Japan biotech start-up raises $31m Series C

Japanese cancer drug developer Chordia Therapeutics has raised JPY 4bn (USD 31.3m) in Series C funding led by Growth Capital of Japan (GCJ) and UTokyo Innovation Platform.

GCJ, a private equity firm set up in 2018, is cited as an affiliate of Nomura Sparx Investment, a recently established joint venture that aims to combine Nomura Holdings' expertise in IPOs with Sparx Group's venture capital and asset management acumen.

Nippon Venture Capital, life sciences-focused Shinsei Capital Partners, and SBI Investment also participated. SBI is investing via the Medipal Innovation Fund, a JPY 10bn corporate VC fund set up with Tokyo-listed pharmaceuticals company Medipal Holdings.

The round brings Chordia's total funding to about JPY 8.2bn, including Series B support from Nippon, Shinsei, Kyoto University Innovation Capital, Jafco, Mitsubishi UFJ Capital, and SMBC Venture Capital in 2019. Ichitaro Akita, CIO of Nomura Sparx, and Makoto (Mark) Ohori, a partner and CIO for life sciences at UTokyo, have joined the board of directors.

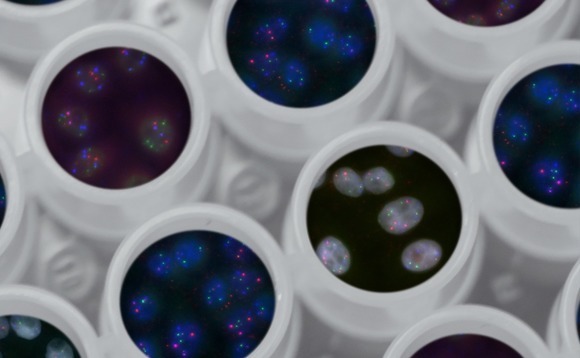

Chordia was founded in 2017 to develop novel cancer therapies through research into RNA regulation, an emerging area of oncology that explores abnormal gene functions. It will use the Series C capital to advance trials for several products targeting RNA dysregulation.

The most advanced candidate, currently in phase-one trials, is an orally administrable drug known as CTX-712 that has been confirmed to cause cancer cell death or have antitumor effects in non-clinical models. A similar project, CTX-177, was granted manufacturing and commercial rights to Ono Pharmaceutical in 2020.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.