China auto parts platform Casstime adds to Series D round

Chinese aftermarket car parts supplier Casstime has raised CNY 200m (USD 27.5m) across two tranches of Series D funding from local investors.

Participants included Mangrove Capital, a tech investment firm formed by alumni of SAIF Partners, China Resources Group, and Standard Chartered, and Vlight Capital, a specialist investor in the automotive supply chain. They were joined by Shenzhen HTI Group, Minxi Xinghang State-owned Investment & Operation, and a new energy vehicle fund backed by the government of Wuhu city, Anhui province.

Support from the Wuhu government comes after Casstime agreed to support the city's efforts to build a local automotive industry supply chain, according to a statement. The Anhui provincial government also included Casstime in its strategic plan for the development of a new energy vehicle industry.

The company has previously received backing from Sequoia Capital China, Source Code Capital, H Capital, Fosun RZ, Shunwei Capital, and Greater Bay Area Homeland Investments. The latter led the second tranche of a Series C – worth USD 50m – in mid-2020. The first tranche of the Series D was reportedly provided by Source Code and Vlight in May 2022.

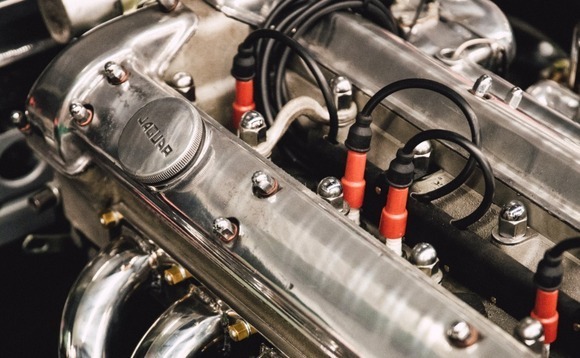

Established by Overmars Jiang, formerly an executive at Huawei Technologies, Casstime positions itself as an internet-enabled solution for a traditional industry that connects suppliers with automotive repair workshops. The company offers a procurement platform, an offline store management system, and supply chain finance and logistics services.

The procurement platform is powered by a Google-style search engine that helps users find the unique part numbers by responding to vehicle identification numbers, standard product names, and colloquial variants. This is a useful function in China since the country does not have a single, industry-wide electronic parts catalogue.

Casstime currently works with 7,000 automotive parts manufacturers across 376 cities that service 3m vehicles every month. It connects them to a network of more than 250,000 workshops. The company claims to cover nearly half the workshops nationwide. The core B2B business has achieved profitability, the statement said.

Last year, Casstime started focusing on large-scale original equipment manufacturers (OEMs) as well, providing centralised procurement platform services. The idea is to create closed loops that cover the entire industry supply chain. The company is also expanding coverage from high-end to mid-to-low-end models and building out its new energy vehicle (NEV) operation.

"There are 16m NEVs in China and demand for after-sales maintenance will increase. For example, the air-conditioning compressor for the "small three" [the power distribution unit, on-board charger, and converter in NEVs] has thermal management needs, so it will be used six times more than in traditional fuel vehicles," said Jiang.

"These issues are now being exposed as ride-hailing vehicles accumulate mileage. Private cars will also experience more after-sales problems as they get older."

He added that Casstime has served 2m NEVs covering 193 models. More than 5,000 NEV after-sales service workshops currently use the company's parts sourcing platform and software solutions.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.