China education: Opportunity erased?

Private equity investors have pumped billions of dollars into Chinese online education platforms, notably in the K-12 space. A regulatory crackdown has left them wondering how they can get their money back

Summer is the busiest time for China's after-school training institutions, online and offline. Now, though, the atmosphere is strangely muted – haunted by a sense of uncertainty, confusion, and perhaps even resignation. Following a stunning regulatory intervention, this heavily private equity-backed industry may never be the same again.

It is an extraordinary fall from grace. Last summer, advertising by online tuition platforms was ubiquitous: on every TV variety show and drama, and all over elevators, bus stops, and subway stations. It is estimated the top 10 players spent more than RMB10 billion ($1.5 billion) on marketing in July and August 2020, twice the comparable figure for 2019.

While regulators were unhappy with the high-cash-burn dynamic, a severe crackdown was not expected. After all, online education was the go-to solution when schools were suspended in response to COVID-19. Even before the pandemic, it was the great leveler, bringing quality tuition to China's most remote villages and towns that would otherwise have gone unserved.

"The government hopes that private companies can promote positive change in the education industry. Therefore, the regulator will be cautious in launching new policies, and supervision will be discreet," Hao Li, a managing director at Lighthouse Capital, told AVCJ in January.

Within weeks, the situation started to change. From March, more than 15 companies were fined for false pricing and misleading advertising - some of them several times. They included TAL Education Group, New Oriental Education & Technology, and Gaotu Techedu, the US-listed market leaders, as well as Yuanfudao and Zuoyebang, the most well-funded unicorns in the private markets.

This was followed by the establishment of an off-campus education and training supervision department under the Ministry of Education. In early July, several provincial and municipal authorities ordered a complete shutdown of off-campus training during the summer vacation. Later the same month, regulators applied the coup de grace: a fundamental restructuring of the industry.

"Many of leading players had been communicating with the regulators, and they expected the introduction of a stricter regulatory framework," one growth-stage education technology investor tells AVCJ. "But no one predicted the intensity of the final version."

The fallout has been brutal. TAL, New Oriental, Gaotu, and NetEase-owned Youdao have seen their stock prices plunge between 70% and 97% from the February peaks. New PE and VC commitments to private operators tailed off earlier in the year, but investors are looking at grim prospects for existing portfolio companies and wondering whether they will ever get their money back.

Business models undermined

New rules issued by China's State Council impact all independent providers of tutoring services from pre-school through K-12 levels. Crucially, for-profit tutoring in core school subjects must stop. Companies providing courses based on the national curriculum must register as non-profit organizations. Pricing will be standardized and set according to government guidance.

No new licenses will be granted in the space, while existing operators must file for approval. Local authorities must conduct comprehensive investigations before issuing any approvals.

"Even when the kindergarten segment was subject to strict regulation in 2018 and private capital was banned, there was no requirement that companies must convert into non-profit organizations," the same growth-stage edtech investor adds. "Now, suddenly all compulsory education should be non-profit."

If there was investor appetite – public or private – for K-12 tuition businesses, capital wouldn't be allowed in. Public listings or any other capital-raising activity is prohibited, while companies that are already listed cannot invest.

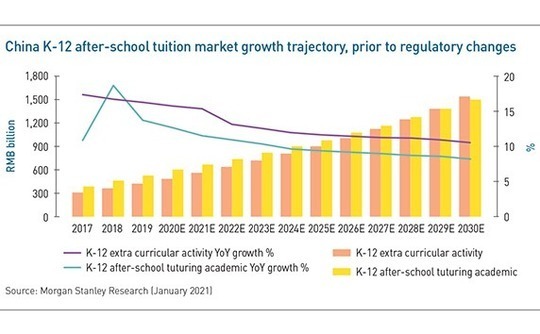

The State Council wants to "effectively reduce the burden on students within one year and have a significant effect within three years," which some industry practitioners interpret as a grace period of up to three years. Nevertheless, analyst projections are dispiriting, with Goldman Sachs claiming that the value of China's after-school tuition market would contract by 76% to $24 billion.

J.P. Morgan added in a recent report: "It's unclear what level of restructuring the companies should undergo with a new regime and, in our view, this makes these stocks virtually uninvestable."

Private equity exposure to the industry is considerable, even as consolidation in the K-12 space has led to the concentration of capital on a few key players. Yuanfudao and Zuoyebang, which rose to prominence through question-and-answer (Q&A) search engines before expanding into large-class tuition, received over $0.60 of every dollar invested in online education last year.

Yuanfudao and Zuoyebang raised $5.85 billion between them last year. Investors include Sequoia Capital China, Hillhouse Capital, FountainVest Partners, Warburg Pincus, CMC Capital Group, SoftBank, Tiger Global Management, Coatue Management, Yunfeng Capital, DST Global, Goldman Sachs, Primavera Capital Group, Trustar Capital, GGV Capital, Boyu Capital, IDG Capital, Legend Capital, and Matrix Partners China. Strategics and sovereigns are in there as well.

"If a big-name fund is not on the shareholder list, it's most likely because they couldn't get an allocation," says an investment professional in one of the groups above. "We must write down our position, but the fund will not request a withdrawal for the time being. We will give the company a chance to transform the business. Bankruptcy and liquidation don't make sense right now."

Small picture, big picture

Transformation options are limited by the wide-ranging scope of the regulations. The prospects for one-to-one English language tuition – as opposed to the large-class format – are uncertain given foreign personnel based overseas cannot be hired to conduct training. VIPKid, which sits third in the overall fundraising rankings after Yuanfudao and Zuoyebang, is a major player in this area.

Meanwhile, online training for pre-school children, defined as those below six years old, has been proscribed. This threatens to torpedo the business models of Huohua Siwei – which filed for a US IPO in May – and PiThinking.

For investors accessing China via the public or private markets, there are bigger-picture concerns. Since the end of last year, Beijing has widened an antitrust investigation of Alibaba Group to include dozens of platform technology companies and targeted internet companies listing in the US for violating personal data collection rules. It raises the question of what will get hit next.

"Even though such moves would in effect add a permanent ‘risk premium' to Chinese stocks and bonds, they should not fundamentally change China's growth model or the broader investment case for the country's financial assets. We don't think a full-scale withdrawal from Chinese stocks is warranted," wrote Luca Paolini, chief strategist at Pictet Asset Management.

Others are not so sure. Eddie Tam, founder of Hong Kong-based Central Asset Investments, views the crackdowns through the lens of US-China tensions. The US fell into Thucydides' Trap a few years ago and now China has followed, he maintains.

"The US has launched a range of trade, finance, media, ideological, and technological wars, which have caused China to reflect on and review all its own policies. It is both necessary and inevitable," Tam tells AVCJ. "But recent policy mutations may have a deeper significance, which seems to represent a change of fundamental economic development model and even diplomatic strategy."

For its part, China has played down the notion of crackdown contagion. Four days after the education regulations were issued, Xinghai Fang, vice chairman of the securities regulator, held a video conference with executives from leading investment banks. He told them that the new rules are aimed at protecting social welfare and the impact should not spill over into other industries.

Moreover, the regulator remains supportive of companies pursuing overseas listings.

Why education?

This may serve to assuage investors' concerns, but it is unclear why China suddenly went cold on private tuition providers. One theory is that "A Love for Dilemma" is to blame. The TV series is a critical study of off-campus training, highlighting how it contributes to unhealthy competition between students and brings anxieties to family life. It prompted widespread public debate.

A new buzzword – involution – has emerged to describe the dilemma. As off-campus training proliferates, students are pressured into taking more classes to stay ahead of peers ultimately competing for the same university places. This increases the burden – economic and otherwise – of raising a child, resulting in smaller families, a declining population, and a financial timebomb.

Speaking at an education forum in late July, Dongping Yang, a member of the National Education Advisory Committee, identified four major problems with private education: it is too big, too profitable, has yet to deliver the expected diversification and innovation, and is run by entrepreneurs and financial investors rather than by educators.

His views attracted criticism from some quarters. Hua Wu, a professor at Zhejiang University, claimed that regulators have severely misjudged private education. "They adjusted the policy orientation from encouraging support to restricting suppression," he wrote. "Private education has been stigmatized. Criticizing it has become the standard of ‘political correctness' in education policy."

Even though many Chinese parents believe their children are overloaded with after-school tuition, they find it hard to let go. Jianzhang Liang, vice chairman of China Entrepreneur Club and co-founder of online travel portal Ctrip, observes that the recent changes are a blow to supply. Demand is as robust and inelastic as ever, given the status attached to attending top schools and universities.

"Just reducing supply will distort the supply-demand relationship. With organized large classes banned, privately arranged small classes or one-to-one education will become more popular, and the educational burden on many families will become even heavier," Liang wrote in an article.

Korea is routinely cited as an example of misguided regulation. The country banned all off-campus training in 1980, but then gradually backtracked. In 2000, the ban was overturned by the courts as a violation of human rights stipulated by the constitution.

Survival instincts

While hoping for a similar retreat, after-school tuition providers in China are focusing on survival. In 2020, ByteDance-owned Dali Education announced plans to invest RMB10 billion each year for the next five years and followed up with a commitment to recruit 10,000 staff in four months.

Today, the company is refunding users and laying off staff. Gogokid, a one-to-one English language learning app that recruited US residents to help Chinese students practice speaking, has ceased operations. Math tuition app Nipaiyi has also been discontinued, while Guagualong, an English teaching app for youngsters, will lose half it staff at the end of this month.

In fact, Dali was already adjusting its model in June. It decided to curb investment in live-streamed large-format classes for K-12 students – delivered under the Qingbei brand – in favor of recorded classes that utilize artificial intelligence. One investor observes that recorded lessons might be considered learning products, thereby circumventing the after-school training supervision.

Gaotu also acted early, axing its program aimed at 3–8-year-olds in May and reportedly imposing a hiring freeze and jettisoning its recruitment team in early July.

Shortly after the new regulations were announced later the same month, CEO Xiangdong Chen announced further cuts: 10 brick-and-mortar education centers would close by August 1, leaving just three in operation; and 10,000 teachers – or one-third of overall staff – would be laid off.

Chen warned in an internal letter that because of policy and market changes, many outstanding technical and management talents would flee the industry and new graduates would be dissuaded from joining. "We must live, Gaotu must live, and if we don't make changes today, we will speed up our extinction," Chen wrote. "We have enough cash on hand to live for 3-5 years. Hopefully, we can make some reforms."

Of the pivots open to industry incumbents, one is to offer so-called quality services, which focus on the arts, sports, or holistic education, rather than the school curriculum. Yuanfudao duly launched Pumpkin Science, initially an experimental incubation project, as a pillar business. It is intended to nurture children's curiosity about science and offer a hands-on experience of scientific phenomena.

Another option is to pursue the hardware route. Tuition platforms used to offer stationery and other learning tools as incentives to attract students, but Youdao has demonstrated its broader potential. In the first quarter, the company's revenue from educational hardware – essentially a self-developed Dictionary Pen – was RMB202 million, up 280% year-on-year. It accounted for 15% of all revenue.

ByteDance is also pushing into the hardware space, releasing the Dali smart learning light, while simultaneously trying to create a new revenue channel in B2B services. Dali CEO Lin Chen told staff in June that helping schools and teachers deliver high-quality teaching was now an area of focus.

However, there are doubts as to whether this business can become a profit center, as demonstrated by 17 Education & Technology Group, which listed in the US last December. The company introduced its smart in-classroom solution in 2012, comprising a suite of homework checking and academic assessment tools. It is used by more than 70,000 K-12 establishments, but largely for free.

17 Education essentially used the service to build up a user base and then expanded into large-class tuition in 2017. In the first nine months of 2020, that segment accounted for 93% of overall revenue.

Investor takeaways

It is difficult to predict what will happen to after-school tuition platforms, assuming the regulations are implemented as planned. But the reversal of fortune has generated some takeaways for investors when considering approaches to China across different industries and strategies.

First, it is important to consider business models in a broad policy context, including the social implications and potential regulatory ramifications. From an environment, social and governance (ESG) perspective, encouraging children to take ever more online courses is problematic.

"The mobile-internet mode, which leverages capital to generate online traffic is in the past. You must invest in something that is beneficial to the whole of society and that is aligned with the government's development agenda. Artificial intelligence and semiconductors – in other words, hardcore technology – are the future," one investor observes.

Nevertheless, Central Asset's Tam sees the renewed focus on hardware, as opposed to a more balanced mindset that takes in different industries, as symptomatic of regulatory haphazardness.

"Why are semiconductors, batteries, and electric vehicles suddenly considered high-tech, and deemed eligible for A-share listings? The internet economy has fallen from the clouds to the ground, while logistics – a high-level mathematical problem involving ‘linear programming optimization' – has been relegated to a worthless low-end cabbage delivery business model," he observes.

This view is endorsed by Weiying Zhang, an economist who believes policy uncertainty is threatening entrepreneurship. "What is legal today is not legal tomorrow, and what can be done today cannot be done tomorrow. Many people lack rational thinking, and when they see a problem in society, they ask the government to intervene without clarifying the real cause," he wrote in a recent article.

"In fact, in many cases, the more government intervention, the bigger the problem; the bigger the problem, the more demand for the government, and the result will be a vicious circle."

On a more positive note, uncertainty is hardly a new feature of China, so in that sense, little has changed. Ray Dalio, co-CIO and chairman of Bridgewater Associates, argues that Beijing has been consistent in the broad direction of its actions, so investors should not use a shock in one area as a pretext for rethinking their approach to the country.

"I encourage you to look at the trends and not misunderstand and over-focus on the wiggles," Dalio said in a LinkedIn post. "Having said that, I do think that it is unfortunate that Chinese policymakers don't publicly communicate the reasoning behind their moves more clearly."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.