Articles by Justin Niessner

Deal focus: India’s Fashinza in vogue with VC

The appeal of the boutique brand ensures that fashion will always be a fragmented space. As e-commerce splinters the industry even further, India’s Fashinza aims to tie it all together

Portfolio: Investcorp and Viz Branz

War, climate change, and COVID-19 are twisting the outlook for Investcorp-owned instant food supplier Viz Branz. But an implacable China growth story has underpinned an aggressive expansion agenda

MDI leads $27m round for Singapore's SwipeRx

Indonesia’s MDI Ventures has led a USD 27m Series B round for Singapore-based mClinica, now rebranded as SwipeRx, an app that connects 45,000 pharmacies across Southeast Asia.

Japan biotech start-up raises $31m Series C

Japanese cancer drug developer Chordia Therapeutics has raised JPY 4bn (USD 31.3m) in Series C funding led by Growth Capital of Japan (GCJ) and UTokyo Innovation Platform.

Philippines fintech player Coins raises $30m

Coins, a Philippines-based financial technology provider focused on blockchain-enabled payment services, has received a USD 30m investment led by Ribbit Captial.

Coatue, Insight lead Series D for Indonesia's Xendit

Coatue Management and Insight Partners have led a USD 300m Series D round for Indonesian payments infrastructure platform Xendit.

Hong Kong's Betatron hits $15m first close on VC fund

Hong Kong’s Betatron Venture Group has reached a first close of USD 15m on its latest fund, which will make early-stage investments across South and Southeast Asia. The target is USD 50m.

SBI, Kyobo Life seek $75m for Asia VC fund

SBI Ven Capital (SBIVC), an ex-Japan VC arm of SBI Holdings, is seeking USD 75m for its latest fund in partnership with Korea’s Kyobo Life Insurance and Singapore’s Nanyang Technological University.

Antler to invest $100m in SE Asia start-ups by 2025

Singapore-based VC firm Antler has committed to investing USD 100m in more than 300 Southeast Asian start-ups by 2025.

Jungle closes fourth SE Asia, India VC fund on $600m

Jungle Ventures has reached a final close of USD 600m on its fourth flagship Southeast Asia and India-focused VC fund. The initial target was USD 350m.

India's Multiples invests $88m in BDR Pharma

Multiples Private Equity has led a consortium in the acquisition of a 9.3% stake in India’s BDR Pharmaceuticals for INR 6.8bn (USD 88.5m).

India’s Fashinza gets $100m Series B

Prosus Ventures and WestBridge Capital have led a USD 100m Series B round for India’s Fashinza, a B2B marketplace and supply chain platform for the fashion industry.

Mithril, BlackRock invest $110m in Singapore’s GreyOrange

Mithril Capital, a VC firm launched by PayPal co-founder Peter Thiel, and BlackRock have provided USD 110m in growth funding to Singapore and US-based robotics player GreyOrange.

Q&A: Sweef Capital’s Jennifer Buckley

Jennifer Buckley spun out the Southeast Asian gender-lens investment unit of impact private equity firm SEAF last year, forming Sweef Capital. Adding to the complexity, it happened mid-fundraise

Deal focus: Mekong unconfined to consumer thesis

Having long eschewed industrial business models, consumer-focused Mekong Capital has made an exception in the name of environmental impact with Vietnam agricultural supplier Entobel

Fund focus: East Ventures expands its LP rolodex

Indonesia’s East Ventures reached beyond Asian LPs for the first time with its latest growth fund. It coincides with several other milestones that signal a new level of institutionalisation

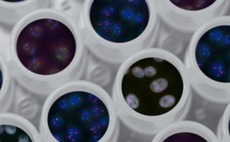

Eight Roads launches $250m India healthcare fund

Eight Roads Ventures has launched its first dedicated healthcare and life-sciences fund for India with a corpus of USD 250m provided entirely by its parent, Fidelity.

Indonesia's Sinar Mas launches smart city VC fund

The real estate arm of Indonesian conglomerate Sinar Mas has launched a smart city technology fund in partnership with East Ventures, Redbadge Pacific, and Prasetia Dwidharma.

PAG backs acquisition of India's Optimus Drugs

PAG has supported the acquisition of Optimus Drugs for an undisclosed sum alongside CX Partners and Samara Capital as part of a joint Indian pharmaceuticals platform play.

Indonesia's Qoala raises $65m Series B

Eurazeo has led a USD 65m Series B round for Indonesia’s Qoala, which claims to be the only insurance technology start-up with licenses in three Southeast Asian countries.

Felicis leads $80m Series B for Singapore SaaS start-up Supabase

Singapore’s Supabase, a software-as-a-service (SaaS) and IT provider for app developers, has confirmed a USD 80m Series B round led by Felicis Ventures.

Crypto exchange KuCoin raises $150m pre-Series B

Singapore-based crypto platform KuCoin has raised USD 150m in pre-Series B funding from an investor group featuring IDG Capital and Matrix Partners, claiming a valuation of USD 10bn.

TPG, Temasek invest $136m in India's Dr Agarwal’s

TPG Growth and Temasek Holdings have invested a combined INR 10.5bn (USD 136m) in Indian eyecare chain Dr. Agarwal’s Eye Hospital, setting up an exit for ADV Partners.

Singapore VC closes food tech fund at $34m

Singapore’s Good Startup, a food technology investor focused on alternative protein, has closed its debut VC fund with USD 34m in commitments.