Growth capital

OTPP invests $80m in India's Xpressbees

Teachers’ Venture Growth (TVG), the late-stage growth investment arm of Ontario Teachers' Pension Plan (OTPP), has invested USD 80m in Indian logistics start-up Xpressbees.

Stellantis buys 20% stake in VC-backed Chinese EV maker

LeapMotor, a Chinese electric vehicle (EV) manufacturer that received substantial private funding prior to its Hong Kong IPO in September 2022, has agreed to sell an approximately 20% stake to European automaker Stellantis for HKD 8.5bn (USD 1.1bn).

Australia's Employment Hero raises Series F at $1.3b valuation

Australian human resources start-up Employment Hero has achieved a valuation of approximately AUD 2bn (USD 1.3bn) on closing a AUD 263m Series F round led by US-based venture capital firm TCV.

China's Didi gets backing from state-owned carmaker

China ride-hailing platform Didi, which delisted from the New York Stock Exchange last year following a scandal-hit post-IPO period, has raised USD 149m in funding from state-backed carmaker GAC Group.

China's Leadrive raises $81m Series D

Legend Capital and Oriza FoFs have led a CNY 600m (USD 81m) Series D round for Leadrive, a Shanghai-headquartered manufacturer of semiconductor power modules and motor control units used in electric vehicles (EVs).

ADIA re-ups in India's Reliance Retail

Abu Dhabi Investment Authority (ADIA) has agreed to invest INR 49.7m (USD 597m) in India’s Reliance Retail within two months of USD 1.25m worth of investments from KKR and Qatar Investment Authority (QIA).

India's True North commits $75m to iLink Digital

True North has agreed to pay USD 75m for a minority stake in iLink Digital, a digital transformation service provider founded in the US by two Indian entrepreneurs.

Indonesia fintech platform Investree gets $231m Series D

Investree Group, operator of a series of lending platforms that target micro, small and medium-sized enterprises (MSMEs) in Southeast Asia, has raised EUR 220m (USD 231m) in Series D funding.

Deal focus: GPs change channel on content streaming

The Fundamentum Group sees mass-market promise in Indian digital audio platform Kuku FM. It’s targeting a 50% market share by focusing on uniquely local content in vernacular languages

China's Enflame secures $273m Series D

Shanghai International Group (SIG) – acting through an assortment of investment units – has led a CNY 2bn (USD 273m) Series D round for Chinese artificial intelligence (AI) chip designer Enflame Technology.

China healthcare AI start-up Huimei gets $41m Series D

Eastern Bell Capital has led a Series D round of more than CNY 300m (USD 41m) for Huimei Cloud Technology, a China-based provider of artificial intelligence-enabled (AI) software that helps doctors make clinical decisions.

China's Lynk Pharmaceutical increases Series C to $44m

China-based drug developer Lynk Pharmaceuticals has closed a second tranche of Series C funding, taking the overall size of the round to CNY 322m (USD 44m).

Leapfrog invests $50m in Singapore's Bolttech

LeapFrog Investments has invested USD 50m in Singapore’s Bolttech, the insurance technology business of Pacific Century Group.

Growtheum backs Indonesia's Kin Dairy

Southeast Asia-focused Growtheum Capital Partners has announced its second dairy deal in five months, with an investment in Indonesia-based ABC Kogen Dairy, commonly known as Kin Dairy.

China auto parts platform Casstime adds to Series D round

Chinese aftermarket car parts supplier Casstime has raised CNY 200m (USD 27.5m) across two tranches of Series D funding from local investors.

Kedaara backs India's K12 Techno Services, Peak XV part-exits

Kedaara Capital has acquired a significant minority stake in India-based education technology business K12 Techno Services, facilitating a partial exit for Peak XV Partners (formerly Sequoia Capital India).

KKR commits an additional $250m to India's Reliance Retail

KKR has agreed to re-up in India’s Reliance Retail, committing another INR 20.6bn (USD 250m) on top of the INR 55bn it put into the neighbourhood store-to-supermarket operator three years ago.

IFM backs New Zealand energy SaaS platform Tally

IFM Investors has committed approximately NZD 50m (USD 29m) to New Zealand-based energy sector software provider Tally Group alongside existing investors SilverTree Equity and Pioneer Capital.

China's GTA Semiconductor raises $1.85b

GTA Semiconductor, a China-based semiconductor foundry specialising in chips for the automotive industry, has raised CNY 13.5bn (USD 1.85bn) in funding from unnamed investors.

China EV maker Hozon raises $961m in crossover funding

Hozon Auto, a Chinese electric vehicle (EV) manufacturer, has raised CNY 7bn (USD 961m) in crossover or pre-IPO funding from unnamed investors.

Korea Credit Data raises $75m, achieves unicorn status

Korea Credit Data (KCD), the operator of a super app aimed at small and medium-sized enterprises (SMEs), has raised KRW 100bn (USD 75.7m) at a valuation of KRW 1.3trn (USD 1bn).

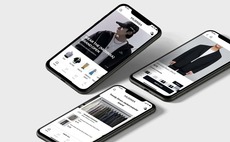

Deal focus: KKR thinks global with Korea’s Musinsa

KKR has made its first tech growth investment in Korea with Musinsa, an online marketplace for a carefully curated selection of streetwear brands with export potential

IFM backs Australian property technology player

IFM Investors has committed AUD 50m (USD 32m) to Smart Urban Properties Australia (SUPA), which claims to be the country’s first unified services provider of utilities and communications infrastructure.

China's Neurophth Biotechnology gets $97m Series C extension

Neurophth Biotechnology, a China-based gene therapy developer specialising in ocular diseases, has raised nearly CNY 700m (USD 97m) in an extended Series C round.