Seed platforms: Fishing minnows from ocean liners

Accelerators and seed investors are increasingly pursuing global mandates and building out large, international teams. The challenges are starting to cast shadows over the benefits, but it’s early days

When US accelerator and venture capital player 500 Startups – now 500 Global – began making early-stage investments in Asia in 2012, taking a planetary approach to seed deals was almost utterly unheard of. Ten years on, it's everywhere.

500 co-founder Christine Tsai told AVCJ last year that one of her firm's key learnings from the past decade was the arguably paradoxical idea that being global is about being hyperlocal. This involved a lot of travel before bases and country funds were set up across Southeast Asia.

"The capital spoke a lot," Tsai said. "The founders in these markets were not accustomed to raising money, so they were bootstrapped. Being from Silicon Valley was definitely notable, and early-stage cheques are always a big need."

The high risks of seed may indeed mean that there will always be a demand gap, but it does appear to be closing.

In the past 12 months alone, several VC firms with international mandates have been hailed as raising the largest ever pre-Series A fund, among them Khosla Ventures (USD 400m), CSC Upshot (USD 400m), and NFX (USD 450m). Greylock Partners appeared to emerge on top last September with a USD 500m seed vehicle.

Even in the doldrums of the so-called venture capital winter of recent months, traction has been strong, with new global seed funds launched or closed by the likes of Techstars, SOSV, and Entrepreneur First. The latter framed its USD 158m haul last month as a non-fund pool of capital.

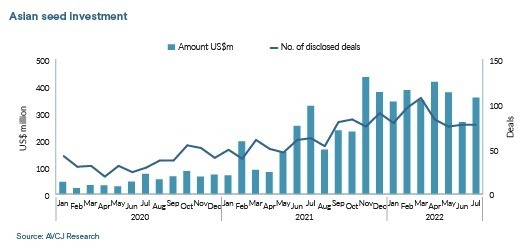

Meanwhile, later-stage GPs have proven increasingly willing to dip into early-stage deals. In Asia, total seed deployments averaged USD 52m a month in 2020. That figure jumped to USD 218m in 2021 and it is at USD 356m for 2022 to date. It's a clear signal that 500 Global's early ability to charm ignored ecosystems with capital and an international profile has been greatly diluted.

The trend is also shifting perceptions within investment firms, raising questions about the longevity of global seed as a model. 500 is showing the first cracks. At least four of the firm's top-performing managers have spun out for reasons ranging from personal ambition and entrepreneurial instincts around independence to mismatched incentives and a lack of fundraising support from the mothership.

In the US, Sheel Mohnot of 500Fintech established Better Tomorrow Ventures, and Edith Yeung of 500 Global Mobile Collective Fund set up Race Capital, both in 2019. In Asia, James Riney and Yohei Sawayama of 500 Japan left to create Coral Capital the same year, and then in 2021, Eddie Thai, head of 500 Vietnam, launched Ascend Ventures Vietnam.

"500 was the only Silicon Valley investor in this region 7-8 years ago, but just two years later, a lot of other global brands started making investments from remote offices, so having a country focus from a global platform became less of a competitive advantage," Thai said.

"As the ecosystem matures, founders realise it's not the brand of the firm that's necessarily the most important thing – it's which partner they get to work with, what does that partner know about my business, how do we jive, how are they able to help me personally."

Alignment issues

The fundamental problem in the global seed model boils down to the difficulty of a massive, inevitably bureaucratic organisation having the agility to be effective in the chaotic trenches of idea-stage entrepreneurship.

The surface niggle is that decisions made by on-the-ground teams in remote markets often require a delayed signature from headquarters in another hemisphere. Slightly more pressing is the idea that small country teams tend to prefer compact portfolios when their global parents espouse high-volume strategies. The elephant in the room is carried interest.

For a global firm, a small seed fund in a frontier market can be an organisational distraction unless it receives significant exposure to the economics. Draper Fisher Jurvetson, another early actor in this space, is said to have historically favoured a 50-50 carry share model, with half going to individual managers and half to the global team. Its early-stage unit, Threshold Ventures, spun out in 2019.

The prevailing norm is closer to 80-20, with the lion's share going to the individual investors. First-time managers leveraging a global seed platform to make a name for themselves typically see this split as more than fair, but the feeling doesn't always last. As one investor put it: "If you're doing 50% IRR like we are, even 20% of carry is a lot of money."

It is not easy to find the right balance. Almost all the global platforms contacted by AVCJ for this story described their carry scheme as a work in progress that would take multiple vintages to figure out. There are calls from country-level teams for splits of 90-10 or 95-5 but also group-level concerns about a lack of alignment. Boosters or bonuses that accrue to managers based on performance are a possible fix.

"When I see the support I get in fundraising and the technology platform that drives values for local funds – it's just a lot of value you cannot get as an independent player," said Jussi Salovaara, co-founder and head of Asia at Antler. "But balancing a blended carry pool is a real risk. It's not something we had to worry about in the beginning, but in the past two years, we've been thinking about it very actively."

Internal cohesion

Singapore-based incubator and investor Antler is a posterchild for the proliferation of global seed. Since launching operations in earnest in 2018, it has opened offices in about 20 cities globally. The team is expanding rapidly, numbering in the hundreds with some 25 staff in Southeast Asia and 20 in India.

Recent activity includes entries in Korea, where serial entrepreneur Jiho Kang plans to invest in 100 companies in the first four years, and Japan, where entrepreneur-investor Ryo Umezawa is in the early stages of building out a team. In May, the firm committed to investing USD 100m in more than 300 Southeast Asian start-ups by 2025. This compares to around 450 deals globally to date.

Antler positions its approach as both centralised and distributed, combining the networking effects of a global platform with the in-depth local coverage afforded by big regional teams. The risk of losing top people through spinouts is arguably heightened by the speed of the firm's expansion, but this is said to be tempered by a focus on internal communications.

Group meetings take place online at least every two weeks, with a selection of regional teams touching base every week. Perhaps uniquely, partners in various regional programs sit on each other's investment committees.

"We want to have an operative relationship between different funds," Salovaara added. "For example, it's particularly valuable for the India and Indonesia teams to work together because there are a lot of similarities with business models and the nature of those markets. There's a lot of information sharing. If someone tries something in one location and it works, that is fed back to the rest of the group."

It is one of several schools of thought that have emerged in terms of keeping global seed teams intact. Startupbootcamp, which has more than 100 staff, attributes its stability in part to its focus on industry-specific accelerators. The group, set up in 2010 by UK-based start-up services firm Rainmaking, now holds events in more than 100 cities globally a year, with each program raising its own seed fund.

Geography is generally less of a constraint in this model. Startupbootcamp is in many locations but each one attracts founders from overseas through specialisation. Moreover, individual seed funds are backed by relevant corporates in the geography staging the event. Energy is a particular focus; the firm has operated accelerators in the sector since 2014.

Investees tend to target industries globally rather than in a specific country, so they are unfazed by being required to incorporate in a jurisdiction outside their home market – a pain point for generalists and single-location players like Y Combinator.

"Start-ups might have just started penetrating their local market but haven't really found product-market fit. We can tap them on the shoulder and say, ‘There's a corporate that's interested in working with you in this other market.' And they take that pretty seriously," said Richard Celm, co-founder of Startupbootcamp.

Collective might?

In-house technology is also being used to glue teams together. Indeed, the tendency of early Silicon Valley players to only invest in their immediate environs was less about closedmindedness than a dependency on face-to-face networking. For some investors, the feasibility of global seed didn't come into focus until the pandemic brought remote communications to the mainstream.

Tech is a unifying factor for Headline, a San Francisco-headquartered platform with USD 4bn in assets under management (AUM). It was formed last year through the combination of Japan's Infinity Ventures and US and Europe-based E.ventures, along with its Brazilian affiliate Redpoint Eventures. Infinity and E.ventures had been collaborating for 10 years prior.

Headline's global staff of more than 100 is about 10% software engineers. Its key seed-stage big data tool, known as Eva, scours public information on the internet about founders and companies and combines it with information from its own network. The analyses are said to be insightful enough to disincentivise successful team members from striking out on their own.

"If you ask an accelerator with a batch of 300 companies every season which are their top 20, they probably couldn't tell you. We can. Our global team of investors looks at more than 5,000 companies a week and 100,000 companies a year using this tool. We look at more companies than any other VC," said Akio Tanaka, co-founder and Asia lead at Headline.

"If we were just a single VC in one region, we probably wouldn't have the resources to build this type of technology. Now that we're a global firm, we can actually do this."

Headline will need time to figure out a globally integrated fundraising process. Its fifth Asia fund is expected to launch soon with a target of USD 200m – Fund IV closed on USD 100m in 2019 under the Infinity brand – but it is unclear how much the firm's US, Europe, and Brazil arms will be able to support this process.

Poor fundraising support has proven a significant risk factor in global seed, if for no other reason than it leaves many first-time managers disappointed. There is a perception that among global brands active in later stages, satellite funds are essentially hived off portions of capital from flagship funds. And whether it works that way or not in multi-stage VCs, it is definitely not happening in seed.

As a result, the country managers do their own legwork and see less value in anchoring their image to the global brand. "We could control our own destiny completely, particularly in terms of brand and messaging, and what we wanted to do," Coral Capital's Riney said about his amicable spinout from 500 Global, adding that the two organisations continued to work together.

"I don't think being global is flawed. There are advantages to that. It's like in the tech industry, where the way you make money is in bundling or unbundling. It's a continuous process where both things are going to happen, and they will coexist."

Cultural questions

Coral is perhaps a unique case study in that Riney is the only non-Japanese founder-GP in Japan. This meant that losing the global branding of 500 wasn't a problem in terms of optics. The bigger branding-related issue was cultural.

"The mindset of the employees, including the founders, has completely changed since we became independent," said Ryo Tsuda, a talent manager and vice president at Coral. "We don't have to think about a brand or approvals – we just have to be ourselves. We only have 14 people now. We're like a Series A start-up."

This point goes back to the fundamental question as to whether a global organisation has the right DNA to do the grassroots work of seed investment and start-up acceleration. And the answer might be in going both global and lean.

Amasia, a seed investor that bridges East and West with bases in the US and Singapore, does so with a team of eight. The firm raised USD 50m for its second fund in 2019 and now has USD 450m in AUM, with Fund III being prepped for launch. Amasia plays globally by leveraging the community-building benefits of various internship, research, and education programs, as well as an increasing thematic focus on climate impact.

"We were a little ahead of the curve in the sustainability trend, especially for Southeast Asia, and a lot of that had to do with the fact that we had an office in the US," Amasia co-founder John Kim said. "I think everyone has a different approach, but it is a tough proposition. It's tough to do seed in Indonesia from Singapore, let alone from around the world."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.