China

China investigates Sino IC Capital executives

Several executives at Sino IC Capital, which manages China's largest semiconductor-focused investment fund, are under investigation for suspected serious legal violations.

Sequoia launches China accelerator

Sequoia Capital China has launched an accelerator programme under the Yue brand, which will provide systematic training and resources for entrepreneurs at the angel and Series A stages.

China's Insilico Medicine gets another $35m

Insilico Medicine, a China-based artificial intelligence-driven drug discovery company, has closed the second tranche of its Series D round on USD 35m, with Prosperity7 Ventures taking the lead.

Cartesian seals deal for China rollout of restaurant chain Popeyes

Cartesian Capital Group, a US private equity firm that has served as Restaurant Brands International’s (RBI) joint venture partner for Burger King in China for the past decade, has been awarded exclusive country development rights for the company’s Popeyes...

China logistics robotics player Geek+ raises $100m

China’s Geek+, a manufacturer of robots used to move merchandise around warehouses, has raised USD 100m in Series E funding at a valuation of about USD 2bn.

Hong Kong's Gly Capital closes debut mobility fund

Gly Capital Management, which is majorly owned by a Chinese automaker, tapped external investors for the first time in raising USD 163m for global investments in smart cities and smart cars

China's Black Sesame completes Series C with $500m haul

Black Sesame Technologies, a China-based chipmaker specializing in autonomous driving applications, has closed a Series C extension led by SummitView Capital. This brings the size of the overall round to USD 500m.

Gaorong, Tsing Song back China CDMO IntellectiveBio

Gaorong Capital and Tsing Song Capital have led a CNY 500m (USD 74m) Series C for IntellectiveBio, a China-based contract development and manufacturing organisation (CDMO).

Morningside joins round for China's Epigenic Therapeutics

Morningside Venture Capital has teamed up with Kingray Capital, Trinity Innovation Fund, TigerYeah Capital, and FountainBridge Capital to provide USD 20m in angel and pre-Series A funding for Epigenic Therapeutics, a China-based gene editing specialist....

China biotech company GluBio raises $22m

China and US-based GluBio Therapeutics, which develops targeted protein degradation (TPD) drugs, has raised an extended Series A round of USD22m led by Qiming Venture Partners.

ADIA, GIC lead $300m round for China's Taibang Biologic

Taibang Biologic Group, a specialist in blood plasma-based pharmaceuticals formerly known as China Biologic Products, has raised a USD 300m round led by Abu Dhabi Investment Authority (ADIA) and GIC.

Portfolio: CBC Group and Ensem Therapeutics

CBC Group plans to allocate USD 300m from its latest flagship fund to a biotech incubation platform. Artificial intelligence-enabled drug discovery player Ensem Therapeutics is an example of what it wants to achieve.

China biotech player Sironax raises $200m Series B

Gaorong Capital and Yunfeng Capital have led a USD 200m Series B round for China’s Sironax, a drug developer targeting age-related degenerative diseases.

Qiming, Quan lead $120m Series B for China's OriCell

Qiming Venture Partners and Quan Capital have led a USD 120m Series B round for OriCell Therapeutics, a China-based drug developer that is working on CAR-T cell therapies that target cancer.

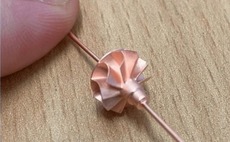

Deal focus: China start-up mines 3D printing's micro potential

Supported by a string of Chinese investors, Boston Micro Fabrication has carved a niche serving global manufacturers that want 3D printing solutions for very small components

China's Ribo Life Science raises $40m as part of Series E

Chinese drug developer Suzhou Ribo Life Science has raised USD 40m in the first tranche of a Series E from existing investors Panlin Capital and Trinity Innovation Fund. Several undisclosed new investors also took part.

Centurium leads $200m round for China textile tech specialist

Centurium Capital has led a USD 200m investment in NTX, a Shanghai-based textile technology start-up that aims to serve as an eco-friendly supply chain partner to fashion and apparel brands.

ABC Impact backs China autism therapy business

ABC Impact, a Singapore-based impact investor established by Temasek Trust, the philanthropic arm of Temasek Holdings, has led a USD 42m Series D for Da Mi & Xiao Mi (DMXM), a Chinese rehabilitation platform for children with autism spectrum disorder...

B Capital, Kunlun back China process mining start-up

B Capital Group and Kunlun Capital have led a CNY 135 (USD 20m) Series A extension for China’s Prothentic Technology, a process mining specialist also known as Wangfanxin.

China's ClearVue targets $100m for blockchain fund

ClearVue Partners, a China-focused investor in consumer and technology, has reached a first close of USD 50m on a fund dedicated to digital assets related to decentralised finance (defi) services and bridging web2 and web3 operating models.

Shenzhen Capital leads Series C for miniature 3D printing player

Shenzhen Capital Group has led a USD 43m Series C round for China and US-based Boston Micro Fabrication (BMF), which specialises in microscale 3D printing systems.