Sectors

Start-up profiles: Sustainability agendas

Early-stage innovators across the region are leveraging both enterprise and consumer-facing models to address sustainability challenges with one eye on rapid commercialization

Quadrant acquires Australia phone mount business

Australia’s Quadrant Private Equity has acquired a controlling stake in Quad Lock, a local smart phone accessories maker focused on device mounts for bikes and cars.

Sequoia leads $20m Series A for Singapore's Incomlend

Sequoia Capital India has led a $20 million Series A round for Incomlend, a Singapore-based invoice trading platform that aims to democratize access to trade finance.

Rocketship targets Asia with second global VC fund

Rocketship, a US-based data science-focused venture capital firm that has backed a number of Indian start-ups, has closed its second global fund at $100 million with a strong focus on Asia.

ByteDance acquires Chinese medical platform for $72m

ByteDance, the PE-backed owner of TikTok and the Toutiao news aggregation service, has acquired VC-backed Chinese medical information platform Baikemy for RMB500 million ($72 million).

Q&A: Circulate Capital's Rob Kaplan

Rob Kaplan is CEO of Singapore’s Circulate Capital, which is dedicated to reducing oceanic plastic pollution. Its $150 million debut fund is backed by the likes of Coca-Cola, PepsiCo, and Unilever

Chinese CRO player Yaoyanshe raises $86m

Yaoyanshe, a Chinese contract research organization (CRO) for novel drugs, has raised RMB600 million ($86 million) across two rounds in the past eight months.

India cosmetics brand MyGlamm acquires content platform

MyGlamm, an online Indian cosmetics brand, has agreed to acquire POPxo, a women-focused content platform, for an undisclosed sum. Both companies have several VC backers.

MUFG launches Singapore venture debt business

Japan’s MUFG Bank has set up a Singapore-based venture debt business alongside Israeli financial technology start-up Liquidity Capital. Its debut fund has been set up with an initial $80 million.

India clean energy: Shock treatment

The economic fallout from COVID-19 will not spare any sector, but careful planning can ensure private equity firms can take advantage of India’s ambitious energy transition goals

China clean energy: Policy power

China’s aggressive renewable energy development targets are creating opportunities for investors in various points along the supply chain, but inconsistent regulation remains a concern

BGH to buy Australia's Village Roadshow for $543m

BGH Capital has agreed to acquire Australian cinema and theme park operator Village Roadshow for A$758 million ($543 million).

Actis acquires two solar assets in India

Actis Capital has acquired a 400 megawatt portfolio of operating solar projects in central India from Acme Solar.

Chinese EV manufacturer Xpeng pursues US IPO

Xpeng Motors, a Chinese electric vehicle (EV) manufacturer backed by Alibaba Group and several PE and VC firms, has filed for a US IPO.

Chinese chip design company Brite raises $50m

Chinese integrated circuit (IC) design company Brite Semiconductor, has raised a RMB350 million ($50 million) Series D round led by Haitong Securities and sector specialist Sunic Capital.

PAI Capital invests $212m in Chinese video display business

PAI Capital, a Hong Kong and London-based asset manager that primarily caters to high net worth individuals (HNWIs), has paid RMB1.45 billion ($212 million) for a 24.22% stake in Vtron Group, a Shenzhen-listed video display systems manufacturer.

VinaCapital completes exit from Vietnam dairy producer

Vietnam’s VinaCapital and Japan’s Daiwa PI Partners have sold the remainder of their interest in Vietnamese dairy producer International Dairy Products (IDP).

China Resources consortium buys Hong Kong's City Super

A consortium led by China Resources Capital (CR Capital) has agreed to acquire a 65% stake in Hong Kong retail and supermarket operator City Super Group.

India used car platform Spinny acquires rival Truebil

Indian online used car marketplace Spinny has acquired local counterpart Truebil, setting up several venture capital exits.

Huagai leads $43m round for China antibiotics developer

China-focused private equity firm Huagai Capital has a led a RMB300 million ($43 million) Series D round for antibiotics developer MicuRX Pharmaceuticals.

LPs & climate change risk: Numbers game

With more information at their fingertips, institutional investors are better positioned to understand and act on climate risks and opportunities in their portfolios. But private markets are still playing catchup

Globis joins $32.6m round for Japan's Photosynth

Globis Capital Partners has joined a JPY3.5 billion ($32.6 million) Series C round for Photosynth, a Japanese internet-of-things (IoT) developer specializing in smart locks for office buildings.

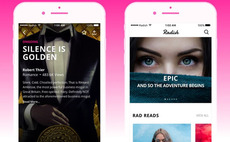

Korea, US-based serialized fiction app gets $63m

SoftBank Ventures Asia and Kakao have led a $63.2 million Series A round for Radish, a Korea and US-based producer and broadcaster of serialized fiction for mobile devices.

India's Byju's acquires online coding school

Byju’s, an Indian online learning platform backed by several PE and VC firms, has acquired WhiteHat Jr, a platform that helps students learn to code.