Hillhouse Capital Management

China mobile charging business targets US listing

Energy Monster, China’s largest mobile device charging service provider by gross revenue, has filed for a US IPO.

Hillhouse agrees partnership with Jardines

Hillhouse Capital has teamed up with Asian conglomerate Jardine Matheson to pursue investment and business development opportunities in Greater China and Southeast Asia.

Warburg Pincus, Hillhouse back China's JD Property

JD Property, the infrastructure property asset management arm of Chinese e-commerce giant JD.com, has raised a $700 million Series A round led by Warburg Pincus and Hillhouse Capital.

China VCs back See Fund's debut vehicle

See Fund, an investment firm established by the founder of Chinese artificial intelligence chip start-up DeePhi Technology, has raised RMB200 million ($31 million) for its debut fund.

Hillhouse launches China sports retail JV with US-based Fanatics

Hillhouse Capital has established a China joint venture with Fanatics, a US-based sports retailer that specializes in licensed sports apparel.

China's Clover Biopharmaceuticals gets $230m Series C

Chengdu-based Clover Biopharmaceuticals has raised $230 million in Series C funding led by GL Ventures and Temasek Holdings. Oceanpine Capital, OrbiMed, and Delos Capital all re-upped.

PE-backed JD Logistics set for Hong Kong listing

JD Logistics, a supply chain solutions and logistics provider that spun-out from Chinese online retailer JD.com, has filed for a Hong Kong IPO. The company has received $2.57 billion in private funding.

AVCJ Awards 2020: Deal of the Year - Mid Cap: Perfect Diary

Perfect Diary’s $100 million Series D round came after the Chinese company proved itself with multiple hit color cosmetics brands and eight months ahead of a bumper US listing

Hillhouse founder bullish on China life sciences

Lei Zhang, founder and CEO of Hillhouse Capital, emphasized the opportunities at the nexus of life sciences and artificial intelligence-enabled supercomputing, while describing his firm as “probably the largest investor in healthcare in China.”

Chinese fitness app Keep raises $360m

Keep, a Chinese mobile app that provides fitness training programs, has raised $360 million in Series F funding led by SoftBank Vision Fund.

Hillhouse leads $28m round for China's DataCloak

DataCloak, a Shenzhen-based start-up that helps companies install data security systems on devices used by employees, has raised a $28 million Series B round led by Hillhouse Capital.

Delivery Hero wins approval for Woowa deal in Korea

Private equity investors in Korean food delivery business Woowa Brothers look set for a liquidity event after regulators gave conditional approval for a $4 billion acquisition by Delivery Hero.

Trustbridge leads $500m round for China's Dxy.cn

Trustbridge Partners has led a $500 million round for Dingxiangyuan – also known as dxy.cn – a Chinese digital medical platform that primarily serves as a forum for healthcare industry professionals.

Sequoia leads $515m Series E for Hong Kong's Lalamove

Lalamove, a Hong Kong-based delivery start-up known as Huolala in mainland China, has completed a $515 million Series E round led by Sequoia Capital China.

China digital services player Deepexi raises $40m

Deepexi, a Chinese start-up that provides digital transformation solutions to enterprise customers, has raised $40 million in the fourth tranche of a Series A funding round.

Deal focus: Speed pays off for Ince with Eeo

Ince Capital's $35 million investment in Eeo Education's Series B round is the largest from its debut fund. The GP has since re-upped in a $265 million Series C at twice the valuation

China education SaaS player raises $225m

Eeo Education, a Chinese software-as-a-service (SaaS) provider to the education sector, has raised a $265 million Series C round led by Hillhouse Capital.

JD Health targets largest Chinese PE-backed IPO in two years

JD Health, a Chinese online-to-offline healthcare business that raised around $1.9 billion from private investors after it spun out from JD.com, is looking to raise HK$26.9 billion ($3.48 billion) in its Hong Kong IPO.

Chinese vision therapy start-up Elumninex raises $50m

Chinese eye disease specialist Elumninex Biosciences has raised a $50 million Series A round led by GL Ventures, Lilly Asia Ventures (LAV), and Quan Capital.

China trucking platform Manbang raises $1.7b

Manbang Group, China's so-called "Uber for trucks" that matches shippers with drivers and fleet operators, has raised a $1.7 billion round led by SoftBank Vision Fund, Sequoia Capital China, Permira and Fidelity.

Baring Asia leads $198m round for Chinese coding start-up

Codemao, a Chinese online education platform that teaches coding to children, has raised RMB1.3 billion ($198 million) in Series D funding led by Baring Private Equity Asia.

PE-backed Perfect Diary jumps 75% on debut after $616m IPO

Yatsen Holding, the parent company of Chinese cosmetics brand Perfect Diary, gained 75% on its first day of trading on the New York Stock Exchange following a $616.9 million IPO.

China open source software player raises $43m Series B

Zilliz, a Chinese open-source software developer specializing in unstructured data processing and analysis, has raised a $43 million Series B round led by Hillhouse Capital affiliate GL Ventures.

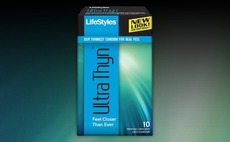

Hillhouse, Boyu, CareCapital back condom maker

Chinese private equity firms Hillhouse Capital, Boyu Capital and CareCapital Partners, a specialist dental and consumer health investor, have paid $200 million for a 40% stake in condom brand LifeStyles.