Buyouts

4Q analysis: Who wants China?

Pan-regional GPs get traction by highlighting their Asia ex-China credentials; buyouts rebound as growth capital – and China – continue to recede; India impresses with bumper exit proceeds

Profile: Elevation Equity Partners' Gordon Cho

Negotiating a spinout while troubled by health issues tested Gordon Cho’s faith and resilience. He feels stronger for the experience and is now looking to make his mark on Korea’s middle market

Deal focus: VIG secures rare airline turnaround opportunity

VIG Partners stepped into the breach when Eastar Jet’s previous white knight bailed. It agreed to recapitalise the airline on obtaining assurances that key licenses and routes remain in place

PAG's Shan emphasizes diversity, control in Asia private equity

Momentum has shifted towards geographically diversified pan-regional investors, control deals, and private markets following a decade dominated by China-centric funds, growth-stage technology plays, and public equities, Weijian Shan, chairman and CEO...

Everstone, Goldman buy IT consulting player Cprime

India and Southeast Asia-focused private equity firm Everstone Capital has teamed up with Goldman Sachs Asset Management to acquire US-headquartered IT consulting business Cprime. The size of the transaction was not disclosed.

Carlyle buys India skincare, beauty platform

The Carlyle Group has acquired a majority stake in VLCC, an Indian skincare and beauty platform backed by Everstone Capital, for an undisclosed sum.

Deal focus: Anchorage gets Aussie icon for a song

Anchorage Capital Partners has acquired David Jones, a longstanding and beloved Australian department store chain, for one-fourth the cost of recent renovation work at a single location

Asia buyouts: The case for control

Investors are looking to minimise external financial and macro risks and emphasise factors they can control – which means more buyouts, careful asset selection, and greater operational intensity

ICG invests in Korea's Big Mama Seafood

Intermediate Capital Group (ICG) has announced a second deal in three weeks from its fourth Asia fund – which closed last year on USD 1.1bn – with a commitment of undisclosed size to Korea-based Big Mama Seafood.

VIG acquires Korea's Eastar Jet

Korea’s VIG Partners has acquired 100% of local low-cost airline Eastar Jet for USD 117m, citing plans to introduce new aircraft to the fleet as part of a “quick turnaround.”

ChrysCapital acquires US-India IT player Xoriant for $350m

India’s ChrysCapital Partners has acquired Xoriant, a US-headquartered but primarily India-based software engineering and IT provider, for about USD 350m.

Advent acquires majority stake in India's Suven Pharma

Advent International has agreed to acquire a 50.1% stake in India-listed drug industry supplier Suven Pharmaceuticals for INR 63.1bn (USD 761.5m) with plans to acquire an additional 26%.

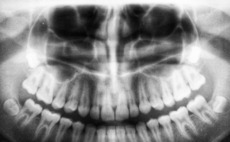

MBK buys Korea dental scanning player Medit, Unison exits

MBK Partners has agreed to buy Medit, a South Korea-based manufacturer of 3D dental scanners, for a valuation of approximately KRW 2.4trn (USD 1.88bn). The transaction facilitates an exit for Unison Capital’s Korea business.

Quadrant buys Australian healthcare equipment supplier

Quadrant Private Equity has bought a majority interest in Aidacare, an Australia-based distributor of healthcare equipment, with a view to supporting domestic and international growth.

Anchorage buys Australian department store chain David Jones

Anchorage Capital Partners has agreed to buy Australian department store chain David Jones from South Africa-listed Woolworths Holdings (WHL).

KKR buys Japan's Bushu Pharmaceuticals from BPEA EQT

KKR has agreed to buy Japan-based contract drug manufacturer Bushu Pharmaceuticals from BPEA EQT – formerly Baring Private Equity Asia – for an undisclosed sum.

TPG buys India's Poonawalla Housing Finance

TPG Capital Asia has agreed to acquire Poonawalla Housing Finance for a pre-money equity valuation of INR 39bn (USD 473m) and inject an additional INR 10bn to support growth.

2023 preview: Buyouts

Even though debt is more readily available in Asia than in the US or Europe, financing costs are up, and buyout investors are reluctant to move for assets in an uncertain and overvalued market

2023 preview: India PE

India’s domestic growth story appears unobstructed, but some international investors could hold their fire. The local PE industry will not graduate to the next level without that foreign capital

2023 preview: Australia PE

Market pressures on Australian businesses, including an increasingly serious labour shortage, are a challenge and opportunity for domestic private equity. So is China, but in less discernible ways

2023 preview: Japan middle market

Confidence in Japan’s middle market is whipping up new deal flow, new funds, and new exit channels that will play out in 2023. This includes the possible reanimation of a dormant IPO market

Q&A: Bain Capital's David Gross-Loh

David Gross-Loh, a managing director and a founding member of the Asia business at Bain Capital, on expanding into Osaka, targeting large-cap carve-outs in Japan, and the availability of deal financing

2022 in review: End of the party?

Fundraising favours the few; deployment becomes progressively slower as investors agonise about valuations, macro prospects, and financing costs; sponsor-to-sponsor deals prop up exits

Australia's Potentia pursues two technology take-privates

Australia-based specialist B2B technology investor Potentia Capital appears to be continuing its pursuit of two listed companies – Nitro Software and Tyro Payments – despite several rejections.