Weekly digest - July 27 2022

|

By the Numbers

AVCJ RESEARCH

SOUTHEAST ASIA IN SIX TRENDS

To coincide with this week's AVCJ Southeast Asia Forum (see here or the full special issue) ...

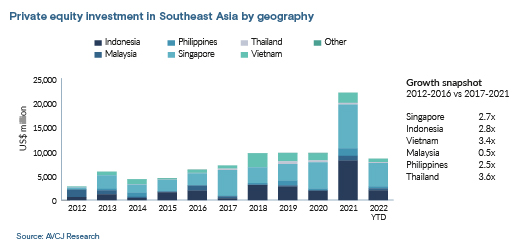

Robust growth-stage activity: Southeast Asia is seemingly (perhaps temporarily) immune to the weakening sentiment on early and growth-stage tech investment. The Asia total has dropped for three consecutive quarters, but Southeast Asia rebounded from USD 2.8bn in the first quarter to USD 3.5bn in the second. This follows deployment of USD 16.4bn in 2021, a threefold increase on the previous year. A fundraising challenge: Growtheum Capital Partners wants to raise USD 750m – this would be the largest first-time private equity vehicle for deployment in Southeast Asia and one of barely a dozen overall to surpass USD 700m. It underlines the challenges of raising capital for a sub-regional PE strategy. The annual average total for the past five years is USD 2.5bn, down from USD 3.1bn for the five before that. Temasek spreads its wings: Unlisted assets have served Temasek Holdings well. Exposure has grown fourfold over the past decade, reaching SGD 210bn (USD 151bn. Most of this is in large, privately held Singapore companies, but allocations to early-stage start-ups and asset management are rising quickly. The latter includes Vertex Holdings, InnoVen Capital, Fullerton Fund Management, and Seatown Holdings International. All are being asked to boost their external fundraising efforts. Singapore vs Hong Kong: Can Singapore supplant Hong Kong as Asia's preeminent PE hub? The debate has been bubbling away for years, but recently it has taken on a political edge as the financial sector considers the implications of mainland China's tighter hold on Hong Kong. The head of private equity at Alberta Investment Management Corporation (AIMCo) explicitly referenced geopolitical issues when explaining the decision to set up an Asian base in Singapore rather than Hong Kong. Local listing options: Stock exchanges in Southeast Asia have recognised they must embrace local technology companies or watch them go public in other markets. Consequently, the Jakarta Stock Exchange accounts for more than 70% of the total proceeds from PE-backed IPOs in Southeast Asia since the start of 202, led by Bukalapak and GoTo. Meanwhile, Singapore is also looking to position itself as a regional technology listing destination, rolling out late-stage and pre-IPOs funds. Vietnam moves up: There is no doubting Vietnam's appeal to private equity investors. Based on capital deployed between 2012 and 2016, Vietnam was Southeast Asia's fourth most popular market. In 2017-2021, it placed third, as investment surged 3.4x to USD 9.2bn. Singapore and Indonesia remain significantly larger in US dollar terms, but their growth over the same period was 2.7x and 2.8x, respectively.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.