4Q analysis: Who wants China?

Pan-regional GPs get traction by highlighting their Asia ex-China credentials; buyouts rebound as growth capital – and China – continue to recede; India impresses with bumper exit proceeds

1) Fundraising: Pan-regional diversification drive

How do you raise a pan-Asian fund in the current environment? Maybe de-emphasize China. There were two significant first closes in the final quarter of 2022: TPG Capital raised USD 3.4bn for its eighth flagship Asia fund and then CVC Capital Partners secured USD 3.5bn for its sixth regional vehicle. Both GPs are targeting USD 6bn and both have made a virtue of their activities Asia ex-China.

TPG's recent deals have focused on Australia, India, and Southeast Asia, but there has been a general effort to dilute single-market risk. In the last two fund cycles, 30%-40% of the portfolio has cut across multiple geographies, and that is expected to top 50% in the latest vintage. It is a play on intra-Asia trade and emerging domestic brands, but it also reflects a more diversified, less China-centric view.

Speaking at the AVCJ Private Equity & Venture Forum, James Coulter, executive chairman and founding partner of TPG, observed that the traditional growth engines of the US, Europe, and China face headwinds. He highlighted the long-term potential of India and Southeast Asia, while stressing that countries move to their own rhythms and it pays to be flexible.

CVC, for its part, emphasizes exposure to Southeast Asia. It accounts for 40% of capital deployed in Asia and has generated some of the firm's biggest exits. Brian Hong, a managing partner at CVC, told the Hong Kong Venture Capital & Private Equity Association's Asia forum last week that attractive demographics and growth profiles and the reconfiguration of supply chains are compelling factors.

Neither TPG nor CVC is turning its back on China, but the tone – and the speed of fundraising – is markedly different from some of their peers. PAG, for example, has arguably the highest proportionate China exposure of any large pan-regional player. It entered the market before TPG and CVC, targeting USD 9bn for Fund IV, and has yet to announce a first close.

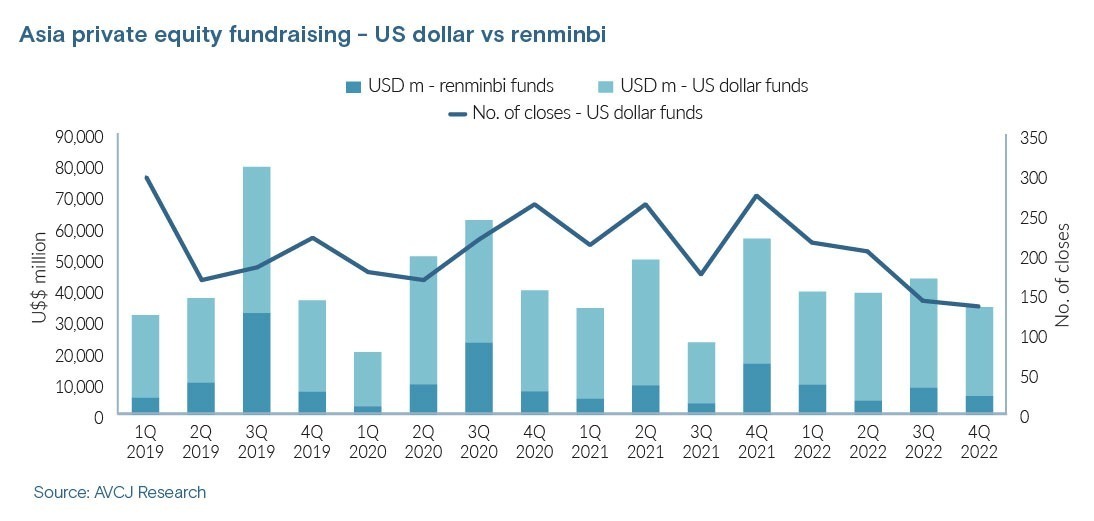

TPG and CVC added zest to an otherwise dispiriting final three months of 2023 for Asia private equity fundraising. Approximately USD 28.5bn was committed to managers in the region, according to provisional data from AVCJ Research. It compares to USD 34.9bn and USD 34.5bn in the two prior quarters. There were 134 partial or final closes, down from 141 and 203.

The China total, inflated by Sequoia Capital China's bumper fundraise in the third quarter, reverted to what has become the norm – dropping from USD 20.3bn to USD 7.9bn. Of this, USD 5.6bn was committed to renminbi-denominated funds. China accounted for 13 of the 25 largest closes in the fourth quarter, but 10 of these were local currency vehicles.

GLP-owned Hidden Hill Capital and Panacea Venture were responsible for the top two US dollar-denominated final closes, on USD 465m and USD 276m. Both are looking beyond China. Hidden Hill's fund, which was supported by a secondary investment from NewQuest Capital Partners, is targeting China and Asia, while Panacea expects the bulk of its latest vintage to be deployed in the US.

All major geographies saw a retraction in fundraising. Even though this was most keenly felt in Australia, which fell from USD 7.6bn to USD 1.5bn, two local VC managers made it into the regional top 10 for the quarter. Blackbird Ventures secured AUD 1bn (USD 647m) for three pools of capital that make up its fifth vintage and Square Peg Capital raised USD 550m for its fourth fund.

Asia fundraising for the entire year came to USD 127.7bn, just short of the USD 128.9bn raised in 2021. The annual average for the preceding eight years is USD 138.3bn. Excluding renminbi funds, the total is USD 99.5bn, which narrowly exceeds 2021 and 2020. However, the number of closes is at an eight-year low of around 430. This compares to approximately 700 in each of 2021 and 2020.

The notion of LPs favouring the few was underlined by Sequoia's activity. In addition to securing USD 8.8bn for its latest set of China funds, the firm raised USD 2bn for India and USD 850m for Southeast Asia (though each GP is a separate affiliate of Sequoia globally). The other two large closes, of USD 11.2bn and USD 6.4bn, were for BPEA EQT and The Blackstone Group's latest pan-Asian funds.

Taken together, Sequoia, BPEA EQT, Blackstone, TPG and CVC received more than one-third of all capital committed to Asia-based managers during 2022.

2) Investment: Buyouts spurred by PE-to-PE

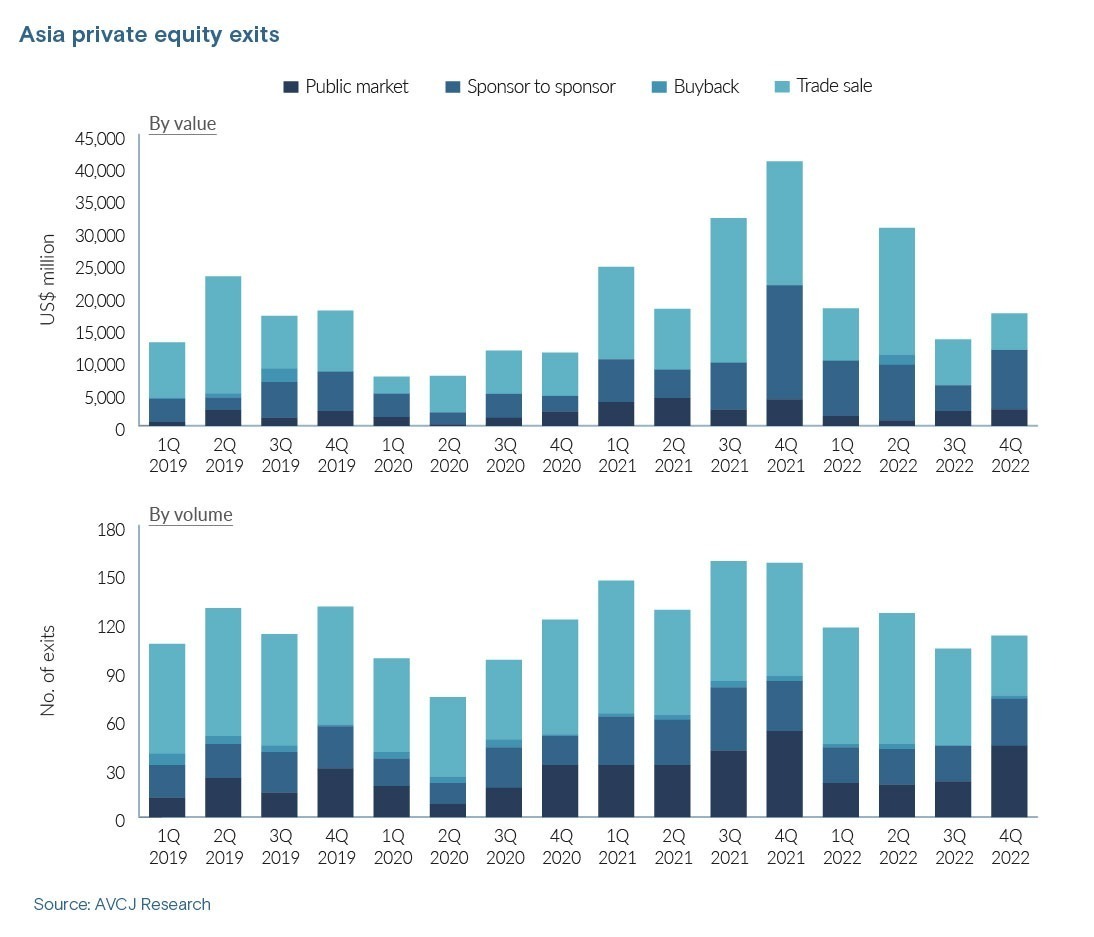

Private equity-to-private equity deals spiked in the last three months of 2021, reaching USD 17.6bn – nearly the same as the previous three quarters combined. It accounted for 43% of all exit activity in Asia and 15% of all investment activity. A similar phenomenon took place in the fourth quarter of 2022: PE-to-PE transactions reached USD 9.2bn, or 53% of exits and 18% of investment.

Four of the 12 largest investments from the quarter followed this pattern, including Medit in Korea, (Unison Capital Korea to MBK Partners), Trimco International (Affinity Equity Partners to Brookfield Asset Management), and Bushu Pharmaceuticals (BPEA EQT to KKR). Brookfield is Trimco's fourth consecutive private equity owner; KKR is Bushu's third.

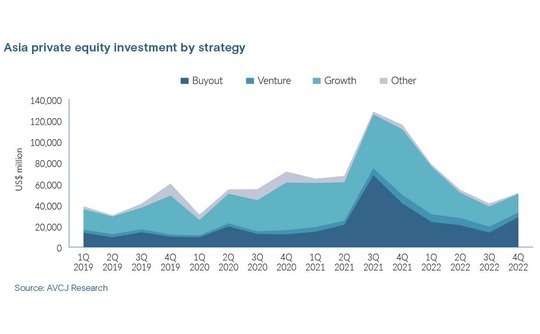

The jump in sponsor-to-sponsor deal flow helped propel buyouts to USD 28.3bn, up from USD 13.7bn in the third quarter. Overall investment rose from USD 41.3bn – the lowest since the quarter that coincided with the global spread of COVID-19 – to USD 51bn. Nevertheless, the total is well short of the USD 77.7bn average for the prior eight quarters.

That honour went to Australia, where investment rebounded from USD 5.9bn to USD 17.5bn. China was also surpassed by India, which posted USD 8.6bn, while Korea and Japan came within touching distance of their rival on USD 6.1bn and USD 5.8bn, respectively. China's average quarterly share of Asia private equity investment since 2016 is 41%. In the fourth quarter of 2023, it sunk to 15.5%.

The Australia total requires some context. The Brookfield-led USD 11.9bn acquisition of Origin Energy, announced in November but yet to close, can be categorised as an energy and utilities play that skews more towards infrastructure than private equity. But it also speaks to a broader theme of investors focusing on the perceived stability of more tangible assets and developed markets.

Of the 25 largest deals announced in the fourth quarter, Australia and Korea accounted for five each, four were in Japan and three were in New Zealand. Industries such as transportation and distribution, healthcare, and telecom were well-represented, as well as energy and utilities.

Only three growth-stage technology deals made it into the top 25. Venture and growth activity in the sector amounted to USD 8.1bn in the final three months of the year, compared to USD 10.5bn, USD 19.3bn, and USD 27.4bn in the three prior quarters. This dovetailed with a slide in growth-stage investment across all sectors, from USD 45.5bn to USD 23.8bn to USD 19bn and then USD 17.7bn.

Most of the key fourth-quarter trends apply to the entirety of 2022, notably the step back from high-conviction emerging markets technology plays, which pushed mature markets and assets to the fore, at least in relative terms.

Private equity investment in Asia reached USD 223.9bn, a steep drop from 2021 but still the second-highest annual total on record. Buyouts came in at USD 86.3bn, down 40% year-on-year, while growth capital fell 45% to USD 105.9bn. Venture rose slightly to USD 24.3bn.

Looking at the numbers by geography, China received USD 60.3bn (down 53%), followed by Australia on USD 48.8bn (down 31%), India on USD 42.2bn (down 37%), Japan on USD 27.2bn (down 12%), Korea on USD 21.9bn (down 39%), and Southeast Asia on USD 15.3bn (down 40%).

3) Exits: India's time to shine

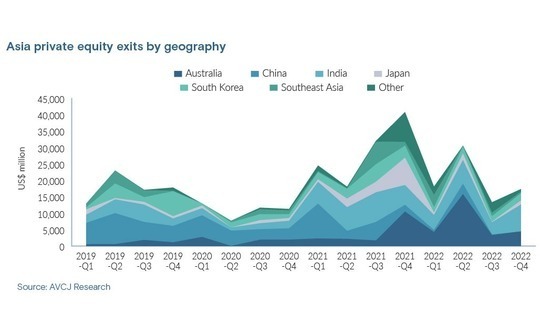

Before financial sponsor-backed IPOs in the US – and post-listing block trades – began to dry up, China routinely generated the bulk of private equity exit proceeds in Asia. Other geographies occasionally surpassed it, but these were intermittent flashes. In 2021, the status quo began to shift. India outmatched China and the country has maintained its lead as its neighbour has flatlined.

India has led Asia by exits, which includes aggregate proceeds from sales to strategic and financial investors, buybacks, and public market sales, in five out of seven quarters from the second quarter of 2021. Otherwise, it has placed second behind Australia.

In the final three months of 2022, India's strength became abundantly clear. The country was responsible for USD 8.2bn – or 47% – of the USD 17.3bn generated by private equity investors during the period. Fifteen of the 25 largest exits in the quarter came out of India.

When broken down by exit type, the swing towards sponsor-to-sponsor transactions, which rose to USD 9.2bn from USD 3.9bn in the third quarter, was accompanied by a retreat in trade sales (USD 7.1bn to USD 5.6bn). Public market sales reached USD 2.5bn, up from USD 2.3bn. The overall total of USD 17.3bn represents a welcome uptick on the previous quarter's USD 13.3bn.

On an annual basis, India's robust fourth quarter wasn't enough to supplant Australia as Asia's biggest exit market. In 2021, India led the region with USD 28.8bn; in 2022, it posted USD 23.7bn to Australia's USD 27.8bn. China, second in 2021 with USD 20.7bn, generated a mere USD 3.9bn.

Overall exits came to USD 79.3bn, the fifth-highest total on record, trailing 2018, 2021, 2017, and 2016. Trade sales slumped from USD 65.1bn to USD 40.4bn, demonstrating that the war in Ukraine, China-US tensions, rising interest rates, and inflation were as challenging for strategic investors as they were for private equity. (although sponsor-to-sponsor exits fell only 16% to USD 30.2bn).

Private equity-backed IPOs generated proceeds of USD 61.3bn, down from USD 91.7bn in 2021. The number of offerings fell from more than 90 to approximately 70.

Chinese companies accounted for 86% of the capital raised, up from 66% in 2021. Notably, 83% of the proceeds region-wide came from mainland exchanges, compared to 33% in 2021, underlining not only how the US and Hong Kong have receded as IPO destinations for Chinese companies, but also the difficulty of public market exits anywhere outside of China.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.