gets $29m Series A

Australia’s Virescent Ventures, a VC firm spun out earlier this year from Clean Energy Finance Corporation (CEFC), has led a AUD 40m (USD 29m) Series A round for local hydrogen energy start-up Hysata.

ADIA, GIC lead $300m round for China's Taibang Biologic

Taibang Biologic Group, a specialist in blood plasma-based pharmaceuticals formerly known as China Biologic Products, has raised a USD 300m round led by Abu Dhabi Investment Authority (ADIA) and GIC.

Sarmaycar, Shorooq back Pakistan fintech player OneLoad

OneLoad, a Pakistan-based digital financial services platform established by local IT player Systems Limited and the International Finance Corporation (IFC), has raised USD 11m in funding.

Allegro buys New Zealand fuel retail business

Australia’s Allegro Funds has agreed to acquire 100% of petrol station chain Gull New Zealand, the largest independent operator of its kind locally, for NZD 552m (USD 327m).

Portfolio: CBC Group and Ensem Therapeutics

CBC Group plans to allocate USD 300m from its latest flagship fund to a biotech incubation platform. Artificial intelligence-enabled drug discovery player Ensem Therapeutics is an example of what it wants to achieve.

China biotech player Sironax raises $200m Series B

Gaorong Capital and Yunfeng Capital have led a USD 200m Series B round for China’s Sironax, a drug developer targeting age-related degenerative diseases.

Qiming, Quan lead $120m Series B for China's OriCell

Qiming Venture Partners and Quan Capital have led a USD 120m Series B round for OriCell Therapeutics, a China-based drug developer that is working on CAR-T cell therapies that target cancer.

Deal focus: Creador goes early in digital banking

Only six digital banks are licensed to operate in the Philippines. Enthused by the prospect of helping build one of these select few from the ground up, Creador moved fast to back UnoAsia

Seed platforms: Fishing minnows from ocean liners

Accelerators and seed investors are increasingly pursuing global mandates and building out large, international teams. The challenges are starting to cast shadows over the benefits, but it’s early days

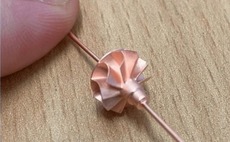

Deal focus: China start-up mines 3D printing's micro potential

Supported by a string of Chinese investors, Boston Micro Fabrication has carved a niche serving global manufacturers that want 3D printing solutions for very small components

Creador backs Philippines digital bank

Creador has made a rare early-stage investment, leading a pre-Series A round of USD 11m for UnoAsia, operator of Uno Digital Bank, one of only six licensed digital banks in the Philippines.

China's Ribo Life Science raises $40m as part of Series E

Chinese drug developer Suzhou Ribo Life Science has raised USD 40m in the first tranche of a Series E from existing investors Panlin Capital and Trinity Innovation Fund. Several undisclosed new investors also took part.

Affirma supports Korea's NPX in Terapin Studios deal

Affirma Capital has confirmed a USD 38m investment in Terapin Studios, a US-based media platform controlled by Korea’s NPX Capital focused on bringing Korean digital comics to global markets.

Skip Capital, Stonepeak pursue Australia's Genex Power

Australia-listed renewable energy producer Genex Power has rejected an initial AUD 320m (USD 225m) buyout offer from Skip Capital and Stonepeak Partners, but it is open to further advances.

Carlyle, Advent commit $1.1b to India's Yes Bank

The Carlyle Group and Advent International have together invested USD 1.1bn in India’s Yes Bank, acquiring equity shares and warrants that could enable them to own up to 20% of the lender.