Portfolio: Investcorp and Viz Branz

War, climate change, and COVID-19 are twisting the outlook for Investcorp-owned instant food supplier Viz Branz. But an implacable China growth story has underpinned an aggressive expansion agenda

It has not been a good year for the cereal industry. The Russia-Ukraine war has put 28% of global wheat exports in limbo, causing prices to jump as much as 40% in recent months. In March, China, the world's largest wheat producer, forecast its worst harvest ever. Last week, India, the second largest, announced an export ban citing similar climate-related shortfalls.

The industry has yet to feel the full brunt of the shock, but it's bracing for it. Singapore-based food company Viz Branz, which attributes 55% of its sales to cereal, has tracked 13% revenue growth in the past nine months. That compares to around 2-3% in the prior financial year. Still, the cost of its wheat and flour inputs has risen about 20% since the start of the conflict.

"So far, it's not significant because the commodity cost has not yet passed to cereal products' market price," Viz Branz CEO Eric Zhong said. "But, in the longer term, if cereal consumer prices increase over 30%, then demand might switch to other categories and products."

There is every expectation that wheat prices will indeed continue to climb, which could accelerate a product diversification drive already underway at Viz. This will include a buildout of the company's coffee business, a longstanding but relatively minor component of overall sales.

New product rollouts have been curtailed by COVID-19, however. Zhong, who joined the company in November and is based in China, has yet to visit staff and operations in Southeast Asia. This includes three of six factories, country teams across Singapore and Myanmar, and a distribution network spanning the region.

When Investcorp, one of the Middle East's biggest alternative asset managers, acquired Viz in 2020 for an undisclosed sum via its Asia Food Growth Fund (AFGF), the plan was slightly more straightforward.

Investcorp wanted to professionalise an old-fashioned, family run business and integrate it with its food platform. The GP has made more than 20 food sector investments globally, having identified the sector as amenable to exit via strategic and financial acquisition or IPO. Four of these were made by AFGF, Investcorp's joint venture with China Resources and Fung Strategic Holdings.

The most recent addition to the platform is Chinese instant food brand Mo Xiaoxian, which is now collaborating closely with Viz on price monitoring in wheat and flour. AFGF's other investees include Hong Kong supermarket operator City Super Group and Heritage Foods, which has a portfolio of condiment and sauce brands in Singapore, Malaysia, and Japan.

Cultural overhaul

Viz was founded in 1988, listed on the Singapore Exchange in 2010, and delisted three years later following a feud between co-founder Khoon Peng Chng and his son Ben Chng, who went on to take a controlling stake in the company. Ben Chng remains on the board of directors but is not involved in management.

The culture was conservative, and workflow was slow. Inter-department emails went days without a reply, with little sense of unity under an umbrella organisation. Every business unit – including product divisions and country teams – had their own general managers, financial team, and HR team.

One of Zhong's first moves in China was to integrate the sales and supply chain teams under more consolidated leadership. Corporate communications were revamped to emphasise a group identity.

"They had good products, but you could feel the isolation between the units," Zhong said of his first impressions. "The people in Shanghai selling coffee and the people in Guangzhou selling cereal didn't even know each other. They had never met. It was not managed as one group – it was piece-by-piece management."

Since acquisition, Investcorp's key contribution has been in replacing leadership with a focus on building out the China business. Zhong was brought in from global beverage giant Vitasoy, where he was China CEO. A new China-based chief marketing officer was also added.

"The talent pool in the industry is there. The challenge is to find individuals who have the skillset required to manage the business but also possess soft skills to manage it during difficult times such as the COVID pandemic," said Walid Majdalani, Investcorp's head of private equity in Asia.

"We wanted C-level management with a blue-chip background but how is also hands-on, entrepreneurial, and worked through business transitions. Being able to meet face-to-face with candidates was the most difficult hurdle to overcome during the headhunting process."

Geographic priorities

About 90% of the Chinese business is in four southern provinces: Zhejiang, Fujian, Guangdong, and Hainan. The plan is to expand tentative footholds in another 13 provinces, with a focus on Hubei, Guangxi, Henan, Jiangsu, Hunan, and Jiangxi. The five-year plan is to expand business outside of the core four provinces from 10% to 30%.

A difficult Southeast Asian presence, which currently represents 32% of overall revenue, is part of the thinking here. Viz's second largest market after China is Myanmar, where it has an instant beverage factory and 12 distributors. The kyat, the local currency, has lost 25% in value since the country's military coup in February 2021, and Viz has not been able to get its money out.

"It's a big directional shift in terms of where the company is and where we want it to be," Majdalani said of the plan to double down on China. "We believe that the starting position of having these loyal customer bases gives us a good baseline to serve as a growth platform."

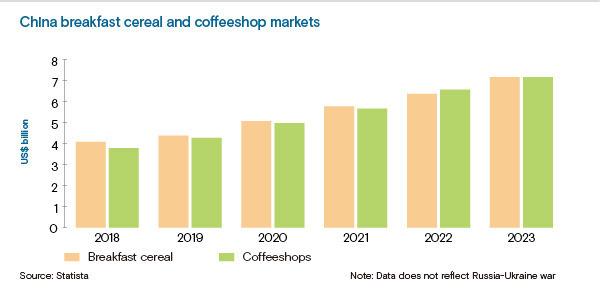

The relative predictability of the opportunity set in China is foundational for this strategy. The size of the domestic breakfast cereal market has been ticking up steadily in the past 10 years and expected to grow by around 10% through 2027, according to Statista, although this projection has not factored in the Russia-Ukraine war.

The coffeeshop industry – most relevant to Viz as a predominantly B2B coffee supplier – has fewer supply chain question marks but is currently mirroring the cereal story. Statista estimates China's breakfast cereal and coffeeshop markets have grown at the same rate and remained the same size as each other for a decade. Both were worth about USD 4bn in 2018 and on track to reach USD 7b by 2023.

The pandemic has proven a significant wildcard, however. Viz's only coffee factory is in locked-down Shanghai, leaving operations at a standstill since March. In anticipation of the closure, Viz sent all available inventory to its network of restaurants and cafes. Some have since run out of coffee, but in light of the lower foot traffic, most have retained ample supplies.

Recent additions to this network include national chains the likes of Sober-Hi Coffee and Nowwa Coffee. Viz also supplies coffee to at least two global fast-food giants. One of these, a burger chain, gets 100% of its coffee from the company. The China B2B coffee business has doubled in size since the Investcorp acquisition and now represents about 15% of total revenue.

Consumer appeal

The flagship brand in the B2C business across cereal and coffee is Gold Roast. In Southeast Asia, it is marketed as an instant coffee in individual sachets and boxes of sachets. In China, it's sold as a breakfast cereal mix, predominantly in 600-gram packs.

Gold Roast was Viz's first brand in 1988 in Singapore and entered China as a cereal in 1992. "Their packaging and ingredients haven't been touched for 10-15 years," Majdalani said. "But what we like about the business is the branding is strong – even if it hasn't necessarily met the requirements of the consumer today."

Recent attempts to connect with modern consumers include a range of nutrition-focused variations on core products, with enriched calcium, fibre, and iron, or reduced fat and sugar. Inspiration was taken from some Japanese brands in the form of cereals with dried fruit.

Gold Roast has also launched a premium line of chia and black sesame-based products in China. Four new varieties of instant cereal were launched in April alone, each with updated packaging.

The packaging rethink is multifaceted. In addition to increasing appeal to younger and health-conscious consumers, a need was identified to increase brand recognition through uniformity. Historically, there has been little consistency in the Viz logo and name across products. This has been rectified since acquisition in China, and Southeast Asia is planned to follow.

In addition to Gold Roast, Viz owns the cereal brands Calsome and Prime Roast, as well as several coffee brands including BenCafe, Cafe21, CappaRoma, and Americafe. There are also tea brands such as Fresh-Up and products such as Cocotime instant hot chocolate and Be-Be crackers.

Form factor experimentation includes cup packages in the style of instant noodle soups for convenience store distribution. This is said to have hit headwinds related to pandemic-dented demand for on-the-go consumables. Overall, new products and packaging concepts have yet to move the needle in overall sales figures but currently represent 10% of orders from distributors.

"Some of the initiatives were hampered in terms of being able to go out quickly as a result of COVID restrictions, but directionally speaking, judging by the top line growth, we're able to use the brand to grow even though it's slower paced than what we would have hoped for," Majdalani said, noting the distributor network is being beefed up in China.

"At least the infrastructure is in place, so we'll be able to hit the ground running when things come back after COVID."

The key product innovation is the simplest: smaller packages. Part of the idea is to lower the purchase price and make it easier to introduce the product to consumers in new geographies.

In addition to the Chinese hinterland, Viz will push deeper in Singapore and Malaysia, where premium offerings could see more traction. A Southeast Asia marketing strategist has been hired to this effect. There are also longer-term plans to enter the Middle East.

Going digital

Smaller packaging is also part of a fledgling e-commerce strategy, which is arguably Investcorp's best gambit for value accretion in China, where lockdowns have digitised shopping for even the most pedestrian household staples. Zhong observes that cereal competitors such as Quaker are now generating 20% of their China sales online, while some start-up brands are at 90%.

"When there's a serious COVID situation in a specific city, our first priority is to protect our employees and make sure they follow instructions and stay at home. Second, because the consumption is still there, we have to speed up the e-commerce and O2O [online-to-offline] model," Zhong said.

The e-commerce program has only been ramped up in earnest since the start of the year and is growing quickly from a miniscule base.

Online accounted for less than 2% of sales in 2021, a figure that is currently tracking around 3.5% for instant beverages and expected to hit 5% across products by year-end. The goal is to hit 10% in 3-4 years through an omnichannel approach, including traditional channels such as Alibaba Group's Taobao operation, as well as social commerce-enabling platforms like Pindoudou and TikTok.

To this end, a cloud-based enterprise resource planning system is being rolled out in combination with new salesforce automation software. This has coincided with the engagement of a chief digital officer, Lucas Jiang, who previously worked for IBM, Procter & Gamble, Mars, and Viatsoy. More IT talent is on the HR agenda, especially where it can ease the transition to a new distribution model.

"You need content providers – not traditional marketing – for e-commerce. They have to be able to make content to attract young consumers and direct-sell product," Zhong said. "Then it's about intelligence because an online business is a data business. You cannot just put a product online and sell it automatically. You need data analysis."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.