2023 preview: Australia PE

Market pressures on Australian businesses, including an increasingly serious labour shortage, are a challenge and opportunity for domestic private equity. So is China, but in less discernible ways

Australian portfolio companies and prospective investments will continue to twist under a labour shortage that has increasingly plagued the business sector across the board in recent years. The most impacted industries will be accommodation and food services, education, administration services, retail, and real estate services.

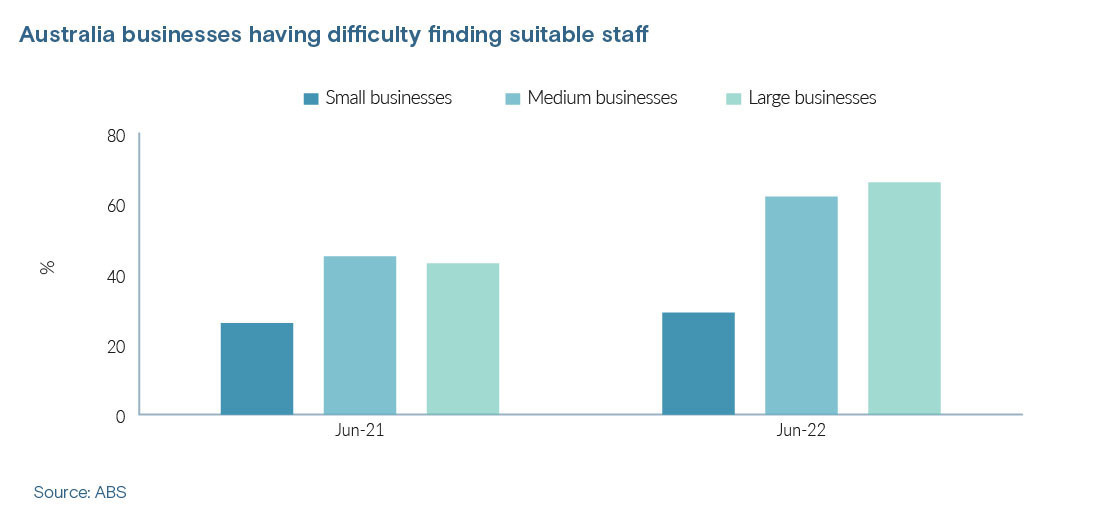

In mid-2021, 45% of medium-sized businesses and 43% of large businesses reported having difficulty finding suitable staff, according to the Australian Bureau of Statistics. Those figures jumped to 62% and 66% as of mid-2022. Companies are experiencing demand that should underpin growth, but they can't fill that demand due to staffing shortages.

Given the customer-facing nature of the most impacted industries and Australia's generally slow-to-change consumer behaviour patterns, automation will be no panacea in the foreseeable future. On the back of COVID-19 shocks and in light of uncertainty for exports and cross-border business in a broader downturn, distress and so-called revitalisation opportunities are tipped to proliferate.

"A lot of management teams are being tested as to whether they have the needed agility or whether they've made the calls early enough on changing their business to deal with dislocation. And from what we've seen, many have not," said Fay Bou, a partner at Allegro Funds.

"That's across most sectors, and even in non-discretionary and non-cyclical sectors like healthcare, education or consumer staples. We don't know if the market will be up or down, but we do believe the uncertainty and volatility is only going to increase in 2023."

There is some expectation that these challenges will spur additional corporate carve-out deal flow. The divested entities needn't be in trouble, merely non-core, and there is plenty of dry powder to pursue them. Private equity fundraising in the country had its second-best year ever in 2022, rallying about USD 3.6bn for growth and buyout strategies.

The raw numbers suggest Australia is positioned to begin expanding deployments from an elevated base after a relatively modest correction from the global 2021 bounce. Total PE investment in the country bounded from a typical USD 16.8bn in 2020 to USD 68.3bn in 2021 and is on track to hit about USD 43.5bn for 2022, making it the second-strongest year on record.

Australia tends to be a disciplined market, however, leading to few projections of a massive uptick in the rate of investment going forward. This is true even in the increasingly robust technology space, which despite leveraging distributed teams and borderless business models remains vulnerable to the labour issue.

The China question

The skills shortfall in tech could be offset in the middle and large-cap space by talent leaving loss-making start-ups that can no longer attract VC funding. But the sector's biggest challenge in the year to come may be more about geopolitics than the workforce.

Tech has produced some of Australian private equity's biggest cross-border successes in recent memory, but in a decoupling and deglobalizing world, those stories could come less frequently.

Potentia Capital's investment in payroll software specialist Ascender helps illustrate the point. During a six-year hold, the private equity firm helped the company build out its global footprint from 14 to 31 countries before selling it last year to US strategic Ceridian for a 16.4x return. This could be harder to do going forward, especially in terms of accessing China.

"If I roll back three years, I would have thought China was going to be a very big part of our future. I think it's going to be less so now, and that's a real shame," said Andrew Gray, a co-founder of Potentia.

"At one stage, we looked at merging Ascender with a business out of China, but those sorts of things are becoming more difficult. And I think the customer base will pivot away from China-based software providers."

China's gravity on Australia is pervasive. It is Australia's largest trading partner in terms of both imports and exports and accounts for one-third of Australian trade with the outside world in terms of goods and services. All of which raises the stakes in the uncertainty around China's reopening in the coming year.

Under one scenario, a spike in COVID-19 infections leads to renewed border closures and constrained industrial capacity, rattling plans to rebuild bridges. In another, a cross-border travel boom spikes fuel prices, disrupting supply chains in seemingly unrelated sectors. Any speculation would be clumsy and wild – which leaves Australian private equity with only one good play.

"A normal operating and open China is a good thing for all of us, but they're going to go through a different process of reopening and relaxing than other countries. So, investors will have to make sure they have businesses with the right management teams that are agile," said Bou. "That's what we can control. The rest – nobody knows what's going to happen."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.