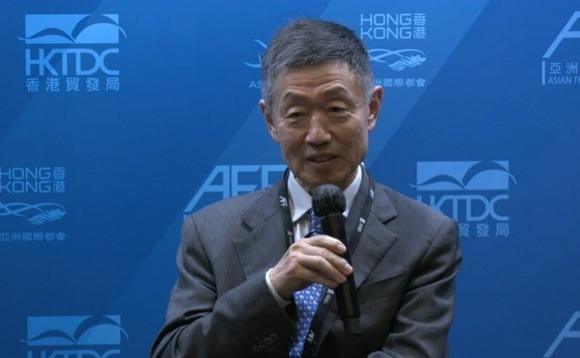

PAG's Shan emphasizes diversity, control in Asia private equity

Momentum has shifted towards geographically diversified pan-regional investors, control deals, and private markets following a decade dominated by China-centric funds, growth-stage technology plays, and public equities, Weijian Shan, chairman and CEO of PAG, told the Asian Financial Forum.

"We are diversified, we do value investing, we focus on private markets," he said. "In the long run, this type of strategy is more stable and conservative and therefore more sustainable."

Shan noted that at times over the past two years, he has despaired in the face of pandemic-related restrictions. However, his "mood has been lifted" by the re-opening of Hong Kong and mainland China, and there is an expectation that 2023 will be better than each of the three years preceding it.

He also expressed the hope that there will be greater policy stability in China as lessons are learned from the arguably excessive regulatory actions taken in sectors such as technology and real estate.

"If the private sector is left alone, business confidence will gradually return," Shan said. "The issue with the Chinese economy is policy flip-flops. When policy changes all the time, it undermines confidence. If there is stability regarding policy … eventually confidence will return. It's easy to bring down confidence and more difficult to bring it up."

Sentiment on Asia is further improved by the region not suffering from the same macroeconomic issues as Western markets.

Shan observed that China's consumer price index rose 1.6% on an annualised basis last November, compared to an 8.5% increase in the US and a double-digit increase in Europe. Inflation in Japan reached 3%, which is relatively high by historical standards, but interest rates are still negative. Meanwhile, the benchmark rate in China fell from 5% to 4.5% last year.

"You would expect China to ease its monetary policy to help with the economy because they have room to do so," Shan said. "Other countries have to raise interest rates to combat inflation; in China, they will do the opposite."

PAG recently invested USD 500m in video-streaming service iQiyi, reflecting a continued commitment to doing deals in China. This is largely driven by economic logic. Shan noted that the firm's addressable market in Asia amounts to USD 33trn in GDP. Of this, China contributes USD 18trn – or four times as much as Japan and six times as much as India. The EU's combined GDP is USD 17trn.

PAG is active across the region – Shan also flagged up recent activity in Japan and Australia in amusement parks and frozen food, respectively – but the firm is wary of cross-border transactions. In China, for example, businesses reliant on export-related revenue are off the table.

"With labour costs rising at a 10% rate and the currency strengthening, the cost of inputs has been rising. And one big problem with the Chinese economy is overcapacity – prices of finished products have been flat or declining, so profit margins for export businesses have been squeezed thinner and thinner," said Shan.

"Now there are also geopolitical reasons to stay away from businesses that rely on cross-border transactions."

However, PAG pursues the opposite strategy in India, targeting cross-border businesses because they generate US dollar revenues and are therefore somewhat insulated from a volatile rupee. At the same time, hedging costs are a function of interest rate differentials between the rupee and the US dollar, and rates in India have touched 10% in recent times.

"At 10% a year, it's too expensive to hedge. Without being able to hedge your currency risk, all you can do is invest in export-oriented businesses that take foreign currency as revenue and use local currency for their costs, so you are naturally hedged," said Shan.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.