Articles by Justin Niessner

Warburg Pincus commits $350m to SE Asia insurance platform

Warburg Pincus has seeded a digital insurance platform for Southeast Asia with a USD 350m equity commitment and two recent acquisitions from Spain-headquartered insurance giant Mapfre.

Globis leads $22m Series C for Japan's Trend Express

Globis Capital Partners has led JPY 3.3bn (USD 22.1m) Series C round for Japan’s Trend Express, a cross-border marketing and data analysis platform focused on Japan-China tourism.

India's Ather Energy adds $50m to Series E

India’s Ather Energy, a two-wheel electric vehicle (EV) brand, has raised about USD 50m from existing investors, extending its Series E round to around USD 178m.

Advantage recruits partner, co-head for Asia ex-Japan

Japan’s Advantage Partners has hired Rahul Bhargava, previously of ADV Partners, as a partner and co-head of Asia ex-Japan. It coincides with the acquisition of a Japanese jewellery industry supplier.

Korea pizza chain raises $25m for India push

Korea-headquartered pizza chain Gopizza has raised USD 25m in Series C funding from new and existing backers to drive an India expansion.

Fund focus: Local LPs lift Fireside to new heights

India’s Fireside Ventures has soaked up rising domestic investor appetite for start-ups with an outsized third vintage, claiming that its consumer brands thesis is beginning to bear fruit

Portfolio: Warburg Pincus and HTDK Group

Warburg Pincus’ investment in Chinese medical devices industry services provider HTDK Group is riding the domestic healthcare wave. Bringing foreigners to the party is the next chapter

Singapore's Bolttech hits $1.5b valuation with Series B

Singapore's Bolttech, an insurance technology provider set up by Pacific Century Group in 2020, has raised an undisclosed sum in Series B funding, claiming a valuation of USD 1.5bn.

India's Byju's raises $250m, ramps up overseas

Indian education technology provider Byju’s has raised USD 250m from existing investors with plans to expand its international business. Funding raised this year alone now tops USD 1bn.

Strategic players converge in Indonesia waste start-up Series A

Indonesia’s Waste4Change signalled broad appetite for exposure to local waste management services with a USD 5m Series A round featuring a diverse range of strategic backers.

Japan's NSSK buys Sakura pharmacy chain

Japanese middle-market private equity firm NSSK has acquired 100% of Kraft, a local pharmacy chain that operates under the Sakura brand, for an undisclosed sum.

US logistics AI start-up gets $100m for Asia entry

US-based Altana Technologies, an artificial intelligence (AI) and analytics provider for the logistics industry, has raised USD 100m in Series B funding with plans to open a Singapore office in early 2023.

Google backs India edtech player Adda247

Google has joined a INR 2.7bn (USD 35m) round for Adda247, an education technology start-up that claims to be India’s largest vernacular language exam preparation platform.

East leads $10m round for Indonesia fintech player Alami

East Ventures has led a USD 10m pre-Series B round for Indonesia’s Alami, a sharia-compliant financial technology provider and small business lender.

Japan digital bank Nudge raises $16m Series A

Japanese digital bank Nudge has completed a USD 16m Series A round led by One Capital, a VC firm led by the former head of Salesforce Ventures Japan.

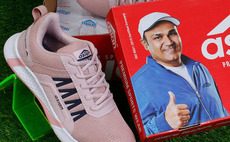

MO Alternates commits $28m to Indian footwear brand

Motilal Oswal Alternates (MO Alts), formerly Motilal Oswal Private Equity, has invested INR 2.2bn (USD 28m) in India’s Asian Footwears, which produces several shoe brands.

Insignia invests $10m in Thai beauty start-up

Insignia Ventures Partners has provided USD 10m in Series A funding to Thailand’s Konvy, a 10-year-old beauty e-commerce start-up.

GP selection: Discriminating customers

Sizeable LPs are hardening their criteria for fund commitments in reaction to a tougher investing environment. But going with fewer, deeper relationships is an uphill climb

Deal focus: Food app targets Thailand's first internet IPO

Thai restaurant delivery app Line Man Wongnai has leveraged the massive messaging service penetration of its parent company to position itself for what is hoped to be a breakthrough IPO

Searchlight backs Singapore's Synergy Marine Group

US-based Searchlight Capital Partners has taken a minority stake in Singapore’s Synergy Marine Group, a shipping fleet manager and maritime services provider, for an undisclosed sum.

Citi, Accel back Hong Kong crypto start-up Xalts

Citi Ventures and Accel have invested in Hong Kong-based Xalts, a start-up founded by former HSBC and Meta personnel, with a view to facilitating digital asset management for institutional investors.

Japan healthcare start-up Ubie closes $43m Series C

Japanese healthcare technology start-up Ubie has closed its Series C round on JPY6.3bn (USD 43.2m) with the latest tranche featuring PE-owned pharmacy chain operator Sogo Medical.

Dymon Asia closes Fund III at $650m hard cap

Dymon Asia Private Equity (DAPE) has closed its third Southeast Asia middle market private equity fund at a hard cap of USD 650m, beating a target of USD 550m.

India's SphitiCap targets $500m for debut VC fund

SphitiCap, a recently established early-stage VC firm in India, has announced the launch of its debut fund targeting USD 500m.