China's GTA Semiconductor raises $1.85b

GTA Semiconductor, a China-based semiconductor foundry specialising in chips for the automotive industry, has raised CNY 13.5bn (USD 1.85bn) in funding from unnamed investors.

Participants included local and national level government guidance funds and financial and strategic investors, according to a statement issued by Mingsheng Capital, a Shenzhen-based private equity firm described as a specialist investor in the semiconductor industry.

AVCJ Research has records of two prior funding rounds for the company. In 2019, Shanghai Integrated Circuit Industry Investment Fund – which appears to be an offshoot of the National Integrated Circuit Industry Investment Fund, otherwise known as the IC Fund or Big Fund – paid CNY 1.8bn for a 45% stake.

Two years later, an investor group committed CNY 6.7bn for a 47.8% interest, while Huada Semiconductor, which already owned 55% of GTA, contributed CNY 1.3bn. The investor group included multiple government guidance funds and industry funds, including the China Internet Investment Fund. Shangqi Capital, an investment unit of SAIC Motor, and CPE were also listed as participants.

In addition, the same round is said to have featured Cathay Capital, which invested via the first of its dedicated China car technology funds.

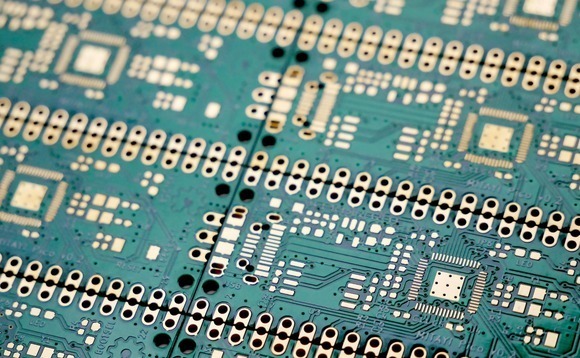

Founded in 2017, GTA has two factories in Shanghai with a monthly production capacity – including under-construction capacity – of 280,000 wafers. It produces six-inch, eight-inch, and 12-inch wafers as well as silicon carbide – a key compound used in semiconductors – microcontrollers, analogue circuits, power units, and sensors.

Within the automotive industry, its chips feature in batteries, charging piles, and a wide range of in-car components, ranging from airbags and smart door controls to lighting and tire pressure gauges.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.