Early-stage

Japan flying car player SkyDrive gets $67m Series C

Japanese flying car developer SkyDrive has raised JPY 9.6bn (USD 67m) in Series C funding featuring US-based Pegasus Tech Ventures and local strategics such as Suzuki Motor.

India gifting platform secures $23m Series B

Join Ventures, an India-based company that owns a portfolio of direct-to-consumer gifting brands, has raised USD 23.5m in Series B funding led by Motilal Oswal Alternate Investment Advisors.

Korea autonomous driving player gets $25m

Korea’s Seoul Robotics, which specialises in computer vision for 3D sensors used by autonomous cars, has raised a USD 25m Series B round led by KB Investment.

Gaorong backs China energy storage company

China-based energy storage company WeView has raised CNY 400 million (USD 57m) from a group including Gaorong Capital, Green Pine Capital Partners, and ZhenFund.

China semiconductor player Shangda raises $99m

Chinese semiconductor packaging and testing company Shangda has raised a Series A extension of CNY700m (USD 99m) co-led by three government-backed funds.

TNB Aura leads $32m round for Singapore electronics brand

Singapore-based VC firm TNB Aura has led a SGD 45m (USD 32m) round for local consumer electronics brand Prism+ ahead of a Southeast Asia expansion.

Fundamentum leads round for India's Kuku FM

Indian growth-stage investor The Fundamentum Partnership has led a USD 21.8m Series B extension for audio platform Kuku FM.

Deal focus: Morse Micro takes Wi-Fi to the next level

Australia’s Main Sequence Ventures plans to make Morse Micro one of the few Wi-Fi chipmakers in an easy-to-imagine future where more reliable, long-range device connectivity surges in demand

China drug developer Worg secures $57m Series B

Worg, a China-based drug developer, has closed a Series B round of CNY400m (USD57m) from five local investors - Jiachen Capital, Longpan Capital, Kaitai Capital, Puhua Capital and Anji Ruixing Capital.

GenBridge, DragonBall back China snacks brand Xueji Chaohuo

GenBridge Capital and DragonBall Capital have led a CNY 600m (USD 86m) Series A round for Xueji Chaohuo, a China-based roasted seeds and nuts brand.

Indonesian crypto exchange Reku raises $11m

Indonesia’s AC Ventures has led a USD 11m Series A round for Reku, a local crypto exchange that claims to offer the lowest fees in the market.

Blackbird leads $23m Series B for Australia's Sonder

Australia’s Blackbird Ventures has led a AUD 35m (USD 23.4m) Series B round for Sonder, a staff and student management app focused on wellbeing and safety.

L'Oréal China investment unit backs local fragrance brand

L'Oréal has completed the debut deal from its newly formed China investment arm by participating in an extended Series A round for local fragrance brand Documents.

Deal focus: L'Oréal shows staying power

Europe-based personal care giant L’Oréal looked past short-term impediments like lockdowns and asset price corrections to join Cathay Capital in supporting Chinese perfume brand Documents

East leads $26m Series A for Indonesia agtech start-up

East Ventures has led a USD 26m Series A round for Indonesia’s Gokomodo, an agriculture technology provider focused on simplifying fragmented and inefficient supply chains.

Australia's Morse Micro gets $95m Series B

Morse Micro, an Australian fabless semiconductor developer specialising in long-range, low-power Wi-Fi for internet of things (IoT) devices, has raised AUD 140m (USD 95m) in Series B funding.

Global Brain leads $30m Series A for Japan's Josys

Global Brain has led a JPY 4.4bn (USD 30.5m) Series A round for Japanese business automation and IT services platform Josys with plans for an international expansion.

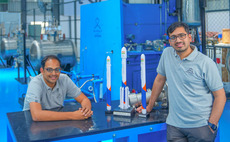

GIC leads $51m round for India space start-up

GIC Private has led a USD 51m Series B round for Indian rocket developer Skyroot Aerospace. It is being touted as the largest round yet in the local space-tech market.

Deal focus: Jai Kisan taps India rural resurgence

The founders of technology-enabled credit platform Jai Kisan went against the grain by forgoing urban customers and targeting India’s rural poor. A USD 50m Series B is an indicator of its progress

Deal focus: Turning data into operational efficiencies

Chinese data mining start-up Prothentic has managed to turn first-time business into repeat subscription business, which led to valuation increase between funding rounds even as the wider market stagnates

China drug developer BoomRay gets $43m

Chinese drug developer BoomRay Pharmaceuticals has raised a CNY300m (USD 43m) Series A round led by Sequoia Capital China.

China cell therapy developer Neukio raises $50m

Shanghai-based cell therapy developer Neukio Biotherapeutics has raised USD 50m in the first tranche of a Series A round led by medical technology-focused CD Capital. Other new investors include Alwin Capital and Surplus Capital.

Japan remote workforce player oVice raises $32m

Japan’s oVice, a start-up that provides virtual co-working spaces for remote and hybrid teams, has raised JPY 4.5bn (USD 32.1m) in Series B funding featuring Jafco and Eight Roads Ventures.

China chip designer Yige raises $42m angel round

Suzhou Yige Technology, a China-based semiconductor chip designer also known as EagleChip, has raised a CNY 286m (USD 41.5m) angel round led by Matrix Partners China, Redpoint China, Sequoia Capital China, CTC Capital, and Vlight Capital.