Baring Asia sells Interplex to Blackstone for $1.6b

Baring Private Equity Asia (BPEA) has sold Interplex, a Singapore-headquartered precision engineering business, to The Blackstone Group for an enterprise value of USD 1.6bn.

The deal means Interplex remains under private equity ownership for a third consecutive iteration. BPEA acquired the business in 2016 from CVC Capital Partners and Standard Chartered Private Equity for approximately USD 320m. The previous owners had delisted and relisted the company, retaining a majority interest through to exit.

Sponsor-to-sponsor transactions have become increasingly prevalent in Asia post-pandemic. Private equity exits reached USD 107.1bn in 2021, up from USD 37.9bn in 2020 and trailing only 2018 in the all-time rankings. Sponsor-to-sponsor activity accounted for 33% of the total, compared to 21% in 2018. Meanwhile, the trade sale share fell from two-thirds to 55%.

In the fourth quarter of 2021 alone, deals in which an asset was passed from one private equity firm to another amounted to USD 17.8bn. The three largest exits all fit this profile and BPEA featured in two – selling Hexaware Technologies to The Carlyle Group and buying Tricor Holdings from Permira.

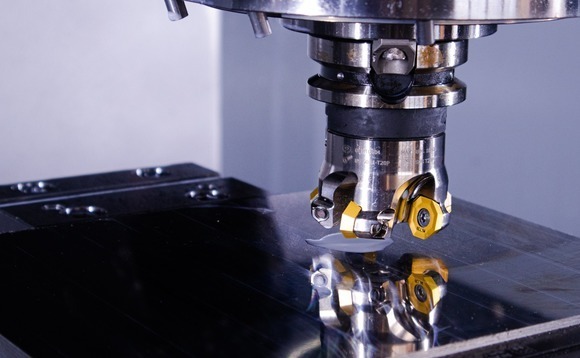

Although private equity ownership remains a constant, Interplex has changed considerably in the past decade. The company was known as Amtek Engineering until 2014 when it acquired Interplex Industries, a US-based operator specialising in miniature precision-engineered solutions for interconnector, electronic packaging, and electromechanical applications.

BPEA claims to have driven an additional transformation in the business, strengthening its focus on customized connectors and other high-precision products. The goal was to derive a majority of revenue from higher-margin business lines in fast-growing technology segments. Today, key customers are in the electric vehicle, autonomous driving, and medical and life sciences spaces.

Interplex has more than 30 manufacturing locations globally as well as 10 R&D sites. Employee headcount is approximately 13,000.

"We saw a lot of potential in Interplex's capabilities and embarked on a long-term strategic plan alongside management to re-orientate the business towards secular megatrends such as technology, data, and electric mobility," said Hong Yong Leong, a managing director at BPEA, in a statement.

BPEA is raising its eighth pan-regional fund, which had completed two closes – with commitments of USD 8.5bn, equal to the target for the entire vehicle – as of October 2021. Blackstone has been raising its second Asia fund. The firm announced a first close of USD 3.1bn in April 2021 and surpassed USD 5bn three months later. The hard cap is USD 6.4bn.

Goldman Sachs acted as exclusive financial advisor to BPEA on the transaction.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.