Hillhouse Capital Management

China's Fenbeitong raises $140m

Chinese enterprise payment and expense management software provider Fenbeitong has raised USD 140m at a valuation of at least USD 1bn in an extended Series C round led by DST Global.

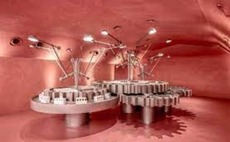

China beauty retailer Harmay raises $200m

Harmay, a China-based omnichannel beauty products retailer, has raised USD 200m across Series C and D rounds.

Grab completes SPAC merger, sees volatile trading debut

Southeast Asia ride-hailing platform turned super app Grab experienced a tumultuous first day of trading on NASDAQ following the completion of its merger with a US-listed special purpose acquisition company (SPAC) at an enterprise valuation of $30.4 billion....

Hillhouse upsizes growth fund to $5.2b

Hillhouse Investment, the buyout and growth capital unit of Asia-focused Hillhouse Group, has raised $5.2 billion for a growth equity fund, more than twice the original target.

Advent sells Chinese mattress maker to Hillhouse

Advent International has sold its controlling stake in AI Dream – operator of the Serta and King Koil mattress brands in China – to Hillhouse Capital.

China education: Opportunity erased?

Private equity investors have pumped billions of dollars into Chinese online education platforms, notably in the K-12 space. A regulatory crackdown has left them wondering how they can get their money back

Korea's Kurly raises $200m, targets domestic listing

Korean grocery delivery platform operator Kurly has raised a $200 million Series F round at a valuation of $2.2 billion, as plans for a US IPO are scrapped in favor of a local listing.

PE-backed China dental player files for Hong Kong IPO

Arrail Group, a leading Chinese dental chain that has raised about $400 million in private funding since 2010, has filed for a Hong Kong IPO.

China: A controversial ESOP

An employee stock ownership plan introduced alongside Hillhouse Capital’s 2019 investment in Gree Electric Appliances has raised questions about enrichment and alignment

China's Manbang trades up after $1.57b US offering

Manbang, a China trucking business that claims to be the world’s largest digital freight platform, gained 13% on debut following a $1.57 billion IPO in the US.

Deal focus: Content to the masses

Xiaoe Tong gained traction during the pandemic in China as channel for educational content providers, big and small, to reach their customers. It is also a SaaS player that stands firm on product standardization

China gene sequencing company raises $63m

QitanTech, a gene sequencing start-up also known as Qitan Technology, has raised a RMB400 million ($63 million) Series B round led by Hillhouse Capital and a VC arm of CDH Investments.

China trucking platform Manbang files for US IPO

Manbang, a China trucking business that claims to be the world’s largest digital freight platform, has filed for a US IPO. The company achieved a valuation of $12 billion in its most recent funding round six months ago.

PE-backed JD Logistics raises $3.2b in Hong Kong IPO

JD Logistics, a supply chain solutions and logistics provider that spun out from Chinese online retailer JD.com, gained 3.3% on its Hong Kong trading debut following a HK$24.6 billion ($3.2 billion) IPO.

China snack maker Weilong raises $549m, pursues HK IPO

China’s leading spicy snack food company Weilong has raised a $549 million pre-IPO round at a valuation of $9.4 billion and filed for a Hong Kong IPO.

Yale's David Swensen dies aged 67

David Swensen, head of the Yale University endowment who pioneered a new approach to institutional investment management, has died aged 67 following a long battle with cancer.

Chinese COVID-19 vaccine developer Clover files for IPO

Clover Biopharmaceuticals, a Chinese pre-revenue drug developer that has raised $315 million across several funding rounds since 2011, has filed for a Hong Kong IPO.

PE investors complete $4.6b China Biologic take-private

An investor group including Centurium Capital, CITIC Capital and Hillhouse Capital has completed its protracted pursuit of China Biologic Products Holdings with a $4.6 billion privatization.

Southeast Asia's Grab to merge with SPAC at $30.4b valuation

Southeast Asia-focused ride hailing and local services platform Grab has agreed to go public in the US through a merger with a special purpose acquisition vehicle (SPAC) at an enterprise valuation of $30.4 billion.

China mRNA vaccine provider Abogen raises $92m

Suzhou Abogen Biosciences, a Chinese mRNA vaccine provider, has raised RMB600 million ($92 million) led by PICC Capital - an investment unit under People’s Insurance Company of China - and state-backed SDIC Venture Capital.

China cybersecurity player ThreatBook raises $77m

Beijing-based cybersecurity solutions provider ThreatBook has completed a RMB500 million ($77 million) Series E round led by CPE and featuring existing investor V Fund.

Hillhouse, Tencent lead Series C for China's Fenbeitong

Hillhouse Capital and Tencent Holdings have led a $92.5 million Series C round for Fenbeitong, a China-based enterprise payment and expense management software provider.