China chip packaging player SJ Semiconductor raises $340m

Legend Capital, CITIC Securities-controlled Goldstone Investment, and Ince Capital have participated in an extended Series C round of USD 340m for SJ Semiconductor, a China-based chip packaging business.

Additional contributions came from Jade Stone Venture Capital, Shangqi Capital, TCL Venture Capital, and China Fortune-Innovation Capital while existing investors Oriza Houwang Investment Management and Oriza Hua Capital re-upped, a statement said.

SJ Semiconductor has now raised USD 1bn to date and has a valuation of USD 2bn. The company added that the portion of the transaction featuring offshore investors has been completed, but onshore participants still have to go through certain procedures.

SJ Semiconductor raised a USD 300m series C in 2021 from Walden CEL Global Fund, CCB International Asset Management, CCB Trust, Country Garden Venture Capital, Guofang Capital and GP Capital, alongside CICC Capital, Oriza Houwang Investment Management, Oriza Hua Capital. This took the company's valuation past the USD 1bn mark, according to AVCJ Research.

Founded in 2014, SJ Semiconductor was a portfolio company of China's National Integrated Circuit Industry Investment Fund, or Big Fund, which focused on semiconductors. The first iteration of the Big Fund subsequently transferred its shares to investors such as China Fortune-Tech Capital, SAIC Motor-backed Hengxu Capital, and Legend Capital.

SJ Semiconductor claims to be the first company in China dedicated to 12-inch silicon wafer packaging and testing. Revenue rose 20% year-on-year in 2022.

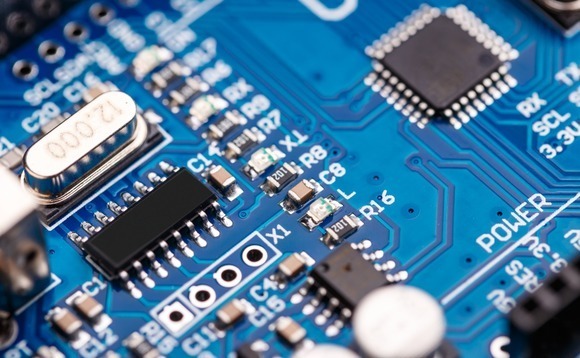

Packaging is an essential part of the semiconductor manufacturing process. A chip is cast in silicon - or fabricated - by foundries and then a packaging specialist encapsulates semiconductor material in a case that prevents physical damage. The case holds the semiconductor die and connects the chip to a board.

After the packaging phase, semiconductor testing companies assess chip performance. SJ Semiconductor describes its offering as an integrated middle-end-of-line (MEOL) solution that covers manufacturing and testing.

In the same space, Chinese semiconductor packaging specialist Jiangsu Jing Chuang Advanced (JCA) Electronic Technology recently raised a Series B extension of several hundreds of million renminbi led by Qiming Venture Partners. Other investors were mostly state-backed institutions.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.