Weekly digest - August 10 2022

|

By the Numbers

AVCJ RESEARCH

RUMINATIONS ON SIZE

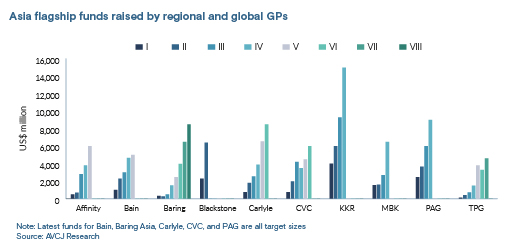

Much of the media coverage around the launch of Bain Capital's latest Asia fund highlight how the target of USD 5bn is modest compared to the sums pursued by some of the firm's global and pan-regional peers. This has always been the case.

Bain closed its first Asian vehicle on USD 1bn in 2007, around the time KKR made its own entrée to the region with a fund four times larger. Meanwhile, the likes of TPG Capital, The Carlyle Group, and CVC Capital Partners, which had run dedicated strategies for longer, has surpassed USD 3bn. Over the next three vintages, Bain moved to USD 2.3bn and on to USD 3bn and USD 4.65bn, increases of 130%, 30%, and 55%. In some cases, increases reflected a broadening of the geographic remit. KKR has been far more aggressive, closing its fourth fund last year on USD 15bn. The same can be said of Carlyle, albeit to a lesser extent, while TPG and CVC have lagged somewhat. It remains to be seen where Bain will end up on Fund V. It has yet to set a hard cap and the USD 5bn target represents institutional capital only. In Fund IV, for example, LPs contributed USD 4bn and an additional USD 650m came from employees and related parties. Moreover, it's worth noting that fund size doesn't prevent Bain chasing the largest deals, with plenty of global capital to drawn on. Others in the market do not appear to be holding back, although their expectations for China investment over the next five years – a key geography for almost every pan-Asian fund – are no doubt an interesting talking point in LP meetings. Carlyle is seeking USD 9bn (up from USD 6.5bn), CVC wants USD 6bn (from USD 4.5bn), and PAG is targeting USD 9bn (from USD 6bn). Baring Private Equity Asia (BPEA) has already collected USD 8.5bn and it is suggested it could close on as much as USD 10bn, while The Blackstone Group – on only its second Asia fund – has scaled up from USD 2.3bn to USD 6.4bn.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.