Industrials

China bio-manufacturing start-up Mojia raises $80m

Temasek Holdings has led a USD 80m Series B round for Shanghai-based bio-manufacturing start-up Mojia Biotech.

Platinum Equity buys Hong Kong lingerie business Hop Lun

US-based private equity firm Platinum Equity has agreed to acquire Hop Lun, a Hong Kong-headquartered producer of fashion lingerie and swimwear that serves a global client base.

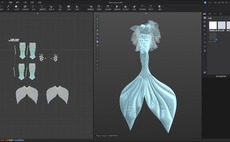

China fashion software platform Linctex raises $100m

Linctex Digital, a Shanghai-based design services platform for the fashion industry, has raised an extended pre-Series B round of nearly USD 100m from GL Ventures and CDH Investments.

Capital Today leads $40m Series B for China's XYZ Robotics

XYZ Robotics, a Chinese start-up specialising in robotic hand-eye coordination, has raised an extended Series B round of USD 40m led by Capital Today China Group.

Deal focus: Hahn finds rich pickings in SK Group

Hahn & Company’s USD 1.3bn acquisition of an industrial materials unit from SKC is its fifth deal involving SK Group in four years. Being a good custodian is regarded as key to securing repeat business

Fullerton reaches $100m first close on Thai PE fund

Singapore’s Fullerton Fund Management has hit a first close of USD 100m on its first Thai private equity strategy in partnership with KBank Private Banking, a division of local lender Kasikorn Bank.

Baring Asia completes $980m take-private of Taiwan's Ginko

Baring Private Equity Asia (BPEA) has completed a take-private of Taiwan-listed contact lens manufacturer Ginko International at a valuation of NTD 27.2bn (USD 980m).

Japan's T Capital buys Fujitsu semiconductor memory assets

Japanese mid-market buyout firm T Capital Partners has agreed to carve out Fujitsu’s semiconductor memory chip business for an undisclosed sum.

Advent raises $25bn for global PE fund, targets China

Advent International has closed its largest ever global private equity fund at the hard cap of USD 25bn with plans to expand its investment activity in Greater China in the next few years.

China industrial internet platform Xuelangyun raises $44m

Xuelangyun, a China-based industrial data service provider, has raised a Series B of CNY 300m (USD 44m) led by China Structural Reform Fund. Poly Capital and an intellectual property fund under Wuxi Guolian Development also participated.

Mithril, BlackRock invest $110m in Singapore's GreyOrange

Mithril Capital, a VC firm launched by PayPal co-founder Peter Thiel, and BlackRock have provided USD 110m in growth funding to Singapore and US-based robotics player GreyOrange.

Deal focus: Mekong unconfined to consumer thesis

Having long eschewed industrial business models, consumer-focused Mekong Capital has made an exception in the name of environmental impact with Vietnam agricultural supplier Entobel

Market volatility thwarts CVC pursuit of Australia's Brambles

CVC Capital Partners has abandoned its proposed acquisition of Australia-based container supplier Brambles, citing market volatility.

Indonesia's Sinar Mas launches smart city VC fund

The real estate arm of Indonesian conglomerate Sinar Mas has launched a smart city technology fund in partnership with East Ventures, Redbadge Pacific, and Prasetia Dwidharma.

GP profile: EmergeVest

Building on unorthodox roots and a highly concentrated portfolio, EmergeVest wants to establish itself as a global-minded Asia specialist in technology-enabled supply chains

Mekong invests $25m in Vietnam insect feed company

Vietnam private equity firm Mekong Capital has invested USD 25m Entobel, a company that makes insect-based ingredients for the animal feed, pet food, and fertiliser industries.

Sequoia, Tiger, Alpha Wave invest $100m in India agtech player

Indian agriculture technology start-up Absolute Foods has confirmed USD 100m in recent funding from Sequoia Capital India, Tiger Global Management, and Alpha Wave Global at a valuation of USD 500m.

China's VisionNav Robotics raises $80m

5Y Capital and Meituan, China’s leading online-to-offline services provider, have led a USD 80m Series C extension for VisionNav Robotics, a local manufacturer of driverless industrial vehicles.

Deal focus: KV Asia finds another way into PPE

Malaysia’s G.B. Industries is already a leading global player in the electrical personal protective equipment space. KV Asia aims to drive growth by professionalising the family-run business

KV Asia buys Malaysia industrial glove manufacturer

KV Asia Capital has acquired a majority stake in G.B. Industries (GBI), a Malaysia-based manufacturer of rubber insulating gloves and sleeves, for an undisclosed sum.

Portfolio: Affinity Equity Partners and ServeOne

Affinity Equity Partners is redefining the B2B outsourcing industry by helping Korea’s ServeOne, escape the gravity of its chaebol parent to access new markets and business lines

ShawKwei buys Australia beauty, healthcare company

ShawKwei & Partners has acquired Australia’s Rauxel, a beauty and healthcare industry supplier, for an undisclosed sum. It will be merged with existing portfolio company Icons Beauty Group.

Hosen closes $280m single asset continuation fund for Kilcoy

Hosen Capital, which makes investments in China’s consumer space, has closed a USD 280m single-asset continuation fund for Kilcoy Global Foods, a beef processing business it has owned since 2013.

India's Omnivore launches $130m agtech VC fund

India’s Omnivore Partners has launched its third domestic agricultural technology VC fund with a target of USD 130m.