GP profile: EmergeVest

Building on unorthodox roots and a highly concentrated portfolio, EmergeVest wants to establish itself as a global-minded Asia specialist in technology-enabled supply chains

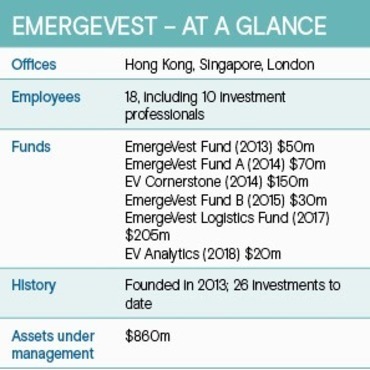

EmergeVest, an Asia-based private equity firm with interests spanning logistics, technology, and financial services, is the product of two secondary transactions: one that effectively kickstarted the GP by acquiring positions from HSBC, where the founders previously worked; and another that facilitated the consolidation of assets into what is now a top 50 global technology logistics business.

"We've been doing GP-led transactions since 2013. We explored buying our portfolio out of HSBC in 2012 and that gave us direct interaction with secondary investors, and we learned about the innovations happening beyond LP stake sales," said Heath Zarin, founder and CEO of EmergeVest and formerly head of principal investments in Asia Pacific for HSBC.

EmergeVest has raised USD 525m across five funds – two of them fully exited – and one evergreen separately managed account. Fund-of-funds feature prominently in the LP base, partly because of the secondary exposure, and those relationships led to small allocations from pension plans and insurance companies. The team drew on its own networks to bring in family offices as well.

Taking the next step on the journey to full institutionalisation and traditional blind pool funds, rather than the highly targeted vehicles raised thus far, may involve yet another secondary transaction. A continuation deal is mooted for EV Cargo – the logistics business that accounts for almost all EmergeVest's asset value – ahead of a planned IPO. Zarin declined to comment on the matter.

"Have they done well and made us money? Yes. Would we have a problem backing them again, whether it's a continuation fund or something else? No," said Juan Delgado Moreira, a vice chairman of Hamilton Lane, which supported the first secondary transaction in 2013.

At the same time, he cautioned that making greater headway with institutional investors isn't straightforward. There are examples of private equity firms in the US and Europe that were built around single assets or clusters of assets and went on to establish themselves as sector specialists. However, it hasn't happened in Asia and the fundraising environment is challenging.

"While they are carving a niche, they remain an unusual type of firm – Asia-based with a highly concentrated portfolio of non-Asia assets in one sector," said Delgado Moreira. "They have been around long enough, and they have the right industry DNA, and it is probably better now to be a global sector specialist than a small Asia generalist. But it's hard for mid-size funds to secure shelf space."

In and out

Hamilton Lane met Zarin a couple of years before that debut deal. It was well known at the time that HSBC wanted to shed balance sheet private equity exposure, forcing the principal investments team to contemplate an independent future. Meanwhile, secondary investors were keen to replicate the spinout of Bank of America Merrill Lynch's Asia PE unit, which became NewQuest Capital Partners.

What would become EmergeVest was conceived in 2008 when Zarin and Roger Moh, a co-founder and managing director of the firm, departed Credit Suisse. They had spent three years building the bank's Asia private equity operation and wanted to be more entrepreneurial. Emergent Investment Group (EIG) was formed, and several investments followed, executed on a deal-by-deal basis.

For three years, they pursued minority investments that were relevant to HSBC from a client perspective, accumulating a portfolio worth USD 120m. When it became clear a full spinout wouldn't be possible, EmergeVest – or EIG reborn – raised a USD 50m fund that financed management buyouts by two Chinese companies and contributed growth capital.

As the lead LP, Hamilton Lane's due diligence focused on the EmergeVest team and how well they knew the assets. It needed to be certain there was a familiarity with the founder, so that HSBC could be exited smoothly and that growth plans would be properly executed. Zarin's pre-private equity career as a fund formation counsel also proved significant.

"Secondary directs and GP-led transactions weren't mainstream back then and they required finesse," said Delgado Moreira. "As an ex-lawyer, Heath isn't scared of structural complexity or funding track complexity. He prioritises the operations of the business and is mature enough to say, ‘Let's get the business right, and then the structure and the funding will follow.'"

The two Fund I investments, garment manufacturer JD United and logistics services provider Cargo Services, were exited with an overall return of 2x. EmergeVest invested in Cargo Services a further three times as the technology-enabled logistics thesis gained traction. It ended up spinning out Allport Cargo Services, a UK freight forwarder Cargo Services acquired in 2010.

"Logistics as a sector is fragmented and well suited to buy and build. There is increasing need for investment in technology, sustainable solutions, outsourcing of services, and changing distribution channels with the rise of e-commerce. Our thesis was you could invest in Western companies and help them enter Asia," said Zarin.

Acquisition spree

A handful of key investments in the space – Allport Cargo Services plus Adjunco, Palletforce, CM Downton, and NFT Distribution – were accompanied by more than a dozen bolt-on acquisitions.

NFT marked the firm's formal entry into the UK market in 2014. Palletforce, a UK PLC that had to be privatised, came a year later and represented a step up in complexity. EmergeVest had to submit a fully-funded offer and then spend six months convincing Palletforce's shareholder business partners – for whom a sale was not based on economics alone – that it was a credible long-term player.

Through these acquisitions, the firm began to get noticed within the logistics sector. This not only attracted inbound deal flow but also operating talent. Simon Pearson, who spent nearly 10 years with NFT and another 10 with Asda in supply chain roles, met Zarin when he moved to Shanghai in 2012 to work with CS Logistics. Pearson helped on the NFT deal and joined full time in 2016.

M&A activity was punctuated by a desire to provide an expansive suite of supply chain services. In addition to moving goods internationally and providing infrastructure at either end, EmergeVest's portfolio of logistics businesses would offer complementary digital and financial services capabilities, from order demand signals and confirmation of delivery to supply chain finance.

"We knew the UK logistics market well and we started seeing more investment opportunities because we were recognised as a specialist in the space. We targeted businesses that were internationally mobile. We could take the IT, operating model, and technology platform and transplant it to other countries in our network. It's like a solution in a box."

This notion of creating a replicable approach is underscored by the EmergeVest Operating System (EVOS), which amounts to an investment playbook encompassing origination, evaluation, execution, management, and realisation. EVOS is made available, module by module, to portfolio companies based on where they sit on the development curve. EmergeVest also uses it internally.

Toyota and Danaher Corporation, which both employ similar operating systems designed to capture, codify, and standardise what works with a view to driving returns, are cited as influences. Comparisons might also be drawn with any number of sector specialist private equity firms, but Pearson, who serves as custodian of EVOS, emphasises the breadth of its applicability.

"While we are experts in supply chains and technology, EVOS covers the entire strategic planning system, including sales effectiveness, large-scale change management and digital transformation, and M&A," he said of the materials, which now run to more than 100 files across different media. "When we do integration, it's a way of achieving convergence and strengthening capabilities."

A broader platform

Zarin and Moh note they are building EmergeVest into a platform capable of serving an extensive portfolio. Overall headcount across investment, operations, legal, and finance is nearing 20. Six are managing director level: three with financial backgrounds (Zarin, Moh, and UK-based Gary Edwards), Pearson helming operations, and then a head of sustainability and a general counsel.

The combination of sector expertise, investment in internal capabilities, and a system that enables standardisation and accountability was a key selling point for Chia-Min Tan, who joined EV Cargo last year in the newly created role of global CFO. With experience in financial reporting at J.P. Morgan, Goldman Sachs, and as CFO of Fullerton Health, her remit is to ready the company for an IPO.

According to Tan, sponsor-led businesses are generally better equipped for the rigours of public market governance than culturally rigid founder-controlled organisations. Yet the intensity of an IPO timeline can be underestimated. It involves compiling watertight historical financial records, building sustainable systems and processes, and crafting a credible and compelling vision for the company.

"There is a commitment to investing in talent at EmergeVest. They have a team that works on financials and someone else who gets debt financing packages done. That's a luxury for a CFO, having people at the sponsor helping us, introducing us to the right people," said Tan.

"They do not hesitate in deploying people from EmergeVest to EV Cargo – sometimes on projects that last six months – and there is discipline at the opco level. Everything works to a five-year plan, and we have weekly meetings where we go through it and people are held accountable."

An EV Cargo IPO is envisaged in the next couple of years, with New York the preferred destination ahead of Hong Kong. The company now employs 2,800 people across 68 offices and serves more than 3,000 customers globally. It moves 350,000 containers of sea freight, 75m kilograms of air freight, and 15m road pallets of goods per year, amounting to USD 32bn in gross merchandise value.

Revenue reached USD 1.8bn in the first half of 2022 and the goal is to hit USD 3bn by 2025. Approximately 40% of revenue is software related. Zarin believes the aptest comparatives are the technology services units of traditional logistics players like DHL, DSV and Kuehne+Nagel or digital disrupters such as Flexport, which raised USD 935m at a valuation of USD 9bn in February.

"EV Cargo is predominantly a technology-enabled global forwarding business. Air freight and ocean freight are the two biggest segments, and in each one the market leaders have 3-5%," Zarin added. "The company is in the top 20 globally for air, ocean, and general logistics services, and top five or 10 for the Asia-UK air and ocean trade lane. It needs to enter the US in a meaningful way."

Three funds were involved in the creation of EV Cargo. Fund A closed on USD 70m in 2014 with support from family offices, made the sole investment targeted, and was then partly syndicated among fund-of-funds a year later. Three more investments were completed by Fund B and EmergeVest Logistics Fund, which closed on USD 30m and USD 205m in 2015 and 2017, respectively.

The Logistics Fund also featured a secondary element: it acquired a strip from Fund A and the entirety of Fund B, while providing USD 100m for new investments. The evergreen separate account, known as EV Cornerstone, has a corpus of USD 150m and participated as an LP in several vehicles.

The Logistics Fund laid the groundwork for a consolidation of Allport Cargo Services, Palletforce, CM Downton and Adjuno as EV Cargo in 2018. Each company made several bolt-on acquisitions, and this continues under the new parent, albeit relying on balance sheet capital instead of equity injections.

Consolidation was a potentially controversial move. Rather than have exposure to a concentrated yet somewhat diversified portfolio, LPs were being asked to tie their fortunes to a single investment. EmergeVest's rationale was that the customers and cash flows would still be diversified, while bringing them under a single umbrella presented cost and capital allocation benefits.

"There is no single point of failure, and together these businesses are stronger rather than weaker. When building portfolios, we've always tried to find businesses that complemented each other. That happened at HSBC, even though we were minority investors," Moh said, noting that CS Logistics served as a delivery partner for JD United.

Looking forward

EmergeVest's conviction around logistics, technology, and financial services is manifested not only in a sizeable GP commitment to EV Cargo but also in a portfolio of early-stage investments. The goal is to keep track of the disruptive forces as work in the core focus areas and support start-ups that might benefit from access to the firm's domain expertise and ecosystem.

Approximately USD 10m has been put to work from the EmergeVest balance sheet in cybersecurity, outsourced software development, data analytics for the grocery industry, and female-focused financial inclusion. The cybersecurity play, Lithic, which allows users to keep credit card details secure when shopping online by generating virtual replacements, was valued at USD 800m last year.

Raising third-party capital for a dedicated early-stage strategy would be considered. It comes down to whether there is sufficient deal flow, whether opportunities are consistent with EmergeVest's overarching interest in meeting rising demand for technology-enabled supply chain solutions, and whether EVOS can be deployed in a way that makes that makes the approach replicable.

This thinking echoes the earlier observation about getting the business element right and trusting that the rest will follow. Indeed, Zarin feels no need to conform: "We are not preoccupied with looking normal. We say what we are: EmergeVest was created by long-time PE professionals; we are operationally led; and we run concentrated portfolios because we are hands-on with management."

Yet there's a recognition that the future might look more like a traditional – and scalable – approach to buy and build, albeit in a sector specialist, operations-heavy context: raising blind pool funds and acquiring centrepiece assets that become the foundation stones of multiple platforms.

Any LP that considers backing such a strategy will use EV Cargo as a reference point. This only intensifies the pressure on EmergeVest to generate liquidity around the business.

"EV Cargo is the best demonstration of our capabilities as a growth buyout investor, but we need to do it in a repeated fashion, creating more billion-dollar companies," said Zarin. "To do that, we must grow our fund size."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.