News

Deal focus: Darwinbox's unusual path to unicorn status

Most of India’s top software-as-a-service companies gained traction in the North American market. Darwinbox cracked Southeast Asia first, thanks to a product with broad appeal and local nuance

Deal focus: Foundation eyes Bright future

In leading a USD 82m cross-currency restructuring of a consumer-tech portfolio managed by China’s Bright Capital, Foundation Private Equity opted for a structure that is unusual yet prioritises alignment

China medtech start-up SiBionics raises $79m

China-based medical technology start-up SiBionics has raised CNY 500m (USD 79m) in a third tranche of Series C funding co-led by CPE and China Life Investment.

Invesco leads $700m round for India's Swiggy

Invesco has led a USD 700m round for India-based on-demand delivery platform Swiggy at a reported valuation of USD 10.5bn.

Australia's BGH sets $2.5b hard cap for Fund II

BGH Capital has set the hard cap for its second Australia and New Zealand-focused fund at approximately AUD 3.5bn (USD 2.5bn), having reached a first close of AUD 3bn.

GLP launches $1.1bn Vietnam logistics fund

GLP, a regional logistics platform that makes private equity investments in ancillary businesses and technologies, has launched its debut Vietnam fund with USD 1.1bn in commitments.

Ex-CVC Asia head raises $200m SPAC

Generation Asia Acquisition, a special purpose acquisition company (SPAC) sponsored by Roy Kuan, formerly Asia managing partner at CVC Capital Partners, has raised USD 200m through a US offering.

Insight leads $56m Series C for India's M2P Fintech

India’s M2P Fintech, a software provider that connects banking infrastructure to consumer-facing technology platforms, has raised USD 56m in Series C funding led by Insight Partners.

BRV leads $140m Series C for Korea's Green Labs

BRV Capital Management has led a KRW 170bn (USD 140m) Series C round for Green Labs, a Korea-based agricultural technology start-up seeking to digitalise the food production value chain.

Vision Fund leads $150m round for China e-commerce enabler

Shoplazza, a China-based software-as-a-service (SaaS) provider specialising in cross-border e-commerce, has raised USD 150m in the first tranche of Series C led by SoftBank Vision Fund II.

River Head Capital hits first close on latest reminbi fund

China’s River Head Capital has achieved a first close on its second Innovation Growth Fund, a renminbi-denominated vehicle that has an overall target of CNY 2bn (USD 135m).

Indonesia e-commerce SaaS player gets $80m Series C

Lummo, an Indonesian e-commerce software-as-a-service (SaaS) provider for small businesses, has raised USD 80m in Series C funding led by Tiger Global Management and Sequoia Capital India.

NPX invests $43m in Korean digital content provider

The private equity arm of US and Korea-based NPX Capital has invested USD 43m in Korean digital cartoon studio Copin Communications.

Brookfield backs Sequoia China's new economy infra fund

Sequoia Capital China has raised a new economy infrastructure fund – which will invest in the likes of logistics, data centres, and life science parks – with Brookfield serving as the largest LP.

Linklaters targets Singapore fund formation space

Linklaters has recruited Joel Seow, formerly a partner at Morgan Lewis, to launch a fund formation practice in Singapore.

Baring Asia sells Interplex to Blackstone for $1.6b

Baring Private Equity Asia (BPEA) has sold Interplex, a Singapore-headquartered precision engineering business, to The Blackstone Group for an enterprise value of USD 1.6bn.

CapVest tops BGH's bid for Australia's Virtus Health

CapVest Partners, a UK-headquartered private equity firm that primarily invests in Europe and North America, has entered the race for Australian fertility care business Virtus Health with an AUD 650.1m (USD 469m) offer.

Hong Kong's Animoca Brands raises $359m at $5b valuation

US-based Liberty City Ventures has led a USD 359m round for Hong Kong blockchain media company Animoca Brands at a pre-money valuation of USD 5bn, more than double its valuation in October.

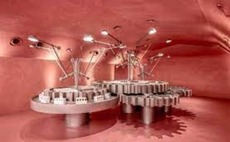

China beauty retailer Harmay raises $200m

Harmay, a China-based omnichannel beauty products retailer, has raised USD 200m across Series C and D rounds.

TPG-owned clinical trials player raises new equity, debt

Novotech, an Asia-based clinical trials specialist controlled by TPG Capital, has secured USD 760m in new equity and debt financing at a post-deal valuation of approximately USD 3bn.

Quadrant exits Australia experiential tourism business

Quadrant Private Equity has sold Journey Beyond, an Australia-based experiential tourism business, to US-based Hornblower Group, which is best known for offering cruise and sightseeing packages.

India digital wealth manager secures $75m Series D

Indian personal finance app INDmoney has raised USD 75m in Series D funding from Steadview Capital, Tiger Global Management, and Dragoneer Investment Group.

Asia PE investment hits new high in 2021

A rebound in China-based activity took Asia private equity investment to a record USD 105.3bn in the fourth quarter, ensuring that 2021 represents a new high watermark for the industry.

EverSource closes India climate impact fund on $741m

EverSource Capital has reached a final close of USD 741m on what is being called India’s largest climate impact fund.