Ince Capital Partners

The innovation game: China GPs play safe

China investors have abandoned their previous high-risk-high-return approach in favour of proven business models and profitability. Hotspots like autonomous driving, biotech, and SaaS are no exception

Chinese retailer KK Group files for Hong Kong IPO

KK Group, a Chinese online-to-offline lifestyle retailer that has raised more than USD 400m in venture capital funding, has filed for a Hong Kong IPO.

LP interview: Dietrich Foundation

The Dietrich Foundation, which has one of the highest China PE and VC allocations of any US LP, is cautious on the market but not disengaged. Meanwhile, India and Southeast Asia are becoming more interesting

China chip packaging player SJ Semiconductor raises $340m

Legend Capital, CITIC Securities-controlled Goldstone Investment, and Ince Capital have participated in an extended Series C round of USD 340m for SJ Semiconductor, a China-based chip packaging business.

Qiming, Ince invest in China, US biotech start-up

Qiming Venture Partners and Ince Capital have led a USD 50m Series B round for China and US-based oncology and autoimmune diseases treatments developer Allorion Therapeutics.

Vision Fund, GGV back China blockchain infrastructure player

China-based blockchain infrastructure developer InfStones has received USD 66m in funding led by SoftBank Vision Fund 2 and GGV Capital. Ince Capital, 10T Fund, SNZ Holding, and A&T Capital also participated.

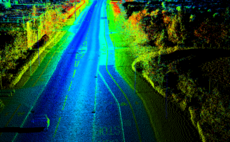

Ince leads $30m round for China's PhiGent Robotics

Beijing-based autonomous driving solutions provider PhiGent Robotics has raised a USD30m Series A round led by Ince Capital. Previous investors such as Atypical Ventures, 5Y Capital, and GSR Ventures re-upped.

China second-hand luxury goods platform Ponhu raises $45m

Ponhu, a China-based second-hand goods trading platform specialising in the luxury segment, has raised USD 45m in an extended Series C round led by Hedgestone Capital.

Fund focus: Ince eyes global entrepreneurs

Blockchain, hardware, and entrepreneurs going global are on the agenda for Ince Capital Partners’ second fund, which closed above target despite LPs getting spooked by the tech sector crackdown

China's Ince raises $700m across two funds

Ince Capital, a Chinese venture capital firm established by J.P. Gan, formerly a managing partner at Qiming Venture Partners, has raised USD 700m for its second fund and for an accompanying vehicle aimed at later-stage opportunities.

Hong Kong IPOs: Winner by default

New York’s loss is expected to be Hong Kong’s gain as regulatory and political turbulence drives Chinese start-ups to look for alternative listing destinations – unless valuations become a sticking point

China-focused NFT marketplace Cybertino raises $10m

A group of Chinese investors including Sky9 Capital, Ince Capital, and Draper Dragon have joined a $10 million round for non-fungible token (NFT) marketplace Cybertino Lab.

Sofina, CDH wealth platform lead round for China's Petkit

Petkit, a Chinese manufacturer of smart devices for pets such as water and food dispensers, has raised $50 million in a Series D round of funding led by Sofina and CDH Investments' wealth management platform.

China's Miaoshou Doctor raises $231m Series F

Beijing Yuanxin Technology, operator of China-based online healthcare services platform Miaoshou Doctor, has raised RMB1.5 billion ($231 million) in Series F funding featuring Sequoia Capital China.

Ince hits $450m first close on second China VC fund

Ince Capital, a Chinese venture capital firm established by J.P. Gan, formerly a managing partner at Qiming Venture Partners, has achieved a first close of approximately $450 million on its second fund.

PatPat raises $510m across Series C, D rounds

PatPat, a Chinese-founded children’s wear brand that claims to be the world’s largest direct-to-consumer (DTC) player in its segment, has raised $510 million across two rounds of funding.

Asia technology: Anatomy of a rebound

Tech investment has been on a tear in Asia, with private equity joining venture capital at the party. While COVID-19 has contributed to these dynamics, the revival is rooted in deeper structural change

Ince seeks $450 million for second China VC fund

Ince Capital is preparing to launch its second China venture capital fund with a target of $450 million, less than 18 months after closing its debut vehicle.

AVCJ Awards 2020: Fundraising of the Year - Venture Capital: Ince Capital Partners

A year after leaving Qiming Venture Partners, J.P. Gan raised $351.9 million for his debut fund at consumer internet-focused Ince Capital Partners

China VC: The naming of firms

The process of coming up with a name for a venture capital firm in China can be fraught with challenges around linguistic and cultural differences as well as questions about brand and values

Deal focus: Speed pays off for Ince with Eeo

Ince Capital's $35 million investment in Eeo Education's Series B round is the largest from its debut fund. The GP has since re-upped in a $265 million Series C at twice the valuation

Alibaba, Jeneration lead $196m round for China's Nice Tuan

Shihuituan, a China-based community group buying platform also known as Nice Tuan, has raised $196 million in the third tranche of a Series C round led by Alibaba Group and Jeneration Capital.

China education SaaS player raises $225m

Eeo Education, a Chinese software-as-a-service (SaaS) provider to the education sector, has raised a $265 million Series C round led by Hillhouse Capital.

CDH leads round for China community group buying player

Shihuituan, a China-based community group buying platform also known as Nice Tuan, has raised $80 million in the second tranche of a Series C round led by CDH Investments.