Australia's Genesis makes biolabs investment

Genesis Capital, a mid-market Australian private equity firm specialising in healthcare, has acquired a majority stake in Crux Biolabs, a contract research organisation (CRO) based in the Melbourne suburbs.

The size of the deal was not disclosed. It comes from Genesis' debut fund – one of few dedicated healthcare private equity vehicles operating in the local market – which closed on AUD 190m (USD 142m) last November. It typically backs companies with AUD 2m-AUD 5m in EBITDA, writing equity cheques of AUD 10m-AUD 30m, although the starting point is lower for buy-and-build plays.

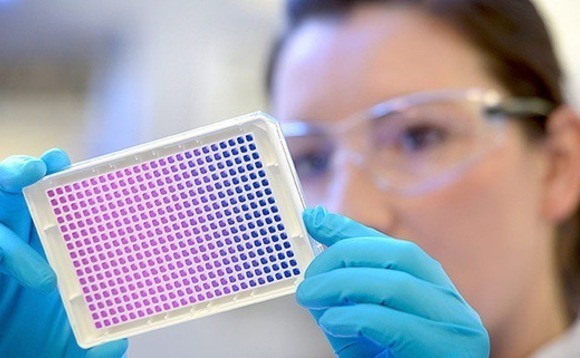

Crux is a bioanalytical laboratory specialising in vaccines, immunotherapies, immuno-oncology and infectious diseases. It was established in 2011 as a local source of ELSA (enzyme-linked immunosorbent assay) kits for Australian researchers, easing reliance on international suppliers.

Since then, the company has expanded into immunoassays for the detection of biomarkers (biological molecules that indicate the presence of abnormalities or disease) and cytokine (a cell-made protein that impacts the effectiveness of immune systems). It has also started offering cell culture facilities for pre-clinical and clinical studies.

In this respect, expansion has been about serving increased demand from international biotech customers that want to use Australia as a location for clinical trials, leveraging the country's research talent and infrastructure, high scientific standards, and robust intellectual property protection.

Several other private equity investments over the past 12 months tap into this theme. Towards the end of last year, The Blackstone Group bought Nucleus Network for a reported AUD 600m, and The Riverside Company acquired Avance Clinical.

Meanwhile, Novotech, which was established in Australia but has expanded throughout Asia, secured USD 760m in new equity and debt financing at a post-deal valuation of USD 3bn. The company has been owned by TPG Capital since 2017, which bought in at a valuation of USD 300m.

Crux already works with pharmaceutical sponsors, CROs, and academic institutions globally in support of their local clinical trial needs, having established a reputation for specialised immunology services that help understand why cutting-edge cancer therapies work for some patients but not others. The new capital from Genesis will be used to grow capacity.

The company has an existing shareholder, Leading Technology Group, a family-owned investment firm focused on life sciences. It will retain an interest in the business.

"In the past few years, we have seen a significant increase in demand for testing services from Crux amidst growing demand for Australia-based clinical trials. As a result of this surge, we have been looking for ways we can grow our capacity to be able to meet the increased needs of the global market," said Catherine Osborne, CEO of Crux, in a statement.

Other investments by Genesis – which was established in 2016 as a deal-by-deal shop and corporate advisor – include general practice network SmartClinics, dental clinical roll-up Totally Smiles, and residential rehabilitation business The Banyans. The firm sold the bulk of its position in SmartClinics to Livingbridge in late 2020.

The team also claims experience with CROs. Founders Michael Caristo and Chris Yoo previously worked for Crescent Capital Partners where one or other of them played a senior role in each Crescent healthcare deal over a period of 10 years, including the likes of Australian Clinical Labs.

Genesis was advised on the Crux deal by Talbot Sayer and EY. Leading Technology Group was advised by Lazard and Tunjic Legal.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.