Korea autonomous driving player gets $25m

Korea’s Seoul Robotics, which specialises in computer vision for 3D sensors used by autonomous cars, has raised a USD 25m Series B round led by KB Investment.

It follows a USD 5m investment in 2020 also led by KB with support from KDB Capital, Korea Development Bank (KDB), Artesian VC, Futureplay, and Access Ventures. Early investors also include Hong Kong accelerator Zeroth AI.

Seoul Robotics describes its technology as "autonomy through infrastructure," a concept that involves placing autonomous driving systems on infrastructure, rather than cars. The idea is to capture the holistic view required to achieve vehicle autonomy.

This approach aims to enhance the scalability and financial viability of intelligent transportation networks by removing the prohibitive costs of equipping individual vehicles with cameras and sensors. It is also hoped to overcome safety barriers by eliminating blindspots.

"Infrastructure has been assisting drivers since the first traffic light was introduced over a hundred years ago, but unlike the current system, which is designed to assist humans, Seoul Robotics is pioneering a new way to leverage infrastructure that enables autonomous robots and cars to reach their full potential," CEO and co-founder HanBin Lee said in a statement.

"This groundbreaking approach is made possible through our leading 3D computer vision technology that has been recognised as the most advanced solution in the industry. With this funding, we will continue developing industry-transforming solutions that will drive the future of mobility and deliver beyond what we can even conceptualise today."

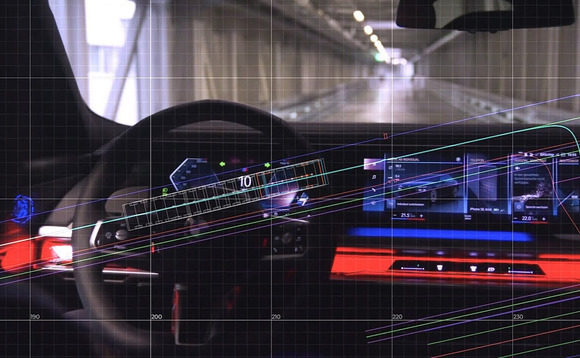

The company's core project is a control tower consisting of a mesh network of sensors and computers. The tower leverages the connectivity already built into modern vehicles to autonomously manoeuvre them without requiring any hardware adjustments. It is currently being used to automate vehicles at a BMW facility in Germany.

The new funding will be applied to the control tower project technology as well as an international expansion and new industry partnerships. It will also support R&D in applications such as rental car fleets and trucking yards.

"Every organisation is looking for ways to bring value and efficiency to driver operations, and the need for autonomous solutions is especially urgent given recent labour shortages in the logistics industry," JunSeok Lee, a director at KB, added.

"[Seoul Robotics'] success to date gives us full confidence that they will continue to transform the logistics industry, as well as great pride in the innovative spirit of Korea's technology sector."

Autonomous driving is an increasingly active niche in Korea. Last month, Hyundai Motor and Kia paid KRW 427.7bn (USD 328.8m) for control of 42dot, a software developer in which they and several VC investors already held minority stakes. Meanwhile, KDB-backed Morai raised USD 20m and KB-backed Autocrypt raised USD 25.5m.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.