2023 preview: India PE

India’s domestic growth story appears unobstructed, but some international investors could hold their fire. The local PE industry will not graduate to the next level without that foreign capital

The World Bank bumped up its Indian GDP growth forecast from 6.5% to 6.9% this month calling the economy "remarkably resilient to the deteriorating external environment." It flagged the insulating effect of a large domestic market being less exposed to international trade flows, improving foreign direct investment inflows, and a prudent regulatory framework.

"GDP growth should see better underlying growth in companies because they're tapping into domestic demand, so we would expect to see more deal flow and more scaled companies in the India large-cap space, or the mid-cap space from the global perspective," said Shashank Singh, a partner and head of India at Apax Partners.

"But if India becomes a beacon of light for global investors in a tough macro environment, we will have to contend with a lot more hammers looking for a nail."

Too many hammers was a problem for Apax in the past year, and it's not unthinkable to see that issue extending into 2023. The private equity firm invests in the country from global pools of capital and was therefore under no pressure to deploy locally if it wasn't seeing good deals. And it wasn't.

Apax made no investments in India in 2022 and was compelled to walk away from various deals where valuations got out of hand. Singh is hoping to be rewarded for his patience in 2023 when bid-ask spreads are expected to narrow. But much will be on hold until the industry unpacks the national budget to be announced in February.

The 2022 slowdown in deployment was severe versus the peak of 2021 but not drastically off the long-term trend. PE investment in India has come to USD 26.6bn this year to date, according to AVCJ Research. That's roughly half the total for the prior year. Average annual deployment for the five years from 2016 to 2020 is USD 18.7bn.

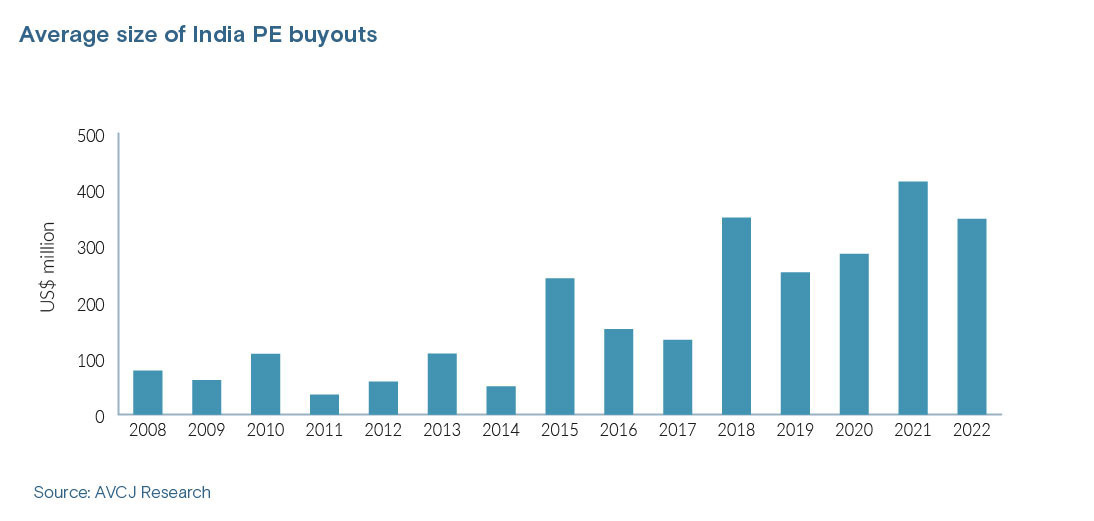

The average Indian buyout has maintained a jerky upward trajectory that hinted at runaway valuations when it peaked at USD 413.9m in 2021. This is excluding The Carlyle Group's USD 3bn acquisition of software company Hexaware, the country's largest ever non-infrastructure PE buyout by some margin. The average for 2022 came in at a healthy USD 348m despite the broader slowdown.

By contrast, this environment has turned out to be conducive to exits in some corners; Apax has realised at least four in the past 12 months. But market-wide, the value of exits was down 50% year-on-year at USD 14.1bn. M&A, including sponsor-to-sponsor deals, will be the primary route going forward. Indian strategics bolstered by good domestic demand and GDP growth are likely to be in a fairly acquisitive mood.

Points of differentiation

Fundraising is expected to be challenging despite presumptions that significant global capital will be redirected from China allocations. More specialised funds will enter the market in a bid to attract capital through differentiation as generalists explore new strategies.

Climate, impact, regional markets, and mass market consumption will be key themes. There is scope for cross-border expansions, especially with the Middle East and Southeast Asia. But much will depend on the reliability of global capital when the rest of the world is not faring as well as India.

"The second or third-generation private equity GPs are now coming into their own. We see about half a dozen local players becoming multi-billion-dollar fund managers in a few years' time," said Manav Bansal, a managing director and head of India at British International Investment (BII).

"But for that to happen, both domestic and global LPs will have to play a role. Investors like BII can help them improve their capacities and standards in governance and disclosures, but the global capital will always be finite."

Limited foreign capital inflows could narrower a recently opened IPO window for start-ups, which could in turn drive digital technology deal flow for buyout firms – but only where the companies in question are profitable. To find out which deals will be made tomorrow, one only needs to find out which deals are being vetted today, and those deals have not had a particularly digital flavour.

Deepak Bhawnani, founder and CEO of Alea Consulting, has spent much of 2022 performing due diligence for private equity firms looking at traditional real assets, including retail outlets and hospitals. The resurgence of brick-and-mortar will overlap – and arguably accelerate – the march of stricter environmental, social, and governance (ESG) compliance locally.

"No private equity client has indicated that they shall not look at ESG closely. Next year is likely to be a year where ESG is going to have more importance for private equity investment in India," Bhawnani said.

"The industry has consistently initiated comprehensive due diligence on G – governance and integrity. However, a drill down, on the E and S, based on the type of business, are important as operational models, supplier-vendor compliance, and internal systems also contribute to protecting the reputation of companies and investors."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.